Quarterly News

To 30 June 2020

Welcome

Welcome to the June quarter news. It has been a busy few months for us as we revert and adjust to life after a period of lockdown. Investors have lived through a few nerve-wracking moments given how volatile the markets have been.

The investment environment will remain challenging. New Zealand and the rest of the world are in a ‘wait-and-see’ mode, watching how the Covid-19 disaster plays out. The jury is still out on whether the world’s recovery will be short and sweet, or long and bitter.

At SuperLife, we have a solid business model to support our clients. Our client advisers and support team are behind you, ready to help protect and grow your assets.

If you haven’t already done so, please register for online access. Going online means you have much better access to your information. You can easily change your investment strategy, increase your contributions or check your SuperLife investment accounts anytime, anywhere.

Please get in touch if you have any questions. When you call, you will be speaking directly with a knowledgeable member of our team. We are here for you.

Enjoy the read.

Hugh Stevens

CEO, Smartshares

In ‘Thoughts on investment strategy’, our chief investment officer Stuart Millar gives his views on what will give investors confidence during an uncertain time, and which sectors are likely to shine.

Get more information on SuperLife’s investment options and returns

Market Update

The second quarter in the global share markets was a somewhat puzzling time. A slew of bad news did little to hold back enthusiastic buyers chasing the S&P 500 for most of April and May with more normality returning towards June.

Bad news on the US economy was largely dismissed by Wall Street despite the US reporting its worst set of unemployment data since the Great Depression of the 1930s. About 20.5 million jobs were lost in April, pushing unemployment rate to 14.7%. June’s unemployment rate fell to 11.1% but was still much higher than February’s level of 3.5%.

The S&P 500 had by end of June recovered 38% from its lowest level seen in March 2020.

A reality check came in the form of the Federal Reserve Open Market Committee’s prognosis in June that the US economy is likely to contract by 6.5% in 2020 before growing by 5% in 2021; and the unemployment rate is expected to reach 9.3% in 2020.

What will continue to provide underlying support, for the US and the world markets, is the resolve between governments and their central banks to provide fiscal and monetary measures to keep their economies going.

The US Congress has been exceptional in how fast it has approved a US$2-trillion plan to boost its economy. Parts of Europe and China are among other countries that have made financial commitments to rebuild their Covid-struck economies.

In New Zealand, the government announced, among others, plans to set aside $50 billion to resuscitate the economy, including over $8 billion to support businesses and the self-employed, and $2.8 billion for those on benefits. New Zealand Treasury has plans for a $60-billion bond issue programme to fund the government’s economic resuscitation effort.

The big picture isn’t rosy. The International Monetary Fund (IMF) expects the world to see its worst economic recession since the 1930s. In June, the IMF’s forecast for global growth was -4.9% for 2020, and 5.4% for 2021. This means the 2021 GDP is a downward adjustment of 6.5 percentage points from the IMF’s pre-COVID-19 projections made in January 2020.

The silver lining is that the market already understands this, and as lockdown measures are lifted, economic activity will resume. A recovery in corporate earnings will help sharemarkets hold onto second quarter gains. The key risk remains a resurgence in Covid-19 infection rates, which will result in a slower economic recovery and lower returns for investors going forward.

International equities

In the June quarter, returns from international shares, after accounting for currency fluctuations, rose 12.2% in the June quarter. Over 12 months, returns were up 7.1%. (FTSE Developed All Cap Index in NZ dollar terms)

NZ equities

NZ equities returns, as measured by the S&P/NZX 50 Gross Index, rose 16.9% during the June quarter. This was the highest quarterly return ever for this index. Over 12 months, NZ equities rose 9% (S&P/NZX 50 Gross Index) despite all the volatility we have experienced this year.

Emerging markets

Emerging market returns rose 19% in the June quarter but were down 3.2% over the year. (FTSE Emerging Markets All Cap)

Australian equities

Australian Equity returns, as measured by the S&P/ASX200 Total Returns Index rose 16.5% in the June quarter, reflecting the strong recovery in equities worldwide following the negative returns in Q1. Over 12 months, Australian equities fell 7.7%. (S&P ASX 200 Total Return Index)

International fixed interest/bonds

Returns from overseas bonds rose 2.4% in the June quarter but over 12 months, returns rose 5.7%. (Bloomberg Barclays Global Aggregate Total Return Index Hedged NZD)

SuperLife Funds

Most fund returns rose over the June quarter in a market still dominated by Covid-led uncertainties. Over 12 months, funds saw a mixed set of returns.

SuperLife Income which does not have any exposure to equities, returned 3.36% in the June quarter and 3.45% over 12 months.

SuperLife Conservative, invested mainly in income assets, returned 6.17% in the June quarter and 1.12% over 12 months.

The SuperLife Balanced Fund (which typically has 60% in equities/listed property and 40% in cash and fixed income) saw returns rise 9.14% in the June quarter. Returns were down 0.48% over 12 months.

SuperLife Growth returns rose 10.41% in the June quarter. Over 12 months, returns were down 2.88%. The SuperLife Growth fund invests mostly in international equities, some cash and fixed interest.

SuperLife High Growth, mostly invested in higher risk assets such as equities and property stocks, returned 12.93% in the June quarter but over 12 months, returns fell 4.15%.

Ethica, which invests into funds that have strict sustainability criteria, returned 10.4% in the June quarter; over 12 months returns rose 2.76%.

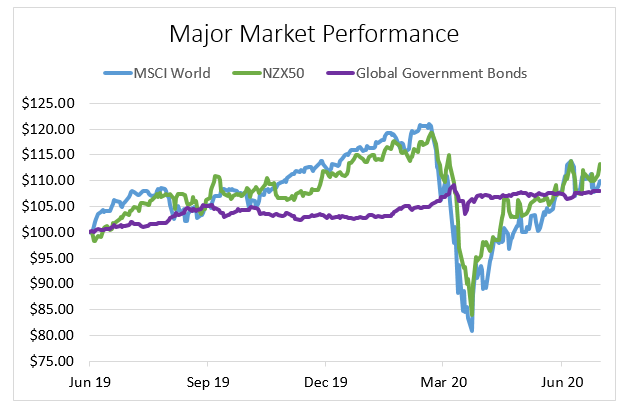

Figure 1: Equities shrug off major losses, bonds stay flat

Source: Bloomberg/SuperLife

The June quarter showed how unpredictable and perplexing investor behaviour can be. The debris barely settled in the global markets financial storm caused by the Covid pandemic before intrepid investors returned with gusto.

Investors’ confidence has since fluctuated with the tide of good or bad news being released about the prospects of the world’s economic recovery.

What’s certain is the fear-led panic selling seen in March has abated. The Chicago Board Options Exchange Volatility Index has hovered under 45 for most of the June quarter after hitting a peak of 82.69 on 16 March. The index is a proxy for how volatile the market is likely to be based on options pricing. A higher number indicates a more volatile market.

What will keep the jitters out of the market?

Investors will be looking for signs the concerted efforts between the world’s central banks and their governments to stimulate economic recovery will produce the intended results.

The market will also need reassurance the US economy isn’t going into a long and protracted economic contraction.

So far, the US Manufacturing Purchasing Managers’ Index (PMI) and housing starts, two key indicators, have yet to show strong and sustained signs of an economy in an expansion mode. Consumer confidence has made a tentative recovery after hitting historical lows in April.

Investors will also need assurance that any economic recovery will not be derailed by inflation. There is comfort on this front. The Federal Reserve had signalled to the market when it last met in June that it intends to keep the federal fund rate at zero to 25 basis points until 2022. The federal funds rate is the rate banks lend to each other to meet liquidity needs. The rate is also indicative of the wider interest rate trend.

Success in the search for a vaccine to the Covid-19 virus, or other forms of effective treatment, remains crucial for economies around the world to focus on repairing the economic devastation caused by the pandemic.

Winners and losers

The investment environment will stay difficult. In the equities sector, the focus will be on defensive industries such as healthcare and technology.

Technology companies will stay important. There is a new-found appreciation for tried and tested technologies that have allowed businesses to continue trading during lockdowns. The winners include technology companies offering online shopping platforms, virtual meeting rooms, and cloud storage solutions.

Cyclicals, or companies whose fate are tied to the economy’s well-being, will continue to face tough times ahead. These include airlines, hotels and businesses linked to tourism and travel.

Search for yields

In the fixed income asset class, the attention will be on the safe-haven nature of government bonds, and high-quality corporate debt.

High-yielding assets will be elusive in a global environment of highly accommodative monetary policy. Investors will seek out debt securities issued by companies with attractive businesses, and a proven track record of managing their capital restructuring to build an improved version of their business.

What this means for SuperLife members

- Your investments are for the long term. It is important not to react to the ‘noise’ in the market and to resist the urge to switch in and out of funds.

- Falls or corrections in the market provide opportunities for members to continue accumulating assets at lower prices.

- Some investments perform well in negative economic environments. New Zealand government bonds and cash provide a safe haven in times of uncertainty.

- Re-think whether you have the right investment strategy as your ability to tolerate risk changes with your age.

- You can leave the choice of investment strategy to SuperLife if you prefer. This option is called SuperLife Age Steps and is designed for those saving for retirement. It automatically sets the proportion of your investment in income and growth assets based on your age.

If you are concerned about your investments, or would like to find out more about how SuperLife can help with your investments, get in touch with us at This email address is being protected from spambots. You need JavaScript enabled to view it. or 0800 27 87 37.

These thoughts on investment strategy do not constitute financial advice and do not take into account personal circumstances. They are designed to illustrate possibilities only. As with all investment decisions, what might be the right strategy over the medium or longer term may not pay off over the very short term. No one can consistently predict what will happen over the short term. Those acting upon the information in this newsletter do so entirely at their own risk. SuperLife does not accept liability for the results of any actions taken or not taken based on this information. While every effort has been made to ensure accuracy, no liability is accepted for errors or omissions in this newsletter.

Will you have enough to retire on?

If you are between 18 and 65, and have been with the SuperLife KiwiSaver for the full financial year (1 April 2019 to 31 March 2020), you may have noticed on your KiwiSaver annual statement an estimate of how much your savings will grow to as a lump sum, and how much this works out to as a weekly income, from the age of 65 to 90.

This projection is now required by the law. It is aimed at getting KiwiSaver members to think a bit more about whether they are on track with their retirement savings.

One question often asked is ‘how much do I need for retirement?’. There is no magic number. What is enough depends on what kind of lifestyle you see for yourself in retirement, what living expenses or financial commitments you have; and any other sources of income you have outside KiwiSaver and superannuation.

You can use Sorted’s retirement calculator to get an idea of whether you need to increase your savings to meet your retirement income expectations.

Another useful tool is New Zealand Superannuation’s budget worksheet which can help you put some numbers around what your likely living expenses are when you are retired.

A little extra saved over a long time can significantly improve your KiwiSaver savings balance.

You might also want to check if you are invested in the right fund (for example a growth fund against a conservative fund) for your age. Your fund choice can affect your long-term savings outcome.

We are here to help. Get in touch at 0800 27 87 37 or email This email address is being protected from spambots. You need JavaScript enabled to view it. to learn more about what choices of funds there are, or to understand your KiwiSaver investments.

New ETFs in July

SuperLife members have the option of investing in 4 new exchange traded funds (ETFs) which were listed on 15 July.

For the first time, investors can directly buy into an all-New Zealand government bond fund. This will also be the first time investors can buy units in a New Zealand-managed passive fund investing in Australia’s 200 largest companies.

The new Core Series funds are:

- S&P/NZX50 Gross Index ETF

- S&P/ASX200 Index ETF (managed in New Zealand)

- S&P/NZX Government Bond ETF

- Total World (NZD Hedged) ETF.

With ETFs, investors can invest in a range of financial products, such as listed companies or government bonds, spreading their risks more broadly.

SuperLife members can choose from over 30 ETFs that provide exposure to different types of investment assets. ETFs have become one of the fastest growing areas within funds management with global assets exceeding US$6 trillion in 2019.

Learn more about our ETFs here. Get in touch at 0800 27 87 37 to speak to a member of our team.

Smartshares Limited is the issuer of SuperLife Invest, the SuperLife KiwiSaver scheme, the SuperLife UK pension transfer scheme and the SuperLife workplace savings scheme. The Product Disclosure Statements and Fund Updates for these schemes are available at www.superlife.co.nz/resources/legal-documents