|

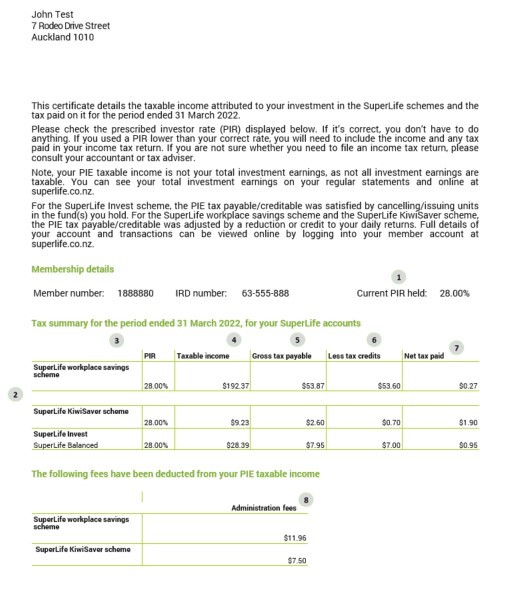

1. Current PIR held This refers to the current PIR we have on record for you.

2. SuperLife schemes The tax summary table covers every SuperLife scheme you are invested. Every fund in SuperLife Invest is detailed because each fund is a PIE. You can learn more about the schemes and funds by reading the relevant product disclosure statement found on superlife.co.nz.

3. PIR This shows the PIR we used to work out the tax on your investment income for each of your SuperLife schemes. Your PIR can be 0%, 10.5%, 17.5% or 28%. You don’t have to do anything if the PIR shown on the certificate is correct. You can work out your PIR here. For joint account holders, the higher PIR rate will be used to work out the tax on your investments.

4. Taxable income This refers to how much of your investment income is taxable. PIEs have special tax treatments so not all the income earned from your PIE investments is taxable. What is taxable depends on the type of assets held by your funds and schemes. Find out more here. Your taxable income is reported less any expenses available for deduction.

5. Gross tax payable This refers to how much tax you are paying on your investment income. The amount is worked out using this formula: Gross tax payable = PIR x taxable income The non-taxable part of your investment return, taxable investment return and the tax payable are shown on your regular member statements which are available online.

6. Tax credits A tax credit reduces the amount of tax that you pay. For example, if the fund you are in earns income from overseas investments for which tax has been paid, a tax credit may be available.

7. Net tax paid This figure is the total tax paid or total tax refunded to your account balance in a SuperLife scheme. Your tax has already been paid on the taxable investment income so no action is needed when you receive this certificate. However, if you gave us the incorrect PIR, you may need to complete a tax return.

8. Administration fees The administration fee is $30 per year or $2.50 per month (if applicable) for KiwiSaver scheme members and $12 per year for the SuperLife Invest and SuperLife workplace savings scheme. |

|