Disability Insurance

SuperLife disability insurance protects you from the loss of income from a severe disability that prevents you from working for an extended period.

SuperLife disability insurance protects you from the loss of income from a severe disability that prevents you from working for an extended period.

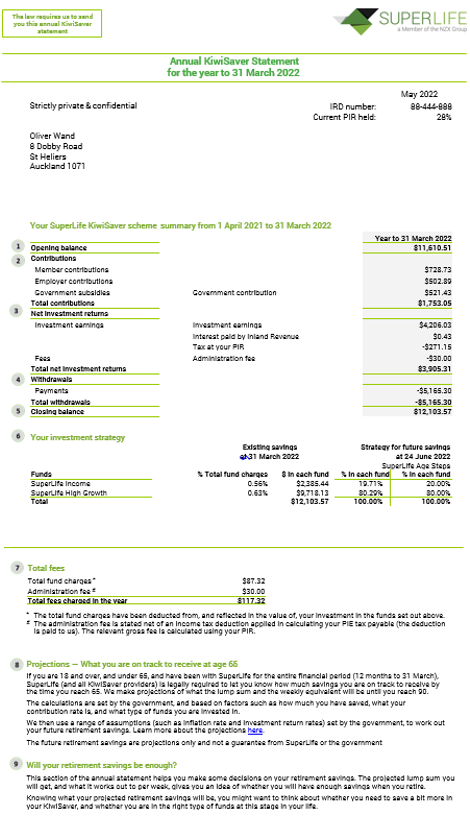

This shows how much you had in your KiwiSaver account at the start of the financial year or the date you became a member, whichever is later.

This shows your contributions, and any employer and government contributions you may have received. If you transferred into the scheme during the year, your transferred balance will show here as well. Find out more about contributing to KiwiSaver, what your employer’s obligation is, and what the government will contribute to your KiwiSaver.

Your investments are taxed at the prescribed investor rate (PIR) you have provided us. The PIR we hold for you is shown in the top right-hand corner of this statement. Make sure your PIR is correct. If you used a PIR lower than your correct rate, you need to include the income, and any tax paid, in your income tax return. If you are not sure whether you need to file an income tax return, please consult your accountant or tax adviser. You can work out your PIR here. If you are unsure of your PIR, you should seek independent professional advice from a tax adviser or speak to Inland Revenue.

This shows how much you have withdrawn from your account. This could be for retirement, a first home purchase, or for other approved early withdrawals.

This shows how much you had in your KiwiSaver account at the end of the financial year.

This shows how your money was invested at the end of the financial year, and the future investment strategy you have chosen. This also shows the total fund charges for each of your funds as a percentage of the fund’s investment value.

The total fees charged for the year are made up of an administration fee (if any) and fund charges. If you were involuntarily transferred in from another scheme as a default member, you were not charged any administration fee if you have all your money in the SuperLife Default Fund. However, there was a transaction cost associated with the transfer into the SuperLife KiwiSaver scheme. The fund charges cover our manager’s fee and other management and administration charges (supervisor, audit and legal costs). Your investment earnings are after the total fund charges. The fees set out above include the GST where applicable. You will only be charged the financial adviser fee if you have a financial adviser and have agreed with your adviser that he/she will be paid a fee for providing you financial advice. The amount of this fee is agreed between you and your financial adviser.

If you are 18 and over, and under 65, and have been with SuperLife for the entire financial period (12 months to 31 March), SuperLife (and all KiwiSaver providers) is legally required to let you know how much savings you are on track to receive by the time you reach 65. We make projections of what the lump sum and the weekly equivalent will be until you reach 90. The calculations are set by the government, and based on factors such as how much you have saved, what your contribution rate is, and what type of funds you are invested in. We then use a range of assumptions (such as inflation rate and investment return rates) set by the government, to work out your future retirement savings. Learn more about the projections here. The future retirement savings are projections only and not a guarantee from SuperLife or the government.

This section of the annual statement helps you make some decisions on your retirement savings. The projected lump sum you will get, and what it works out to per week, gives you an idea of whether you will have enough savings when you retire. Knowing what your projected retirement savings will be, you might want to think about whether you need to save a bit more in your KiwiSaver, and whether you are in the right type of funds at this stage in your life. |

|

You might have noticed the new homepage, updated design across the site, or change to the navigational structure. You can take a closer look at some of the changes below. We value your feedback so please share your thoughts with us. You can do so by clicking here or the “Feedback” link at the top of any page.

-- content here --

-- Block start --

Use our Quick Links widget anywhere on the site to quickly view the returns and fees for all of our investment options and schemes, read our updated frequently asked questions on a broad range of investment topics, or invest on behalf of a child.

-- Block end --

-- Block start --

A clean, mobile-responsive design means you can easily access important information, such as your investment options or our educational resources, on any device at home or on the go.

-- Block end --

-- Block start --

Not sure where to start when it comes to joining SuperLife or choosing your investment options? Read our Help Me Choose page, which includes important information to get started, or leave us a note on any topic and our team will get in touch.

Do you know what level of income you’d like to have when you retire? What about how much you need to have invested, to provide that income? Or, how you should invest your assets to provide you with that income? The answers to these questions are in the SuperLife “Thinking about your retirement” guide.

In planning your retirement, it must be remembered that in New Zealand, almost everyone who reaches age 65 qualifies for the state benefit (New Zealand Superannuation). For a single person this is $20,008 a year after tax. A married couple gets $30,781 (1 April 2016). You need to decide how much more you will need in retirement above this and and know how much you should be saving to achieve that goal?

The answer to “how much you should be saving?” is different for everyone, according to their individual circumstances. For you it will depend on your:

To work out your position, check out the calculators at www.superlife.co.nz and on www.sorted.co.nz. Here is an example which may assist you when thinking about your own situation.

Tracy is single, 45 years old and has no dependants. Tracy earns $60,000 a year. She’d like to retire at age 65 with an annual income of $38,517 after-tax (in today’s dollars). She currently has $40,000 in a superannuation scheme, $10,000 in KiwiSaver and is contributing $3,000 a year (5% of her pay) which is being split 2% to superannuation and 3% to KiwiSaver. These are both being matched $1 per $1 by her employer (including ESCT) as applicable. After the ESCT tax, the net employer contribution is $2,100.

| Scenario | Tracy |

| Current age | 45 |

| Intended retirement age | 65 (20 years' time) |

| Target retirement income | $38,517 p.a. (in today's dollar i.e. about 80% of her after-tax income) |

| Current income | $60,000 i.e. $48,146 after tax |

| Current accumulated savings | $50,000 ($40,000 Super, $10,000 KiwiSaver) |

| Current annual savings | |

| - Tracy | $3,000 |

| - Her employer | $2,100 (net of ESCT) |

| - Government | $521 (KiwiSaver MTC) |

In order to generate assets to provide a total annual income of $38,517, Tracy will need assets of around $340,000 on her retirement at 65. This will provide an income of $18,509 p.a. which together with her NZ Super benefit provides the $38,517 target. It also allows for the $38,517 to grow to match inflation. It assumes a 2.5% p.a. real return and that in retirement Tracy will spend both the investment income and her savings i.e. if she times it right, she will die as she spends her last dollar.

Of the required savings, Tracy already has $50,000 saved which will grow to $81,000 at age 65 in today’s dollars. Assuming Tracy continues to save at $3,000 a year, her total additional superannuation including the Company’s contribution will be equal to $140,000 in today’s dollars, by her intended retirement age. Tracy will therefore have a shortfall or gap.

| Scenario | Tracy |

| Super and KiwiSaver balance on retirement | $221,000 |

| Amount required | $340,000 |

| Shortfall | $119,000 |

To meet the shortfall, Tracy will need to consider further savings.

Assuming that Tracy will not inherit any money, Tracy will need to save more than her current $3,000 contributions in order to reach her retirement goals. She can do this by contributing voluntarily to her current superannuation scheme or by investing in assets outside the superannuation scheme (e.g. in a business or a rental house etc.). Tracy can start now and do it uniformly over the period to age 65, or start later when she has more disposable income. If she were able to invest a further $4,680 a year (i.e. $390 a month), she should be able to make up the shortfall and reach her retirement income goal (a retirement income of $38,517 per year).

| Scenario | Tracy |

| Additional savings (amount p.a.) | $4,680 |

| Investment return (% p.a.) | 2.5% p.a. |

| (after tax, expenses and inflation) | |

| Additional savings at retirement | $119,000 |

Of course there are other options. If Tracy has other demands on her money (e.g. a mortgage), she should probably defer saving until the mortgage is paid off. Saving by paying off a mortgage is a very efficient form of saving. When the mortgage is paid off, the amount required to be saved will be more than $4,680, but at that time, Tracy will be able to also make savings equal to her current mortgage payments.

If you want to test your financial position and what you might have to do, check out the SuperLife “savings calculator” at www.SuperLife.co.nz. Also, phone SuperLife for the booklet “Retirement savings guide”.

____________________________________________________________________________________

1. If Tracy doesn’t want to spend her savings and only wants to live off the income, she will need assets of $700,000 not $340,000.

The legal stuff

This is not a product disclosure statement for the purpose of the Financial Markets Conduct Act 2013. A product disclosure statement is available from SuperLife free of charge. Before making a decision, you should consider whether you need to seek financial advice. If you wish to have personalised financial advice, you should talk to an appropriately experienced Authorised Financial Adviser.

Why try to pick stocks when you can own the whole index? SuperLife lets you access the full range of Smart Exchange Traded Funds (ETFs).