Welcome!

What a difference a few months make. Since our last update, much of the world’s focus has turned to COVID vaccination programmes and what they might mean for human health, along with greater social freedom and economic growth.

The US economy has already awoken with a roar. However, there are challenges related to reigniting a US$20 trillion economic engine. There are now signs of price pressures, bottlenecks and supply chain issues as the US economy rebounds from a very low base.

One of our most important roles as a fund manager is to periodically revisit our capital market assumptions and the resulting strategy we determine for how we allocate your investment across different types of assets (for example equities, bonds, cash). We have completed our most recent review and are now making some changes to the investment targets in our diversified funds. The aim is to give your investments greater resilience to meet the ever-shifting forces at play in global markets. For example, in an environment where interest rates are rising, we may increase how much we invest in cash, and reduce bond holdings.

A piece of good news from us — Smartshares will from 1 December 2021, be one of six default KiwiSaver providers in the country. When someone joins the KiwiSaver scheme but does not choose a provider, the government assigns the person a provider out of the six.

As a default KiwiSaver provider, we will be offering a new low-cost balanced fund. This fund will be available to all SuperLife KiwiSaver members. We will have more information for you about this in the coming months.

As always, we are happy to help answer any questions about your investments. Email us at This email address is being protected from spambots. You need JavaScript enabled to view it., call us at 0800 27 87 37, or chat using the icon found at superlife.co.nz.

In ‘Thoughts on investment strategy’, our chief investment officer, Stuart Millar, is of the view that while the market is jittery about the prospect of interest rates moving higher earlier than expected, fundamentals are still sound, and equities will continue to command centre stage.

Enjoy the read.

Hugh Stevens

CEO, Smartshares

Market Update

There is some reason to cheer. The world’s economic giant, the US, is no longer in hibernation. The US economy posted a sterling second quarter growth of 6.5% (advance estimate), after growing 6.3% in the first quarter.

The V-shaped economic recovery seen in the US — where the economy had a precipitous fall, followed by a sharp rebound — brings with it some teething pains.

There is euphoria on the one hand, as the US gets out of lockdown. Shopping malls have reopened, bars and restaurants are refilling, and consumer confidence has improved. On the other hand, there are now bottlenecks and supply chain issues in the US. These are the challenges associated with reigniting the world’s largest economy.

The US recovery has been helped by the country’s massive and rapid vaccination programme; the US government’s strong resolve to lift the economy out of its doldrums; and President Joe Biden’s aggressive push for fiscal stimulus programmes.

Consumer confidence rose in June and is at its highest level since the pandemic surged in March 2020, according to the Conference Board Consumer Confidence Index®.

The US consumer price index rose 5.4% in the year to June 2021, the sharpest 12-month climb since August 2008. However, the rise was against June 2020’s unusually low inflation level when the US was facing a COVID shutdown.

What remains to be seen is whether consumer confidence will continue a smooth upward trek or face some starts and stops in between.

Equities still in demand

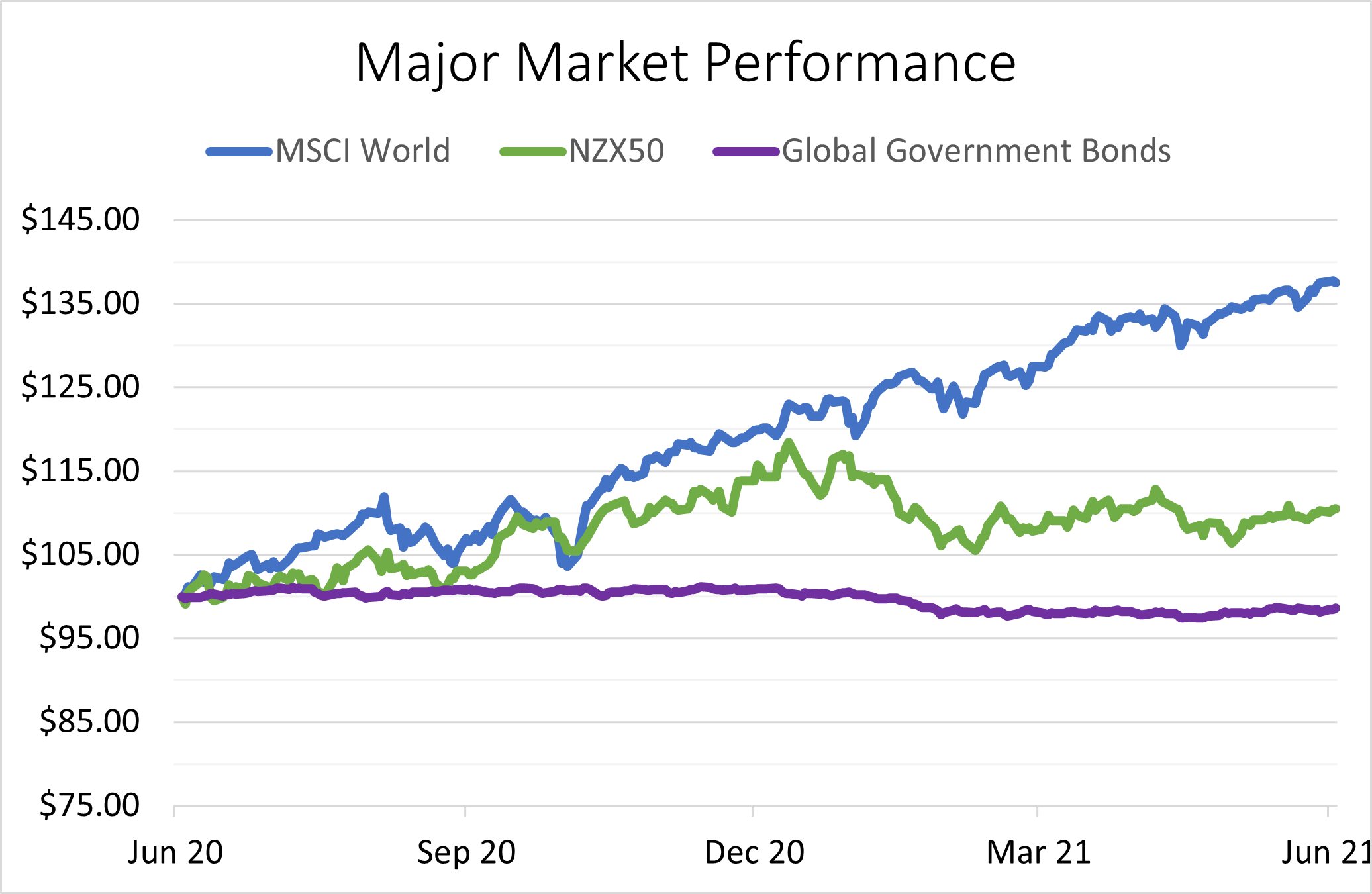

Equities remained the undoubted star in the June quarter despite some rumblings of a comeback from bonds. The S&P 500 Index, which tracks 500 of the largest US companies, rose 14.4% in the six months to 30 June 2021, and 38.6% over 12 months.

Smaller stocks have continued their rebound seen during the last quarter. This was reflected in the Russell 2000 Index which was up 17% in the six months to 30 June 2021, and 60.3% over 12 months.

The S&P/NZX 50 Gross Index, the bellwether for our top 50 largest companies, was up 10.5% over 12 months but down 3.3% over six months. However, the index had been on a steady rise since the COVID-related impact in late March 2020.

Given the aggressive asset purchase programme by the US Federal Reserve, which has been flooding money into the market through its bond buying programme, fixed interest assets and bonds continued to languish. The benchmark 10-year US government bond yielded 1.6% and the NZ 10-year government bond 1.8% at the start of June 2021.

The VIX Index, a measure of expected volatility of the S&P 500, has fallen around 48% from 12 months ago, and 30% from six months ago. At the height of the COVID pandemic, the VIX Index, crossed 80. It has been sitting under 30 since March 2021. This indicates investors are expecting the S&P 500 will fluctuate within a 30% band of the index.

International equities

In the June quarter, international shares, converted to NZ dollars, returned 7.5%. Over 12 months, returns were 30.5% (FTSE Developed All Cap Index NZD).

NZ equities

NZ equities, as measured by the S&P/NZX 50 Gross Index, returned 0.7% in the quarter and 10.5% over 12 months.

Australian equities

Australian equities, as measured by the S&P/ASX200 Total Returns Index, returned 8.3% in the quarter and 27.8% over 12 months.

Emerging markets

Emerging markets returned 5.7% in the quarter and 39.5% over 12 months (FTSE Emerging Markets All Cap).

International fixed interest/bonds

In line with a low interest rate environment, overseas bond returns were flat at 1% in the June quarter. Over 12 months, returns were zero per cent as a result of very low, and sometimes negative, interest rates. (Bloomberg Barclays Global Aggregate Total Return Index, NZD hedged).

NZ bonds

NZ bonds returned 0.3% in the quarter but over 12 months, returns fell 1.2%. (S&P/NZX A-Grade Corporate Bond Index).

SuperLife funds

SuperLife Income, which does not have any exposure to equities, had a flat quarter. The fund returned 0.5% in the June quarter, and 0.5% over 12 months.

SuperLife Conservative, invested mainly in income assets, returned 2.1% in the quarter, and 8.5% over 12 months.

SuperLife Balanced (which typically has 60% in equities/listed property and 40% in cash and fixed income) returned 3.7% in the quarter and 17.3% over 12 months.

SuperLife Growth, returned 4.6% in the quarter and 22.9% over 12 months.

SuperLife High Growth, invested mostly in higher risk assets such as equities and property stocks, returned 5.5% in the quarter and 28.9% over 12 months.

Ethica, our socially responsible diversified fund, returned 3.8% in the quarter and 20.3% over 12 months.

Figure 1: Equities continue ascent, bonds lack pulse

Source: Bloomberg/SuperLife

The current market conditions sit in the realm of what is termed as a kind of ‘Goldilocks’ market. This term — borrowed from the classic childhood bedtime story Goldilocks and the Three Bears — describes a market that is ‘just right’ — neither too hot, nor too cold.

Investors have shown a healthy dose of caution and optimism in a world climbing out of economic despair.

Although equities have had a good run in the last year, the price gains have been backed by solid rebounds in performance. Of the 443 companies in the S&P 500 that have reported earnings to date for the second quarter of 2021, 87.4% have reported earnings above analysts’ expectations. Second and third quarter earnings are estimated to increase 93.1% and 29.8% from a year ago. Source: (Lipper Alpha Insight, 9 August 2021).

What will unnerve investors?

The rise of COVID-19’s Delta variant has caused several countries which were previously out of lockdowns to reimpose them, and others to introduce tighter social distancing and mask use rules.

Between the old administration and President Biden’s administration, over US$6 trillion in fiscal stimulus programmes have been pushed through.

Another main fuel for the economy’s recovery is the Federal Reserve’s commitment to keeping money supply flowing, so the cost of funds can be kept low, to support economic activities.

Recently, the US market was spooked by the possibility of the Federal Reserve raising interest rates sooner than expected due to signs of rising inflationary pressures. These fears were abated, however, as the market warmed to the Fed’s position that the recent inflationary pressures were transitory, and not permanent in nature.

Federal Reserve officials are largely split over whether there are enough signals to put the brakes on keeping the money supply flowing. One camp is in favour of acting sooner rather than later, while the other is not convinced the economic indicators are strong enough to warrant early action.

Another factor at the top of investors’ minds is whether the current market has sufficiently taken into account the anticipated rise in interest rates, and whether the eventual interest rate adjustments will be at a level higher, or lower, than expected.

What does all this mean for investors?

The next few months will continue to be a time for adjusting to the turbulence surrounding how much the interest rate environment will change, and the challenges of managing new COVID variants around the world.

- Equities have turned in some stellar returns for most of SuperLife’s funds in the March quarter and stayed firm in the June quarter. However, investors should not expect the exceptional returns to be repeated as the gains were against a very low market seen last year.

- Bonds have consistently trailed equities in the last 12 months. This situation is unlikely to change much unless inflation accelerates out of control to warrant a sharp revision to current interest rates.

- Yields between 10-year US treasury bills and corporate bonds (of a similar tenure) have been narrowing, reflecting investors are more confident of the prospects of an economic recovery, hence a higher tolerance for the risks associated with corporate bonds.

- Whether the yield spread (the difference in yields between treasury bills and corporate bonds) will continue to narrow depends on whether the market continues to think the inflationary impact being felt is not a problem given it is growing from a low base last year.

- Investors will continue to focus on quality bonds issued by companies with a track record of strong management, and good performance, given the low interest rate environment.

- Companies whose performance is tied to the rebound in the economy, will also continue to be attractive.

- While last year’s equities market was powered by big tech stocks, as the economy makes its comeback, smaller companies are also benefitting from the recovery.

- The S&P 500’s valuation no longer looks cheap. However, investors are likely to continue looking for reasonable investments, and equities remain more attractive relative to bonds.

SuperLife offers access to a range of funds across different sectors and country exposures, so investors can create portfolios tailored to their needs.

Our Ethica fund is a socially responsible fund with investments in a balance of income and growth assets.

The SuperLife Age Steps option lets you set your investment in income and growth assets based on your age. This means as you get older, the proportion of your investment in more volatile growth assets will be reduced, lowering the expected size of the ups and downs in the value of your investment.

If you are concerned about your investments or would like to find out more about how SuperLife can help with your investments, get in touch with us at This email address is being protected from spambots. You need JavaScript enabled to view it. or 0800 27 87 37.

This information does not constitute financial advice and does not take account of personal circumstances; rather, it is designed to illustrate possibilities. As with all investment decisions, what might be the right strategy over the medium or longer term may not pay off over the very short term. No one can consistently predict what will happen over the short term. Those acting upon the information in this newsletter do so entirely at their own risk. SuperLife does not accept liability for the results of any actions taken or not taken based on this information. While every effort has been made to ensure accuracy, no liability is accepted for errors or omissions in this newsletter.

Default KiwiSaver status

In December 2021, SuperLife will become one of six default KiwiSaver providers appointed by the government to help KiwiSaver members with their savings.

What does ‘default’ mean in this context? When someone joins the KiwiSaver scheme for the first time, the person gets to choose who the KiwiSaver provider will be. The New Zealand Government allocates one of the six ‘default’ providers to members who signed up to KiwiSaver but did not choose a provider.

As a default KiwiSaver provider, SuperLife will be offering a new low-cost balanced fund. This fund will be available to all SuperLife members.

The new SuperLife Balance Fund is a diversified fund, with a carefully constructed mix of different amounts, in various types of assets (e.g., riskier assets such as equities, or less risky ones such as fixed income assets). SuperLife currently already has six diversified funds members can select.

Besides the SuperLife diversified funds, members can also choose from a comprehensive list of ethical, age steps, sector and guest manager funds.

Most of SuperLife’s funds are designed to track market indices. These can be in broad market indices (such as NZX50 or S&P 500) or indices targeting industries or sectors.

We will have more information for you on the new SuperLife Balanced Fund option soon.