Quarterly News

To 31 December 2020

Welcome

Welcome! What an eventful year it has been, and a challenging one for many. As we have learned to live with the uncertainties presented by COVID-19, we have also had time to reflect on what’s important to us, personally, and as a society.

As we continue to work hard to grow your savings and investments, Smartshares has also grown — we now manage more than $5 billion on behalf of more than 75,000 New Zealanders. This growth allows us to continue to review fees and charges – something we recently wrote to you about. Smartshares offers some of the lowest cost investment products in New Zealand and we all know that minimising fees is one of the most reliable ways of achieving our financial goals.

I am also pleased to note that our good work was recognised when Smartshares’ New Zealand Top 10 Fund was named Good Returns’ New Zealand Equities Fund of the Year for 2020.

We were also finalists in the Fund Manager of the Year, the Australasian Fixed Interest Fund of the Year, and the Global Equities Fund of the Year categories.

While none of us was able to predict the events of 2020, based on current expectations for the year ahead, global economies are expected to recover at a measured pace. The inauguration of US President Joe Biden has given markets hope of more fiscal stimulus for the US economy. There is, however, a risk of more market volatility as the world comes to terms with how to address and manage the ongoing threat of COVID-19 and its variants.

In ‘Thoughts on investment strategy’, our chief investment officer Stuart Millar is of the view that markets will be looking for signs of a more broad-based recovery in the US; and for central banks and governments, globally, to stay on track with their efforts to support their economies.

Remember we are here to help with your investment needs. Please call us on 0800 27 87 37 and talk with one of our experienced customer service team members should you need help with our products, or with your account. We can also be reached by email at This email address is being protected from spambots. You need JavaScript enabled to view it..

Enjoy the read.

Hugh Stevens

CEO, Smartshares

Follow these links to:

Market Update

International equities

In the December quarter, international shares, after accounting for currency fluctuations, returned 6.4%.

Over 12 months, returns were 9.7% (FTSE Developed All Cap Index in NZ dollar terms).

NZ equities

NZ equities, as measured by the S&P/NZX 50 Gross Index, returned 11.4% in the quarter. Over 12 months, NZ equities returned 13.9% (S&P/NZX 50 Gross Index).

Emerging markets

Emerging markets returned 17.5% in the quarter and 15.5% over the year (FTSE Emerging Markets All Cap).

Australian equities

Australian equities, as measured by the S&P/ASX200 Total Returns Index, returned 13.7% in the quarter. Over 12 months, Australian equities returned 1.4% (S&P ASX 200 Total Return Index).

International fixed interest/bonds

Overseas bonds returned 0.8% in the quarter and 5.4% over 12 months (Bloomberg Barclays Global Aggregate Total Return Index, NZD hedged).

NZ bonds

NZ bonds fell by 1% in the quarter but returned 5.4% over 12 months (S&P/NZX A-Grade Corporate Bond Index).

SuperLife funds

SuperLife Income, which does not have any exposure to equities, returned 0.5% in the December quarter, and 4.1% over 12 months.

SuperLife Conservative, invested mainly in income assets, returned 3.7% in the quarter, and 4.5% over 12 months.

SuperLife Balanced (which typically has 60% in equities/listed property and 40% in cash and fixed income) returned 6.9% in the quarter and 5.7% over 12 months.

SuperLife Growth returned 8.8% in the quarter. Over 12 months, returns were 5.3%.

SuperLife High Growth, invested mostly in higher risk assets such as equities and property stocks, returned 10.9% in the quarter and 5.3% over 12 months.

Ethica, a socially responsible fund, returned 7.7% in the December quarter. Over 12 months, returns were 9.6%.

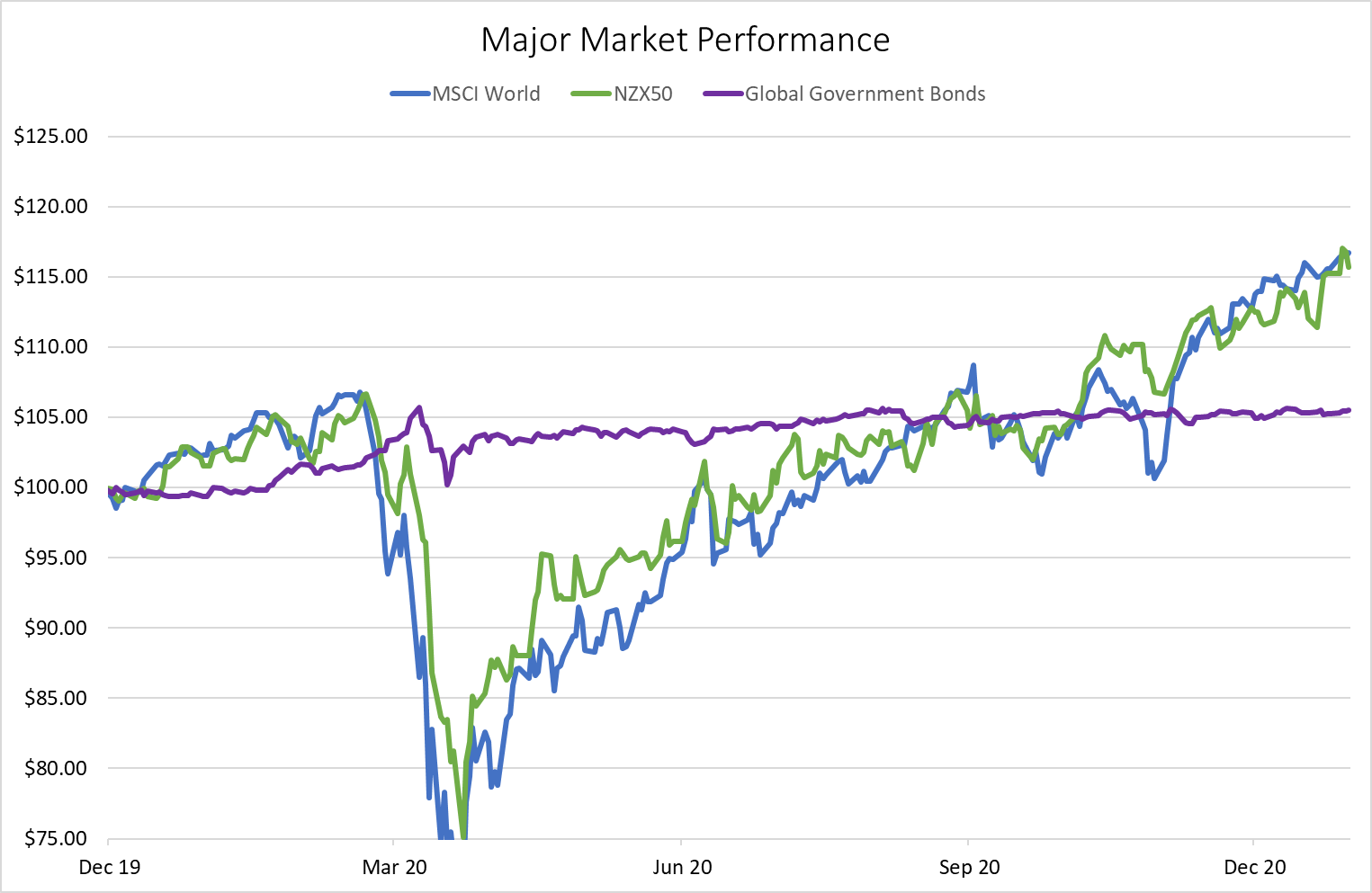

Figure 1: Equities recovery choppy, bonds stay flat lined

Source: Bloomberg/SuperLife

Not too hot, not too cold but just right. This might be what investors are looking for in the investment environment as they try to shake off lingering fears of new waves of COVID-19 variants derailing any hope of a smooth global economic recovery.

Much of the last quarter was spent waiting for news on what type of vaccines will be ready for rollout to populations around the world. Front runners in the race to supply COVID-19 vaccines are pharmaceutical companies such as Astra Zeneca, Moderna, and Pfizer. Most of the coming months will be spent looking at how widely available these vaccines will be, and what the results will show.

In New Zealand, the maiden shipment of Pfizer’s vaccine has recently landed on our shores. The US, UK, Canada, and China, among others, have also approved COVID-19 vaccines for use.

The S&P 500 closed the December (Dec) quarter up 11.7%. Despite a year fraught with uncertainties and massive panic selling in the week of 23 March, the S&P 500 closed 16.3% higher in 2020. The market continued its pendulum swings, often sitting between mild exuberance and a healthy dose of caution.

While giant companies such as Facebook, Amazon, Apple, Netflix, and Google (Alphabet Inc) took centre stage most of last year, the Dec quarter saw cyclical companies (companies whose fortunes are tied to the wider economy, such as tourism and services) make tentative advances.

Year of adjusting to the new COVID era

Investors will remember 2020 as a year of learning to live with COVID-19, and 2021 as a year of picking up the destructive trails left by COVID-19. The question some will ask is: will there be a double-dip recession or will economies move in a straight upward trajectory?

Governments and central banks around the world will be trying to keep a balance between spending money to stimulate their economies while trying not to create excessive national debt burdens.

Investors will be looking for strong signals from governments and their central banks to stay on track with their efforts to support their economies’ turnaround. They will be looking for central banks to stay committed to accommodative monetary policy, and for governments to continue providing financial aid to households and businesses hurt by the economic downturn.

The US market had reasons to cheer as the US Congress in December 2020 cleared the hurdle for a US$900-billion pandemic relief bill to become law. This aid package, which will improve investor confidence, is on top of a US$2-trillion package the Congress approved in March 2020. President Joe Biden also unveiled a US$1.9-trillion stimulus package in January this year which he plans to fast track, with or without Republican support.

The question remains how much more aggressive President Biden’s government will be in handing out government money to ignite the US economy.

In the US, the government is already facing the daunting prospect of managing its largest deficit since World War 2. US public debt is projected at around 107% of gross domestic product in 2023, a historic high. (Source: npr.org) In New Zealand, government debt is expected to hit 52.6% of GDP by 2023 – nearly twice its current level.

What does all this mean for investors?

The months ahead will see the unfolding of further recessionary impact; the recovery process across the world; and the unpredictable nature of a new virus and its variants.

Investors are likely to continue their hunt for value among companies benefitting from a broader-based recovery in the economy. These areas include financial, property, and services sectors.

Here are some thoughts on what to watch out for in the current investment environment.

- The low interest rate environment is expected to provide a level of support for the equities market, particularly for companies whose fortunes are tied to an economy on the mend. Sectors with strong exposure to property, and emerging markets, are also expected to see some demand. Companies whose fortunes are relatively immune to economic fluctuations are also likely to be attractive.

- Fixed income and cash returns will stay unattractive relative to equities. However, the safe haven nature of government bonds means there will continue to be underlying demand. Corporate bonds from issuers with a proven track record of good management will continue to be sought after.

- Giant companies such as Facebook, Apple, Amazon, Netflix and Google (Alphabet Inc), collectively known as FAANG, had standout runs in 2020. A correction in their prices would dampen the current strength of the S&P 500.

- The relative strength of the NZ dollar against the US will benefit investors with hedged global equities holdings.

- 2020 was an important lesson on why long-term investors should avoid selling shares while the market is going through extreme volatility. A better option is to average the cost of investments over time by accumulating regularly when opportunities arise.

SuperLife offers access to 42 funds across different sectors and country exposures, so investors can create portfolios tailored to their needs.

Our Ethica fund is a socially responsible fund with investments in a balance of income and growth assets.

If you are getting close to retirement, the SuperLife Age Steps option lets you set your investment in income and growth assets based on your age. This means as you get older, the proportion of your investment in more volatile growth assets will be reduced, lowering the expected size of the ups and downs in the value of your investment.

If you are concerned about your investments, or would like to find out more about how SuperLife can help with your investments, get in touch with us at This email address is being protected from spambots. You need JavaScript enabled to view it. or 0800 27 87 37.

These thoughts on investment strategy do not constitute financial advice and do not take into account personal circumstances. They are designed to illustrate possibilities only. As with all investment decisions, what might be the right strategy over the medium or longer term may not pay off over the very short term. No one can consistently predict what will happen over the short term. Those acting upon the information in this newsletter do so entirely at their own risk. SuperLife does not accept liability for the results of any actions taken or not taken based on this information. While every effort has been made to ensure accuracy, no liability is accepted for errors or omissions in this newsletter.

Protecting your privacy

An important part of what SuperLife does every day involves collecting information about you.

We collect information when you use our websites and when you join the SuperLife KiwiSaver, SuperLife Invest, workplace savings or UK pension transfer scheme. We also collect your information from third parties when you have given us permission to do so, or if the information is publicly available.

The information we collect about you includes your name, postal and email address and contact numbers; the time and date you use our websites; and the web pages you visited.

Other information we may collect include your computer’s IP address (the identifier of your computer which allows the computer to send and receive information); your computer’s operating system and browsers; and the search engines you use.

Our website may also have software, often referred to as cookies, to help us personalise information or advertisements for you.

How we use your information

We respect your privacy and have strict rules on how we use your information.

We may use information collected from you for verifying your identity and address; for providing you with our products and services; and for managing our relationship with you.

From time to time, we may use your information to conduct market research and other research for marketing or product development purposes.

Sometimes, we may need to disclose your information to third parties (e.g. to carry out your instructions) and government agencies when required.

How we store your information

We store your information in-house, or with third parties contracted to hold the information for us in New Zealand and overseas.

We will take reasonable steps to ensure that your information is protected from unauthorised access, modification, disclosure or misuse.

You can find out more about our Privacy Policy here.

Under the new Privacy Act 2020, which came into effect on December 1 2020, all businesses are required to notify the Privacy Commissioner’s Office of any privacy breaches which are believed to have, or likely to cause serious harm. We are available to discuss any questions you may have about how we collect, use or store your private data. Please call or email with your questions.