Kia ora koutou,

Happy New Year! We hope you enjoyed a well-deserved break over the holiday season. The team at Smartshares are back and ready for an action packed 2023. It was a busy end of 2022 at Smartshares and in case you missed it, below is a recap of some of the highlights we celebrated as a business.

Highlights of 2022

- We kick-started 2022 by being awarded a world-first Asia Region Funds Passport – opening the door for us to offer eligible funds to investors in Australia, Japan, Thailand and Korea.

- Successfully completed the acquisition of ASB Superannuation Master Trust – further extending our workplace savings services to the employees of more than 240 New Zealand businesses.

- Became a founding champion for the Financial Services Council’s campaign ‘It Starts with Action’ – a campaign that is founded to help women grow their financial wellbeing.

- Started our partnership with the Cook Islands National Superannuation Fund (CINSF) – to manage NZD200 million of CINSF member funds.

- Visited our investors for the first time in person since 2019 with Investor Seminars in Auckland, Christchurch and Wellington.

- We saw over 3,000 attendees at the 2022 Taranaki Tu Mai event in Hawera and signed up over 500 members to the Ka Uruora WhanauSaver plan.

- Smartshares won Fund Manager of the Year and took home awards in three other categories at the Research IP Fund Manager of the Year 2022 awards.

- Announced that we are acquiring the management rights to the QuayStreet Funds and KiwiSaver in February 2023, with the aim of creating greater synergies and enhancing investor outcomes.

The last quarter of 2022 brought about a mixed bag of economic results and it hasn’t been plain sailing for markets. An important note to remember is that periods of market downturn also create opportunities for investors to buy quality assets at lower prices. A strong, diversified investment strategy is crucial to riding out market fluctuations and being able to take advantage of opportunities as they arise.

We’re here to help

Did you know you can find information about your investment portfolio and your account balance on the SuperLife mobile app and the member portal? Register for access or login at my.superlife.co.nz.

If you had questions or want to talk to someone about your investments, reach out to us via email at This email address is being protected from spambots. You need JavaScript enabled to view it. or call us on 0800 27 87 37.

Ngā mihi,

Hugh Stevens

Fund spotlight: Smartshares US500 (USF)

The Smartshares US500 ETF – designed to track the return on the S&P 500 Index, a broad index of 500 shares listed on US exchanges as selected by S&P Dow Jones Indices. The S&P 500 has a history stretching back to March 1957, making it one of the market’s longest running indices. The Smartshares US500 ETF fund recently won 2 awards at the Research IP Fund Manager of the Year 2022 – the Global Equities Fund of the Year and the Longevity Award.

Fund birthday: 29 July 2015 More information: Smartshares US 500 How to invest in USF: Visit our website for ways to invest in Smartshares US500 ETF.

Team spotlight: Meet our Customer Experience

Put a face to the names of the wonderful humans you speak to when you contact us. The team are all based in the Auckland office and are ready to take your calls about anything related to SuperLife. Watch this space in 2023 to learn more about our amazing team.

We’ve recently celebrated Melissa’s promotion to a Senior Customer Experience Specialist – congratulations Melissa!

(From left to right: Tendai Charingira, Melissa Robinson, Joeran Karstroem and Krishna Maheswaram)

Industry Awards

We were incredibly proud to take home the Fund Manager of the Year award at the Research IP awards for 2022. We were selected from a pool of all fund managers who were a finalist in another award category, who consistently performed across all products, and who met a broad range of criteria covering governance, philosophy and process, risk management, and fees amongst others. We are also proud to have taken home the Longevity Award for our Smartshares US 500 ETF, Global Equities Fund of the Year for the Smartshares US 500 ETF fund and the Australian Equities Fund of the Year for the Smartshares Australian Top 20 ETF fund.

Market Update

Mixed economic news in the final quarter of 2022 has set up a number of possible scenarios for 2023. At one end, current and future central bank tightening may be enough to ensure a smooth moderation of inflation and transition activity back to more normal levels. This is a soft-landing scenario where the global economy avoids or experiences only a shallow recession without a sharp deterioration in labour markets. On the other end, central banks may have to do more to prevent an imbalance in aggregate demand by raising interest rates more than the market anticipates, increasing the likelihood of a deeper recession as conditions deteriorate.

Central banks continue to make headlines

During the last quarter of 2022, most central banks globally continued to increase interest rates. Interestingly, central bank “speak” is signaling that decision-makers expect they can pause or slow the pace of tightening and allow the lagging effects of lifting interest rates to flow through to the real economy.

In New Zealand, the Reserve Bank has taken a combative tone as there is little evidence to suggest the economy is moderating at the pace required to curb inflation. Wage and price bargaining remains elevated, and consumer spending activity likely won’t slow significantly until mid-2023 when mortgage rate increases start to bite.

The States continue to slow

The December Manufacturing Institute of Supply Chain Management (ISM) survey indicated a slowing US economy for the second month since the onset of the pandemic recovery.

The survey showed easing demand as companies delayed capital expenditures and continued to manage higher labour costs amidst economic uncertainty.

Supply chain issues beginning to ease

Positively, we have begun to see easing in supply chain issues brought about by the pandemic and the war in Ukraine. Shipping costs have started to reduce, and oil prices have begun to moderate. This has been positive for equities and bonds alike as it suggests the supply side inflation pressures of the last year are dissipating.

What does this mean for our funds

While the economic outcome remains uncertain amid rising interest rates, we should expect both equity and bond markets to remain choppy with expected returns to be neutral to slightly positive. If our more optimistic economic scenario comes to fruition, growth-oriented funds, with higher exposure to equities, could deliver strongly positive returns over the next 12 months.

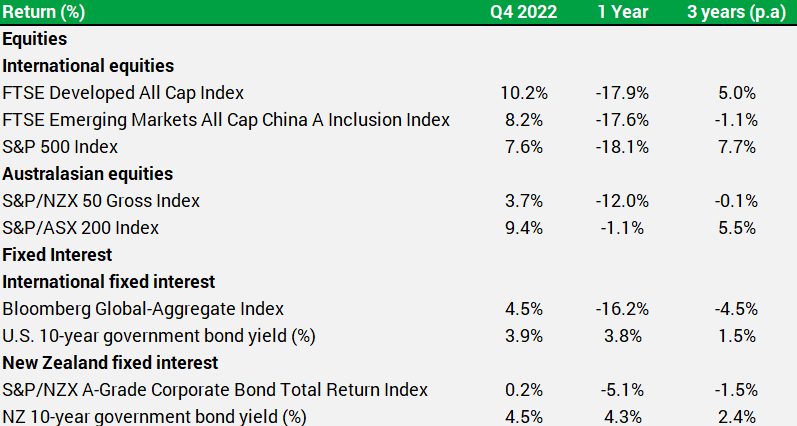

World indices at a glance:

(Data source: Bloomberg, compiled by SuperLife)

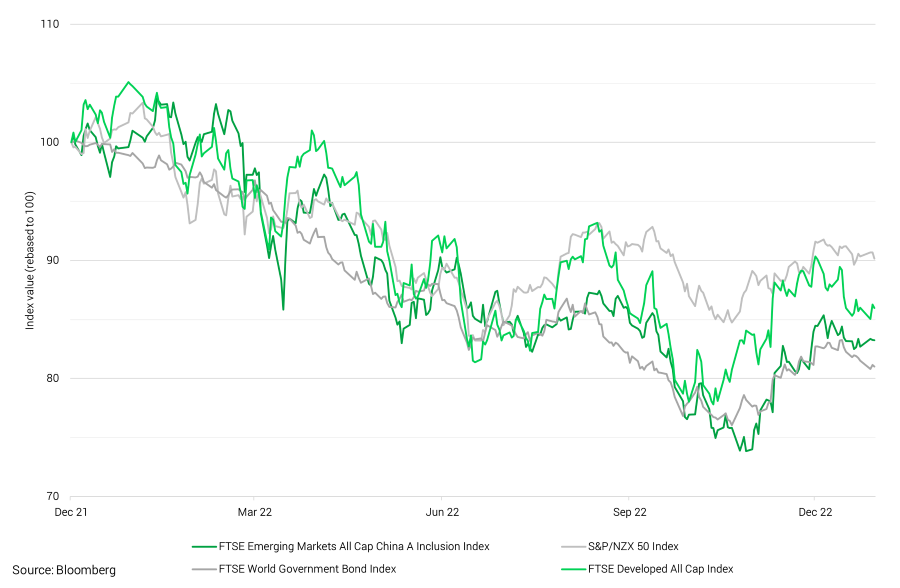

Global assets: major market movements over the last 12 months

(Source: Bloomberg)

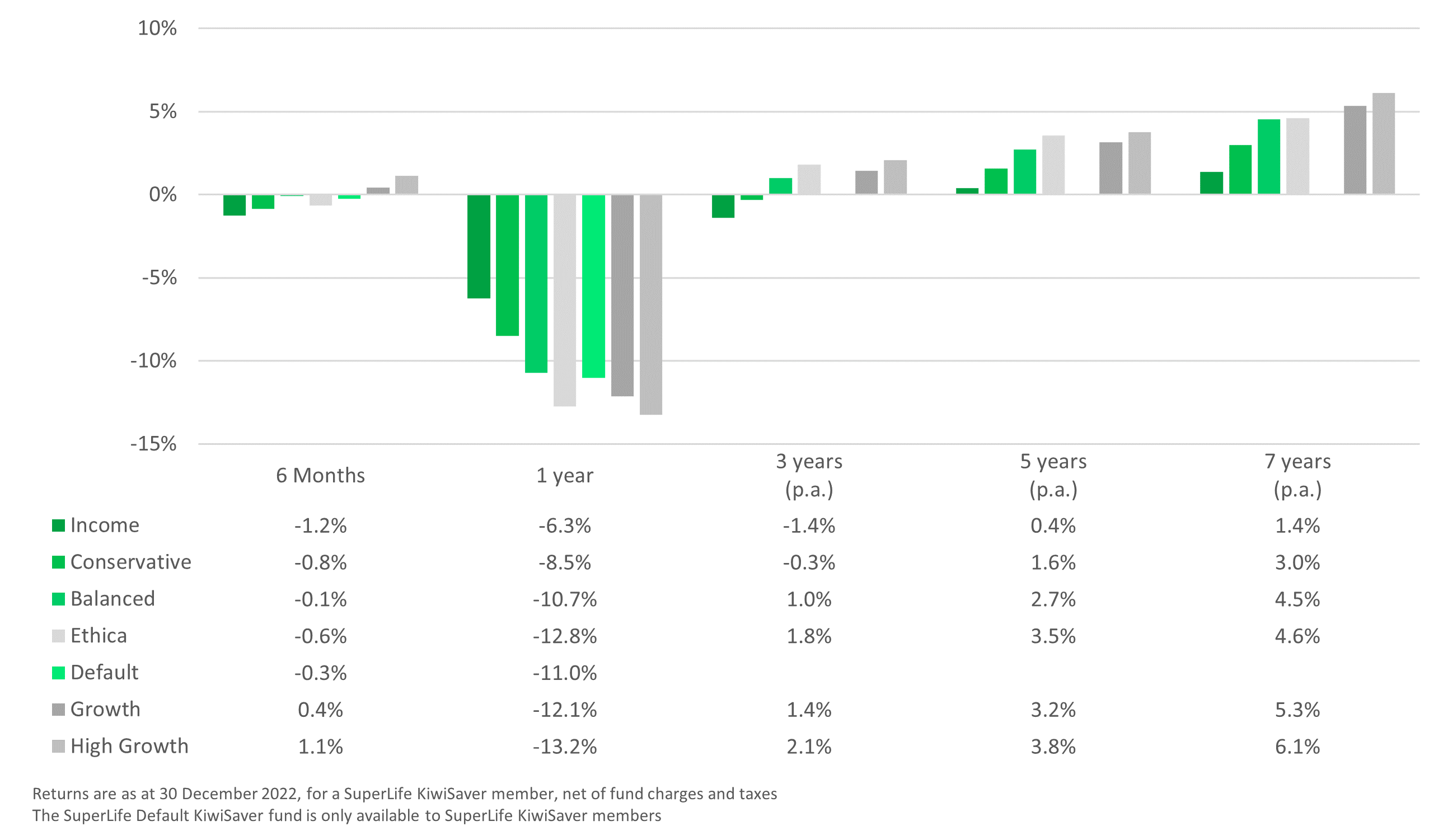

SuperLife KiwiSaver Diversified Funds as at 30 December 2022

(Note: Past returns are not a reliable indicator of future performance)

The annual returns of each of the above diversified funds in SuperLife KiwiSaver (after fund charges and tax) for each of the last 10 years ending 31 March and the annual returns of each fund's applicable market index are available in the most recently published fund update for the fund. Fund updates for the SuperLife KiwiSaver Scheme can be accessed here.

Ways to invest

SuperLife offers access to a range of funds across different sectors and country exposures, so investors can create portfolios tailored to their needs.

Our Ethica fund is a socially responsible fund with investments in a balance of income and growth assets.

With our SuperLife Age Steps option, we automatically set the proportion of your investment in income and growth assets based on your age. This means as you get older, the proportion of your investment in more volatile growth assets will be reduced, lowering the expected size of the ups and downs in the value of your investment.

If you would like to find out more about how SuperLife can help with your investments, get in touch with us at This email address is being protected from spambots. You need JavaScript enabled to view it. or phone 0800 27 87 37.

This information does not constitute financial advice and does not take account of personal circumstances; rather, it is designed to illustrate possibilities. As with all investment decisions, what might be the right strategy over the medium or longer term may not pay off over the very short term. No one can consistently predict what will happen over the short term. Those acting upon the information in this newsletter do so entirely at their own risk. SuperLife does not accept liability for the results of any actions taken or not taken based on this information. While every effort has been made to ensure accuracy, no liability is accepted for errors or omissions in this newsletter.