We suggest that fund managers should not be able to quote just gross (pre-tax; pre-fees) returns either to clients or to the public. Gross returns can be very misleading.

If investors are to understand what return they are likely to receive or have received, quoting gross returns leads to misleading comparisons and conclusions. It is not possible, based on the gross returns alone, to work out whether a manager is relatively good or bad and whether the return will result in a higher or lower amount being paid to the investor. This is on top of the normal uncertainties surrounding past returns in general and covered usually by the general warning “past returns are not a good guide to the future”.

Publishing gross returns does not help an investor, unless they are accompanied by a lot of additional information on the investment structure, the tax basis and the fees. Even with the additional information, only a sophisticated investor could understand what the implications might be to the return they will receive.

The problem in part is caused by the complexities of the tax regime. In New Zealand we have a tax regime that has three different tax treatments that can apply (accruals, FDR and Australasian shares). These when combined with the complications of PIE and non-PIE vehicles make drawing conclusions from gross returns difficult.

A simplified example helps to show why quoting just gross returns should be outlawed.

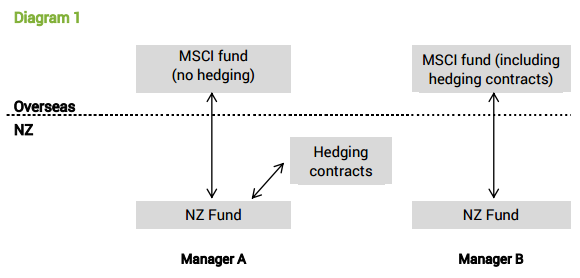

Take two managers; Manager A and Manager B. Assume both are successful index managers and so achieve the return of the market index less their fees. Both invest in overseas shares and have funds that follow the MSCI index on a fully hedged basis, i.e. both fully remove the risks associated with currency movements.

- Manager A buys units in an overseas-based overseas share fund and separately buys hedging contracts to remove the currency risk, i.e. the hedging contracts are taken out separate to the units in the overseas share fund. Manager A charges 1% of assets after tax.

- Manager B buys also units in an overseas-based overseas share fund but one where the hedging contracts are bought and held by the overseas manager within the overseas fund. Manager B therefore just owns units in the overseas share fund. Manager B charges 0.25% of assets after tax.

The difference between the two NZ funds relate to the manager fees (1% vs 0.25%) and the structure of the arrangements for the hedging contracts (outside the fund vs within the fund). The different structure leads to different tax treatments.

The arrangements are shown by Diagram 1 below.

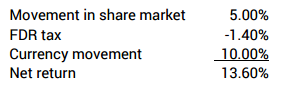

Assume that the return from overseas shares for the year was 5% and that the movement in the currency (the NZ dollar) was 10%. As the NZ dollar strengthened by 10%, the hedging contracts would pay out an amount to offset the loss caused by the 10% rise in the NZ dollar plus any tax effect i.e. will produce a return of 10% after tax.

The investments in the overseas share funds are taxed on a deemed 5% dividend income, under New Zealand’s FDR regime. They are not taxed on the actual return. For a top rate taxpayer (i.e. one on a PIR of 28%), this reduces the actual return by 1.4% whether the actual return is positive or negative. The 1.4% is 28% of the 5% deemed dividend (for those wanting the mathematical formula).

Gains from currency contract investments in the overseas fund (Manager B) are not taxed as they are within the fund and therefore are included under the FDR regime calculation. In contrast, the gains from the separate currency contracts (Manager A) are taxed during the year under the accruals regime on the actual return (currency gain or loss). Therefore, for Manager A to ensure that after-tax it receives a return to offset the currency movement, it must take out (buy) currency contracts of 1.39 times the assets it has invested. The extra 0.39 provides for the 28% tax so that after paying the tax on any gain, it eliminates the currency risk

i.e. (100% - 28% tax) x 1.39 x currency movement = 1.0 x the currency movement

The net returns (after-tax and then after-fees)

The net of tax but pre-fees return, for each manager, is 13.6% for the year. This is made up of:

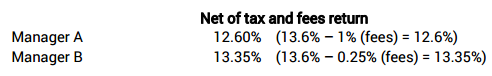

Therefore the net of tax and fees return of the managers is the 13.6% less fees.

Clearly Manager B is better for the investor, as 13.35% is higher than 12.6% and this difference in percentage returns will make a large difference in accumulated wealth at retirement. This highlights the importance of low fees, all else being equal.

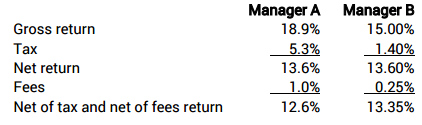

The gross return

The industry normally does not quote net returns and but rather the before-tax returns. In this case, Manager A has an advantage, as the currency contracts are outside the product, are taxed separately and the tax paid adds to the gross return.

The gross return of Manager A is the 5% (from shares) plus 1.39 x 10% (from currency) = 18.9%. The gross return for Manager B is the 5% (from shares) plus 10% (from currency) = 15%.

On a gross basis, Manager A has a higher return and looks better than Manager B. Even if the gross returns are adjusted for fees[1] as done in some performance surveys, Manager A (at 17.9%) still looks better then Manager B (14.75%). However, Manager B is still better and gives the investor a higher return in the hand. It is the return to the investor that is important; the return in the hand. As the table shows, Manager A pays a lot more tax but that doesn’t help the investor.

The difference in gross returns relates to the treatment of tax on currency and how the currency contracts are managed and structured. The difference in the return to the investor is driven by fees. No matter what warnings are given and how often investors are advised not to look at returns they will focus on the headline returns in the surveys. They will assume that they are fair and the best information available.

Currency management is important

In the example, the big difference in gross returns relates to the 10% movement in currency. While 10% sounds high, movements at this level are common. Experience shows that currency moves +/- 10% in a year, about half the time so it is common to get variations of this level. If an investor really wanted a higher gross return:

- When the NZ dollar strengthens, it pays to have the currency outside the product.

- If the NZ dollar weakens, it pays to have the currency within the overseas product.

If the focus is instead on the return to the investor, lower fees are better.

Disclosure of returns

Regulators have a choice. They can regulate for:

- consistency in quoted gross returns (knowing that investors will often be misled and therefore make poor investment decisions), or

- consistency in the gross returns but require disclosure of the tax treatment and product structure (knowing that investors will be confused by the additional material and instead focus on the high level gross returns and therefore be misled), or

- disclosure of the return to the investor in the hand i.e. the net returns after both tax and fees. Information should also be provided on structure and tax but if the investor does not read it, the disclosed relative returns will not be misleading due to the tax treatment.

The answer is that they should adopt a principled approach and require managers to disclose performance in a way that is not misleading and in a way that is understood by the average non-expert investor. Under a principled approach if Manager A disclosed the 18.9% or the 17.9%, it would breach the principle because the expected net returns to the investor are lower than other managers and the investor would be clearly misled.

Active management complications

The example used index managers to eliminate a further source of confusion. Active management introduces a further level of volatility and potentially misleading returns that also requires additional disclosure and explanation. In any given period, certain styles of active managers work better than others i.e. will generate above market returns, but will not do so in all periods. Again therefore, where a manager performs above or below the market index, the difference should be explained so the investor understands whether it is a temporary or a permanent return advantage. An active manager should not be allowed to disclose above market returns that relate to style or philosophy, unless it is a permanent advantage based on demonstrable skill that is likely to be persistent.

Quoted returns should still be after-tax, after-fees and allow for cash flows and be shown in dollars, as well as percentages. Showing returns in dollars highlights the significance that small differences in percentages make to the ultimate savings. Where a manager quotes returns in marketing material, it should have to give a certificate that it does not think the returns are misleading and any quoted comparison with other funds is fair. At the same time, we think regulators should require the provision of sufficient financial data to a central body so that returns can be calculated by that body in a consistent way. Also, a non-industry organisation, like AUT or the University of Auckland, should be given a contract to analyse the data and publish comparative tables.

¹ Note: for simplicity, the fees were taken as being after-tax fees. In practice, fees would be tax deductible and therefore the gap between Manager A and Manager B after-fees but before tax, would not be as great.