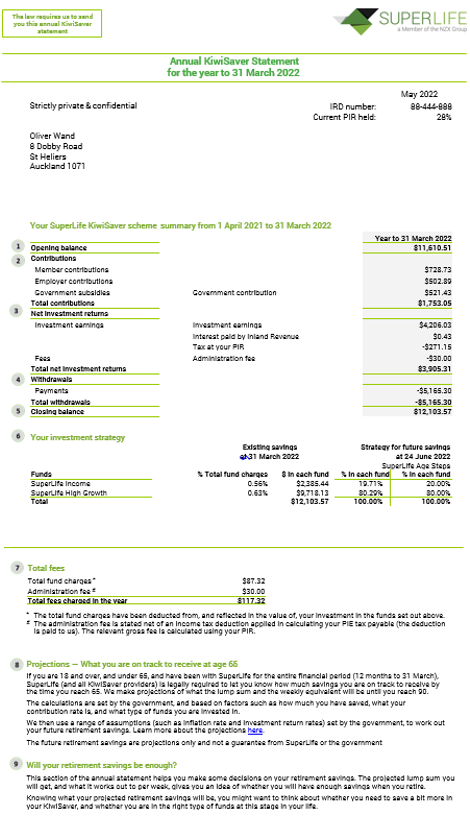

This shows how much you had in your KiwiSaver account at the start of the financial year or the date you became a member, whichever is later.

This shows your contributions, and any employer and government contributions you may have received. If you transferred into the scheme during the year, your transferred balance will show here as well. Find out more about contributing to KiwiSaver, what your employer’s obligation is, and what the government will contribute to your KiwiSaver.

Your investments are taxed at the prescribed investor rate (PIR) you have provided us. The PIR we hold for you is shown in the top right-hand corner of this statement. Make sure your PIR is correct. If you used a PIR lower than your correct rate, you need to include the income, and any tax paid, in your income tax return. If you are not sure whether you need to file an income tax return, please consult your accountant or tax adviser. You can work out your PIR here. If you are unsure of your PIR, you should seek independent professional advice from a tax adviser or speak to Inland Revenue.

This shows how much you have withdrawn from your account. This could be for retirement, a first home purchase, or for other approved early withdrawals.

This shows how much you had in your KiwiSaver account at the end of the financial year.

This shows how your money was invested at the end of the financial year, and the future investment strategy you have chosen. This also shows the total fund charges for each of your funds as a percentage of the fund’s investment value.

The total fees charged for the year are made up of an administration fee (if any) and fund charges. If you were involuntarily transferred in from another scheme as a default member, you were not charged any administration fee if you have all your money in the SuperLife Default Fund. However, there was a transaction cost associated with the transfer into the SuperLife KiwiSaver scheme. The fund charges cover our manager’s fee and other management and administration charges (supervisor, audit and legal costs). Your investment earnings are after the total fund charges. The fees set out above include the GST where applicable. You will only be charged the financial adviser fee if you have a financial adviser and have agreed with your adviser that he/she will be paid a fee for providing you financial advice. The amount of this fee is agreed between you and your financial adviser.

If you are 18 and over, and under 65, and have been with SuperLife for the entire financial period (12 months to 31 March), SuperLife (and all KiwiSaver providers) is legally required to let you know how much savings you are on track to receive by the time you reach 65. We make projections of what the lump sum and the weekly equivalent will be until you reach 90. The calculations are set by the government, and based on factors such as how much you have saved, what your contribution rate is, and what type of funds you are invested in. We then use a range of assumptions (such as inflation rate and investment return rates) set by the government, to work out your future retirement savings. Learn more about the projections here. The future retirement savings are projections only and not a guarantee from SuperLife or the government.

This section of the annual statement helps you make some decisions on your retirement savings. The projected lump sum you will get, and what it works out to per week, gives you an idea of whether you will have enough savings when you retire. Knowing what your projected retirement savings will be, you might want to think about whether you need to save a bit more in your KiwiSaver, and whether you are in the right type of funds at this stage in your life. |

|