Kia ora,

What a year it has been so far. 2023 has already given Aotearoa big challenges and change, and we hope that you and your loved ones are safe and well.

I’m Graham Law, and it’s a privilege to introduce myself to you as the Acting CEO of Smartshares. Since 2017, I’ve been the Chief Financial and Corporate Officer of the NZX Group and I’m excited for this new opportunity. After brilliantly leading and growing Smartshares for over five years, we farewelled Hugh Stevens in March. Hugh leaves behind a legacy of building better futures for our investors, and I’m looking forward to continuing that success while we search for our next CEO.

Last month the world celebrated International Women’s Day, and we launched a campaign that celebrated both the occasion and the women of Smartshares. The theme for this year was ‘Embracing Equity’, and we wanted to do something meaningful to show our support. ‘7 Women, 7 Questions’ was our week-long campaign, and profiled one of the women of Smartshares each day with 7 questions. You can hear the incredible stories they shared on our social channels: LinkedIn, Facebook or Instagram.

Celebrating more growth

In February, we achieved another huge milestone - $10 billion in funds under management. This is huge growth from the $2.7 billion we were managing five years ago, and we are honoured to be trusted with the savings of more New Zealanders. Our business growth has come from both business acquisitions and organically, from more investors using our products to save for their future. We announced earlier this year that we have acquired the management rights and related assets of QuayStreet Asset Management from Craigs Investment Partners. This acquisition brings an expanded product offering for our investors, and more market-leading investment expertise with five new members joining the Smartshares team.

Pushing through the turbulence

Indicators are showing we’re near the peak of the current monetary tightening cycle. As global markets manage recent uncertainty, we’re expecting our portfolios to show varying returns. As always, we encourage you to set your investment strategy to match your timeframe and appetite towards investment risk.

Want to change your investment strategy and view regular updates on your investment portfolio? Register and login to our member portal and SuperLife app at my.superlife.co.nz to get your account balance in minutes. If you have any questions or want to talk to our team, please don’t hesitate to get in touch on 0800 27 87 37.

Ngā mihi nui,

Graham Law

Acting CEO, Smartshares

Fund spotlight: Smartshares S&P/NZX 50 ETF (NZG)

The Smartshares S&P/NZX 50 ETF is designed to track the return (before tax, fees and other expenses) on the S&P/NZX 50 Index. This broad Index measures the performance of the 50 largest, eligible stocks listed on the Main Board of the NZX by float-adjusted market capitalisation.

The S&P NZX50 Index is widely considered as New Zealand’s preeminent benchmark index and it covers approximately 90% of the NZ equity market capitalisation. The Index recently celebrated its 20th birthday, and since its inception the Index has increased by [1].

Since its launch in July 2020, the Smartshares S&P/NZX 50 ETF has grown to a total fund value of almost $530 million.

Fund birthday: 15 July 2020 More information: Smartshares S&P/NZX 50 ETF

How to invest in NZG: Visit our website for ways to invest in the Smartshares S&P/NZX 50 ETF.

Supporting an important cause

Last year our Client Development team proudly spent their volunteer day helping Chained Dog Rehabilitation and Rehoming NZ. To continue our support for this great organisation, Amanda Fraser-Jones from Chained Dog came and talked to the Smartshares team about the important work they do. Thanks to their support and rehoming, dogs around Aotearoa get to live their best lives far away from a chain.

We learned about the process of fostering and adopting a dog, the different community initiatives that Chained Dog run and how dogs get into their care. It was an interesting and enlightening discussion, and we’re grateful to Amanda for sharing her time with us. Learn more about their amazing work on their website: www.chaineddog.org.nz

All smiles after our lunch and learn session Amanda Fraser-Jones (pictured centre in blue)

The Market Breakdown: The rises and falls of banks, inflation and returns

Following a very challenging 2022, there was reprieve for investors in this first quarter as global equity and fixed income markets made solid gains. Nonetheless, whilst risk assets have managed to claw back a decent amount of last year’s losses it wasn’t an entirely smooth ride. Volatility reigned supreme, fuelled by the banking sector over in the US sparking uncertainty across the globe. That turmoil also lifted expectations that central banks will move away from policy tightening and begin easing in the second half of this year.

The biggest event this quarter was the crisis that unfolded in US banks. The failures of Silicon Valley Bank and Signature Bank were caused by mismanagement of both asset and liability risks, which led to their concentrated depositor base making bank runs. These failures put the entire banking sector under pressure, and while the S&P 500 Bank Index fell 12.3%, the fallout hit the smaller regional US banks segment the hardest. The S&P 500 Regional Banks Index is perceived as being more vulnerable to shocks than the larger rivals and was sold-off sharply, ending the quarter 31.0% lower. The crisis also spilled over to Europe, with Credit Suisse AG - a famous 166-year-old Swiss bank - ending up being a victim of rapidly diminishing confidence in the global banking system. In what became a historical first, the Swiss National Bank together with the Swiss Government managed to broker a controversial rescue deal over the span of a weekend. They agreed that UBS would acquire its long-term arch-rival in a CHF 3 billion all-stock deal.

Banks bounce back

Fortunately, the crisis in the banking sector seemed contained to smaller and more vulnerable banks, with government and central bank responses preventing a spiral into more widespread systemic failure. Markets reacted by pricing a less aggressive future trajectory for monetary policy, with the corresponding fall in global bond yields supporting positive returns for fixed income markets. The Bloomberg Global Aggregate Total Return Index (NZD Hedged) had its best quarter in over three years, making a return of 2.7%. Global equity markets also rose, as lower bond yields usually create higher equity valuations. The MSCI World (NZD) Index returned 8.9%, which was largely led by strong performance from segments of the equity market with higher long-term growth prospects: Communications (+20.6%) and Information Technology (+19.4%). The more value-oriented market segments, such as Financials (-1.6%) and Energy (-3.4%), underperformed amidst concerns that future economic growth and potential demand would be affected by the global banking stress.

As markets reacted to the banking crisis and anticipated an economic slowdown, major central banks around the world continued to hike rates - just at a slower pace. The US Federal Reserve (Fed) raised rates twice, putting the Fed rate in the 4.75% - 5% range and placing borrowing costs at the highest level since 2007. The Bank of England raised interest rates to 4.25%, and RBNZ hiked rates by another 50bp to 5.25%

Looking locally

In the flight to safe havens, New Zealand and Australian banks remained sound. Government bonds finished ahead of corporate bonds as credit spreads spiked, before partially retracting as liquidity assurances took effect. The S&P/ASX Australian Government Bond Index was a top performer, delivering +3.8% for the month of March, underpinned by market participants shifting to a top-of-hiking-cycle view in Australia.

US CPI remains elevated at 6% year on year, suggesting that further policy firming may be needed to maintain a course of lowering inflation. In New Zealand, GDP for the December quarter printed 0.6% quarter on quarter, markedly lower than the RBNZ’s forecast of a weaker economy materialising in June. This will bring into question whether the RBNZ still thinks its projected 5.5% peak in the OCR is warranted.

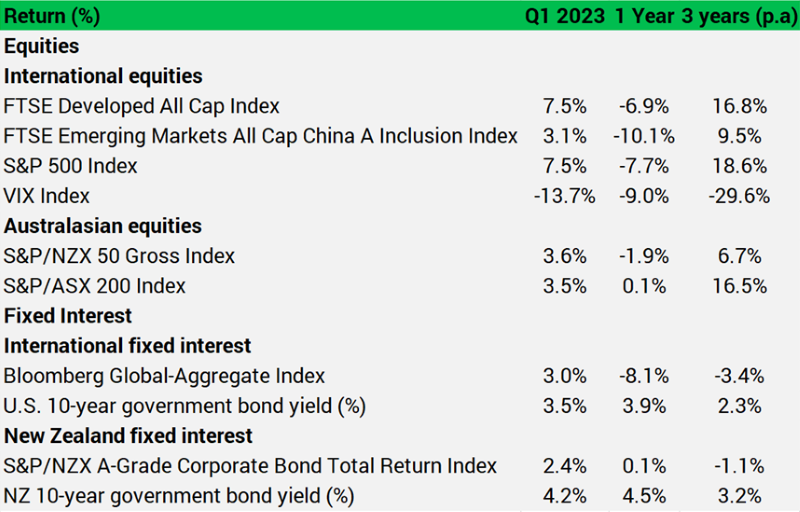

World indices at a glance:

(Data source: Bloomberg, compiled by SuperLife)

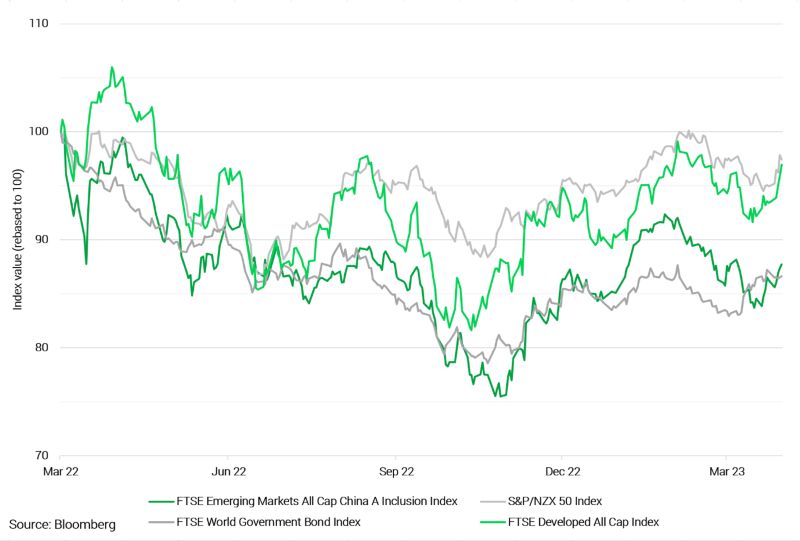

Global assets: major market movements over the last 12 months

(Source: Bloomberg)

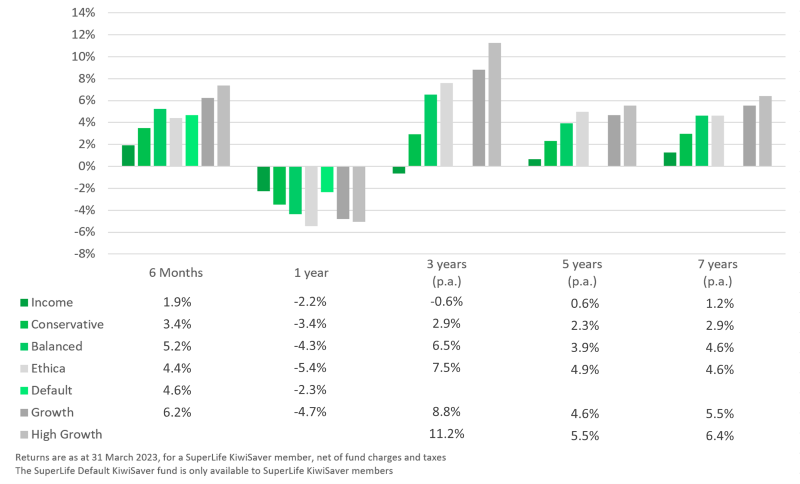

SuperLife KiwiSaver Diversified Funds as at 31 March 2023

(Note: Past returns are not a reliable indicator of future performance)

The annual returns of each of the above diversified funds in SuperLife KiwiSaver (after fund charges and tax) for each of the last 10 years ending 31 March and the annual returns of each fund's applicable market index are available in the most recently published fund update for the fund. Fund updates for the SuperLife KiwiSaver Scheme can be accessed here.

Ways to invest

SuperLife offers access to a range of funds across different sectors and country exposures, so investors can create portfolios tailored to their needs.

Our Ethica fund is a socially responsible fund with investments in a balance of income and growth assets.

With our SuperLife Age Steps option, we automatically set the proportion of your investment in income and growth assets based on your age. This means as you get older, the proportion of your investment in more volatile growth assets will be reduced, lowering the expected size of the ups and downs in the value of your investment.

If you would like to find out more about how SuperLife can help with your investments, get in touch with us at This email address is being protected from spambots. You need JavaScript enabled to view it. or phone 0800 27 87 37.

This information does not constitute financial advice and does not take account of personal circumstances; rather, it is designed to illustrate possibilities. As with all investment decisions, what might be the right strategy over the medium or longer term may not pay off over the very short term. No one can consistently predict what will happen over the short term. Those acting upon the information in this newsletter do so entirely at their own risk. SuperLife does not accept liability for the results of any actions taken or not taken based on this information. While every effort has been made to ensure accuracy, no liability is accepted for errors or omissions in this newsletter.