Quarterly News

To 30 June 2018

Welcome

Welcome to the June quarter news. Thanks to those members who provided some feedback on the last news. In response, we have now added a print version of the news on the website for those who prefer to print and read. We welcome your feedback on information you would like to read here. If you have any questions, please contact the SuperLife team.

This quarter we provide an update on market activity in particular where equity markets overall bounced back from the losses in the March quarter. You can view each of our funds and their performance by following the link below or log in to the website to see how your own investment strategy has performed.

Our regular My Future Strategy update provides information (but not advice) on what to think about when considering your future strategy. It does not take account of individual circumstances.

Also in this edition:

- The member tax credit (MTC) is being paid into KiwiSaver accounts. Did you get your maximum KiwiSaver government contribution?

- Details of the changes to the Statement of Investment Policies and Objectives (SIPO)

- Should you have a rainy day fund? There’s been discussion about helping people build a fund to help them through unexpected events that affect their finances. We encourage you to read the article below on how the SuperLife Invest scheme can you with rainy day problems.

Market Update

The following comments are written by Aaron Drew, Principal, MyFiduciary. Aaron’s industry experience includes the New Zealand Superannuation Fund where he was a member of its investment committee, the Reserve Bank of New Zealand and the OECD in France.

Overall, equity markets bounced back from their March quarter losses in the period to the end of June and reached a record high in New Zealand dollar terms. However, some markets performed very well, and some poorly. The New Zealand dollar fell against most currencies, and this boosted the return on offshore equities and property (on an unhedged basis). The June quarter highlighted the importance of maintaining a well-diversified portfolio – enabling it to benefit from strong markets, and to be cushioned from markets not doing so well.

Australian equities returned around 8.2% in Australian dollar terms, bouncing strongly back from their poor performance earlier in the year. Overseas shares in developed markets returned around 1.7% in their home currency terms, and 8.5% in New Zealand dollar terms. This much stronger New Zealand dollar return to overseas shares occurred because the Kiwi fell by around 6.5% against the US dollar in the period, and the size of US equity markets is huge, comprising well over 50% of global equity markets.

Emerging markets were resilient to the sell-off seen at the start of 2018 but suffered a reversal of fortune in the June quarter, falling by around 3%. The Chinese market had a particularly poor quarter, and this was largely attributed to the escalation in trade tensions following the decision of the US Administration to impose steel and aluminum tariffs on China and many other countries.

SuperLife’s NZ bond fund returned around 1% for the quarter and 3.5% for the year. This return is well ahead of short-term cash rates, indicating that NZ bonds have offered a good premium. International bonds returns were softer for the quarter at around 0.2%, bringing the annual return to around 1.6%. As discussed in the March quarter news, international bonds have been hit over the year by interest rates increasing at a faster pace than what had been expected.

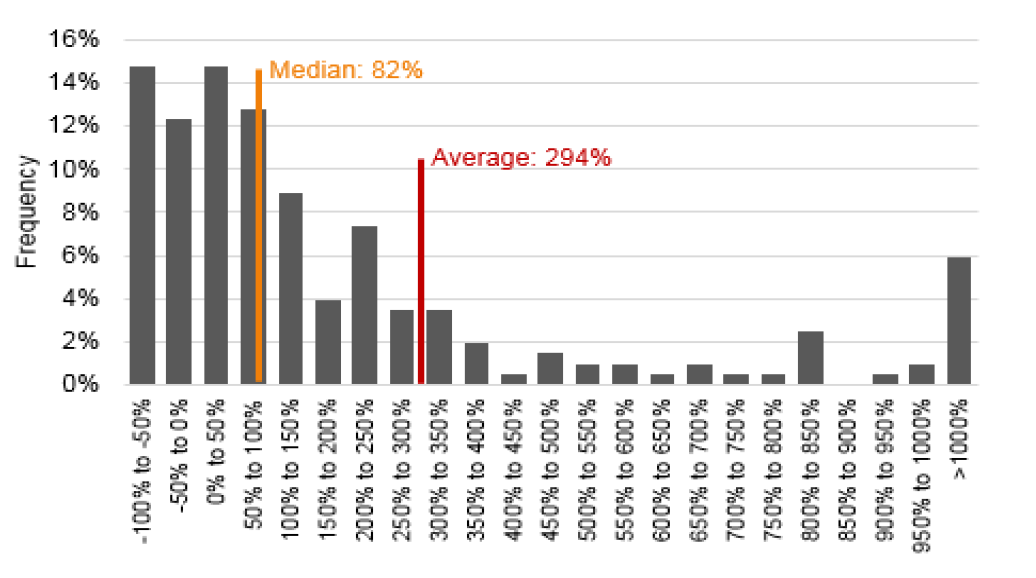

The New Zealand equity market deserves special mention as it again had a strong quarter, with the S&P/NZX 50 portfolio index returning around 7.5%. Over the past 5 years, our market has been a stand-out performer, returning around 15% per annum. However, this pleasing result is heavily influenced by a handful of stocks that have performed exceptionally well, most recently A2 Milk. The chart below shows that this is a feature of our market (and others) over longer time periods too. The distribution of company returns is not evenly balanced. Some companies have returned over 1000%, while others have failed. This means the middle or median New Zealand listed company return (around 4% p.a. over the past 15 years) is much lower than the average return across the market (around 7.5% over the period). This pattern in equity markets also helps to explain why most active equity managers fail to consistently beat the market – they miss out, or are underweight, the small handful of stocks that do extremely well over their full time on the market. In contrast, to the extent a passive fund tracks the market, it will hold the exceptional performers.

Get more information on SuperLife's 41 investment options and their returns.

Distribution of company returns on the New Zealand exchange over the past 15 years

My Future Strategy

The following comments are written by Aaron Drew, Principal, MyFiduciary. Aaron’s experience includes the New Zealand Superannuation Fund where he was a member of its investment committee, the Reserve Bank of New Zealand and the OECD in France.

For investors with long-term horizons, staying the course with your present investment strategy is usually the best option, subject to your goals, objectives and cash needs remaining broadly the same as when your strategy was established. Ideally, this is something you should consider, but not necessarily amend, annually, or when there is a material change in your financial position.

For investors with short-term cash needs, or who have taken more risk than they are normally comfortable with, it might make sense to increase cash holdings or move to a lower risk portfolio. The run-up in markets over recent years has been exceptional, and while the global economic growth environment is expected to remain robust, there is no doubt that risks to global growth have increased following the US Administration’s decision to place steel and aluminium tariffs on most economies.

For investors concerned with performance over a medium-term horizon (the next 3 – 5 years or so), there may also be an opportunity to enhance returns by updating your longer-term allocation to cash, bonds, equities and property stocks as follows:

- Holding less in bonds, and therefore more cash and shares. This reflects the view that interest rates may still increase more quickly than is currently factored into bond prices given the strength of global growth and employment conditions, and the potential for this to increase inflation faster than expected. Tariffs and the potential for disruptions in global supply chains if tensions escalate also raise prices.

- Favouring non-government (corporate) bonds over government bonds, given government bonds tend to be issued at a longer term (or maturity date) than corporate bonds. This means they are more sensitive to the risk of interest rates increasing at a faster pace than is expected.

- Favouring value, emerging markets, Australian and European stocks compared to US stocks and New Zealand stocks. These markets are broadly assessed to offer more value.

- Maintaining holdings of property stocks at around your long-term allocation.

- Maintaining the currency hedge on overseas shares at around your long-term allocation (this is a change in the view from March and reflects the decline in the New Zealand dollar over the previous few months).

This strategy does not take account of individual circumstances.

As with all investment decisions, what might be the right strategy over the medium term may not be right over the short term.

Update of Statement of Investment Policies and Objectives (SIPO)

We have recently completed our annual review of investment strategy and have updated the SIPOs for each of the SuperLife schemes to reflect the outcome of that review.

What is a SIPO?

A SIPO is a publicly available document describing the investment objectives and parameters for a scheme. It includes detailed information on each fund’s investment strategy, objective and permitted investments.

Find the latest SIPO for each SuperLife scheme.

How often is a SIPO reviewed?

We review each SIPO annually to ensure it incorporates applicable changes to the law and guidance provided by Financial Markets Authority, as well as any changes following our annual review of investment strategy.

Before amending a SIPO, we discuss the changes with Public Trust, the supervisor of the SuperLife schemes.

What has changed following the SIPO review?

The most recent SIPO review included changes to target investment mixes (for Ethica and the managed funds) and market indices.

The changes to the target investment mixes increase each fund’s target allocation to international assets. We still maintain a relatively high overall allocation to New Zealand shares, but we have reduced our allocation to Australian shares. Also, by improving our cashflow management, and because of the schemes’ continued growth, we have managed to reduce our allocation to cash because holding too much reduces a fund’s longer run performance. Each must hold some cash to facilitate switches and withdrawals.

The changes to market indices are to ensure the index against which a fund is measured is better aligned to the fund’s assets.

Finally, we have changed the SuperLife Invest SIPO to allow the scheme to generate revenue for its investors from financial product lending. This is when a financial institution does not have sufficient financial products to complete a sale that it has agreed to, and therefore commonly temporarily borrows financial products from a fund to meet its obligations.

Did you get your maximum KiwiSaver government contribution?

The member tax credit (MTC) for the year to 30 June 2018 is being paid to KiwiSaver accounts. Did you make the most of your maximum $521 KiwiSaver government contribution?

If you save $1,043 by 30 June each year (the equivalent of about $20 a week) you can get the maximum $521 MTC from the government. This might be a smaller amount if you join or leave KiwiSaver part way through the year.

Now is a good time to work out how you can get the maximum MTC for the next year.

- Check your payslip to see how much you are saving from your pay. Your savings rate can be 3%, 4% or 8% of pay. If it’s less than $20 a week or $87 a month, you can choose to increase your savings rate from 3% to 4% or 8%.

- You can easily set up a regular KiwiSaver contribution from your bank account or save a lump sum if you register for online access.

- You can also complete the lump sum contribution form and send it to us. This lets you use internet banking or attach a cheque. Employees can choose to do this in addition to saving through their pay.

- Contact us to find out if you can transfer savings from your SuperLife workplace savings or SuperLife Invest accounts to your SuperLife KiwiSaver scheme account.

- There is draft legislation to change the name of MTC to the more understandable “Government Contribution”. We support this change of term as many members have been confused about whether the credit relates to other tax paid or your tax return (it doesn’t).

Build up your rainy day fund with SuperLife Invest

Unexpected events such as losing your job or a major health issue can reduce your income, increase your expenses, or both.

A rainy day fund can help pay essential daily living costs such as rent, mortgage and food bills during these times. Saving a little over time, and being disciplined enough not to spend it, can help you build up an emergency fund. The Sorted website has a good article about why a rainy day fund is a good idea.

A SuperLife Invest account encourages you to save a little over time and build up your rainy day fund – provided you don’t touch it other than for real emergencies. Unlike a KiwiSaver account, a SuperLife Invest account lets you withdraw the funds when you need to (usually one business day’s notice) by simply completing a form.

This email address is being protected from spambots. You need JavaScript enabled to view it.

Call 0800 27 87 37

Smartshares Limited is the issuer of SuperLife Invest, the SuperLife KiwiSaver scheme, the SuperLife UK pension transfer scheme and the SuperLife workplace savings scheme. The Product Disclosure Statements and Fund Updates for these schemes are available at www.superlife.co.nz/resources/legal-documents