Kia ora koutou,

With daylight savings in full swing and summer just around the corner there is a notable buzz in the air. The recent lifting of Covid-related restrictions has given daily life a semblance of normality as borders re-open and activity increases.

Smartshares has also been a hive of activity. We’ve had many new investors joining us this year, many following our appointment by the New Zealand Government as a default KiwiSaver scheme provider and as the manager of the ASB Superannuation Master Trust. We are proud to now manage more than $8 billion of funds under management on behalf of more than 110,000 investors across New Zealand and the world.

Over the next two weeks myself, together with our Chief Investment Officer, Stuart Millar, and our Chief Customer Officer, Donna Mason, head to Wellington, Christchurch and Auckland to deliver our first in-person client seminars since 2019. We are excited to get out and about and look forward to seeing many of you in person.

You will read in the market update & outlook that markets continue to be volatile. In particular global markets have been challenging as inflationary pressures have proven stubborn in the face of central bank rate hikes.

We have seen the World Bank and the International Monetary Fund (organisations who promote growth and development of economies) moderate their growth forecasts. The IMF in July trimmed its 2022 global growth forecast to 3.2%, a 0.4-percentage point trim from its April projection. In June, the World Bank cut its 2022 global growth projection to 2.9%, significantly lower than the 4.1% it had forecast in January. This means that markets may continue to be volatile for some time yet. When markets fall it is understandable to feel unsettled. In many people it triggers an inclination to sell to avoid further losses. Remember that any loss in value of your investments is only realised or locked in when you sell or switch and, if you do so, you risk missing out on a market recovery. Many of our members see this period in the cycle as an opportunity to invest more to take advantage of lower market prices.

We’re here to help

Did you know you can find information about your investment portfolio and your account balance on the SuperLife mobile app and the member portal? Register for access or login at my.superlife.co.nz.

If you had questions or want to talk to someone about your investments, reach out to us via email at This email address is being protected from spambots. You need JavaScript enabled to view it. or call us on 0800 27 87 37.

Ngā mihi,

Hugh Stevens

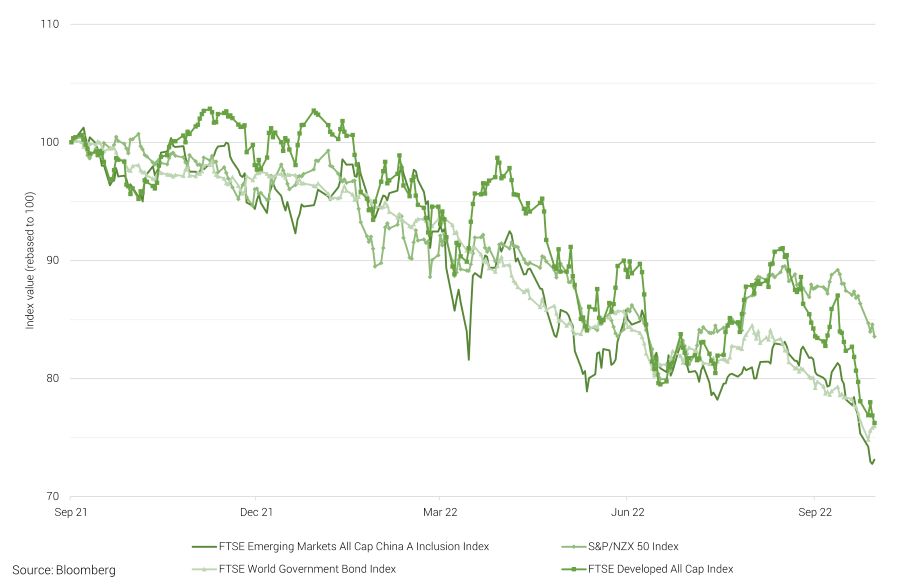

World indices at a glance: Longer-term bond yields turn north, equities head south

(Data source: Bloomberg, compiled by SuperLife)

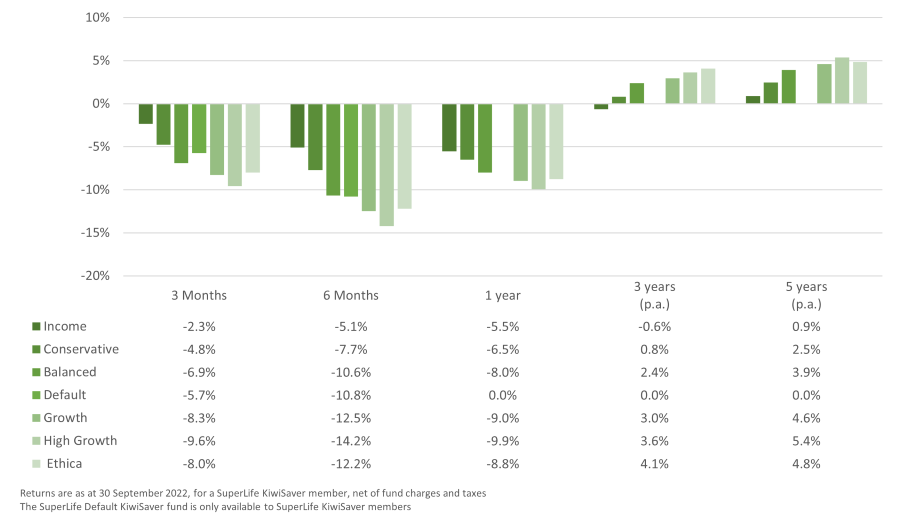

SuperLife Diversified Funds as at 30 September 2022

(Note: Past returns are not a reliable indicator of future performance)

Global assets: Rocky first half for global markets

Market update & outlook

The September quarter saw continued volatility in financial markets, characterised by strong gains in the first half and equally strong losses in the second half. This was mirrored in the VIX Index (a measure of market volatility) that eased to 12-month lows in August, only to spike toward the end of September.

Central bank policy the dominant driver of returns over the last quarter

Initially, markets had become inclined to believe that the US Federal Reserve would pivot away from continued strong rate hikes as recessionary fears manifested. Accordingly, asset prices recovered from June quarter lows only to sell off again from mid-August. The catalyst for the sell-off was a redoubling of inflation fighting rhetoric from policymakers, coupled with economic data suggesting inflationary pressure is still strong.

Markets are now focussed on economic evidence that may suggest a change in monetary policy behaviour. Firming indicators of growth and labour market strength suggest central banks will hike short-term interest rates more than is currently priced, increasing the potential for asset prices to fall. On the other hand, economic data and a continuing moderation in commodity and energy prices looks encouraging for markets to believe that inflation fighting efforts are working and that an adjustment is underway. It should be expected that markets will fluctuate for some time yet and outsized pricing moves are likely as new information comes to light.

Impact of changes in the UK government

Incoming prime minister Liz Truss rattled markets by announcing a fiscal stimulus package at odds with the Bank of England’s policy efforts which are becoming more oriented towards less economic stimulus. This caused markets to question the robustness of the UK’s fiscal situation and manifested in the Pound dropping dramatically and sent bond rates soaring. This put pressure on derivatives markets and fears of contagion set in, requiring the bank of England to intervene and steady markets by purchasing long dated bonds. This event is illustrative of the sensitivity of markets presently and it should not be a surprise to see other central banks providing liquidity support should similar events arise.

New Zealand market over the last quarter

Turning to New Zealand, Reserve Bank governor Adrian Orr was reported by Radio NZ in late September saying more interest rate hikes might be needed to manage inflation, currently sitting at 7.3% (June 2022 quarter) despite us having a head start on most of the developed world in our inflation fight. The Quarterly Survey of Business Opinion revealed that businesses are still downbeat, but a little less so than Q2. Capacity constraints are acute and labour market pressures remain a stifling factor. Like global markets, New Zealand investors are looking for signals that the RBNZ will ease off on further rate hikes. As at the end of September, the market expects the Official Cash Rate to peak at 4.5% in the middle of 2023, however there is upside risk to that assessment and some bank economists have recently increased their calls for where short term interest rates will peak.

Negative news has been dominating headlines. However, it pays to keep a long-term perspective, and focus on one irrefutable fact: all falls in the markets no matter how sharp, are always followed by recoveries although some recoveries may take longer than others. Those who are committed to their investment goals may want to consider using periods of market correction to accumulate assets at lower prices.

Ways to invest

SuperLife offers access to a range of funds across different sectors and country exposures, so investors can create portfolios tailored to their needs.

Our Ethica fund is a socially responsible fund with investments in a balance of income and growth assets.

With our SuperLife Age Steps option, we automatically set the proportion of your investment in income and growth assets based on your age. This means as you get older, the proportion of your investment in more volatile growth assets will be reduced, lowering the expected size of the ups and downs in the value of your investment.

If you would like to find out more about how SuperLife can help with your investments, get in touch with us at This email address is being protected from spambots. You need JavaScript enabled to view it. or phone 0800 27 87 37.

This information does not constitute financial advice and does not take account of personal circumstances; rather, it is designed to illustrate possibilities. As with all investment decisions, what might be the right strategy over the medium or longer term may not pay off over the very short term. No one can consistently predict what will happen over the short term. Those acting upon the information in this newsletter do so entirely at their own risk. SuperLife does not accept liability for the results of any actions taken or not taken based on this information. While every effort has been made to ensure accuracy, no liability is accepted for errors or omissions in this newsletter.