Highlights and news from the past quarter at SuperLife

In this issue

From Anna’s desk:

Market ups and downs are a normal part of investing, but there are steps you can take to stay on track.

Investing 101:

Learn five strategies for navigating market swings.

Fund Spotlight:

Now is the time to check your KiwiSaver balance to ensure you're on track for the full government contribution.

The Stocktake:

Global markets faced challenges in Q1 2025 due to trade tensions and geopolitical uncertainty.

Kia ora koutou,

So far in 2025, we're seeing plenty of uncertainty and market fluctuations. It’s a reminder of why long-term thinking is so important when investing.

Although downturns can be unnerving, making decisions based on short-term market movements can hurt your long-term returns.

History shows that staying invested during periods of market ups and downs is one of the best ways to build wealth over time.

Trying to predict when the market will rise or fall, especially in uncertain times, can lead to locking in losses or missing out on potential recoveries.

That said, we understand that your investment needs may change over time. It’s a good idea to periodically review your portfolio to ensure it’s well-balanced and still aligned with your goals, time frame, and risk tolerance.

At SuperLife, we’re backed by the team at Smart – seasoned investment professionals who follow a disciplined process and manage risk with care.

Their approach aligns perfectly with our philosophy; the wise invest Smart.

All of us are here to help you navigate your investment journey and make informed, smart decisions. So, focus on these long-term factors, not short-term market changes, when making investment choices.

In this update we have included a useful resource for investors on how to navigate market swings. You’ll also find answers to frequently asked questions about market uncertainty here.

Ngā mihi nui,

Anna Scott - CEO

Smart (Smartshares Limited)

Investing 101

Five strategies for dealing with market volatility

Uncertain markets can be challenging, but having a solid strategy can help. Learn five practical strategies to manage volatility and stay on track with your investment goals.

This article is from our team at Smartshares Limited (Smart), which manages SuperLife. As part of the NZX Group, Smart provides investment expertise across a range of funds, including the SuperLife KiwiSaver Scheme and listed and unlisted investment funds.

Learn more about index-tracking investments

Smart's CEO Anna Scott spoke to Garth Bray at Sharesies about Exchange Traded Funds (ETFs) and what it really means to track the market, and why playing the long game could be the best approach.

As the team behind SuperLife’s investment solutions, Smart’s experts regularly provide market updates and industry perspectives.

Fund spotlight

Check your KiwiSaver balance – don’t miss out on the government contribution

If eligible, for every $1 you save to your KiwiSaver account, the government contributes 50c – up to $521.43 a year. To receive the full amount, you’ll need to contribute at least $1,042.86 before 23 June.

Check your balance and top up with regular contributions or make a lump sum payment on your SuperLife member portal.

Not with the SuperLife KiwiSaver Scheme?

Our low fees, flexible investment options, and expert-managed Age Steps fund make it easy to invest your way. Switching is simple-see how SuperLife could work for you.

Leaving your employer? Keep your workplace savings working for you

If you’re in a SuperLife workplace savings plan and have recently left your employer, you can stay invested with SuperLife as an individual member.

This gives you the opportunity to keep growing your investments over time while having easy access to your investments to make top-ups or withdrawals when needed.

To find out what your options are, get in touch with our team. We’re here to help you make the most of your savings and stay on track toward your financial goals.

The Stocktake

- Global markets faced challenges in Q1 2025 due to trade tensions and geopolitical uncertainty.

- Global Equities: US stocks, particularly tech, declined, while European stocks outperformed.

- Uncertainty will persist, but a well-diversified, long-term strategy remains the best approach.

Navigating uncertainty amid US volatility

Global markets faced significant challenges in Q1 2025 as escalating trade tensions and geopolitical uncertainty triggered market volatility. President Trump’s trade policies, marked by widespread tariffs, have affected business and consumer confidence. This uncertainty led to a sharp sell-off in US equity markets, lower US bond yields and a lower USD.

The narrative of "US exceptionalism" seems to be fading as the US economy loses momentum faster than anticipated. Meanwhile, strong earnings in Europe, optimism over a potential Ukraine-Russia peace deal, and a tech-driven rally in China fueled a rotation out of US equity markets.

The current levels of uncertainty are not uncommon in equity markets. The reality is that investor sentiment ebbs and flows and is a common feature of global markets.

At the time of writing, the market appears to be showing some signs of support with long-term investors prepared to buy the dip and acquire stocks at a discount. But remaining well diversified will be crucial through on-going geopolitical uncertainty.

Central Banks & Monetary Policy

The US Federal Reserve (Fed) paused rate cuts in January and March. Despite rising inflation projections, the Fed continues to project two more 25 basis point cuts in 2025 and a longer-term Federal Funds Rate of 3%.

In New Zealand, the Reserve Bank (RBNZ) continued its easing cycle with a third consecutive 50-basis point cut at its February meeting. The Governor noted that inflation remains near the midpoint of the 1-3% target, the exchange rate is at fair value, and the economy has passed the low point—a perfect position for handling future shocks. This optimistic outlook helped lift yields over the quarter.

However, Adrian Orr’s unexpected resignation as Governor added uncertainty around what the future direction of monetary policy will be. The market expects the RBNZ to continue cutting towards a more neutral OCR of 3% throughout 2025.

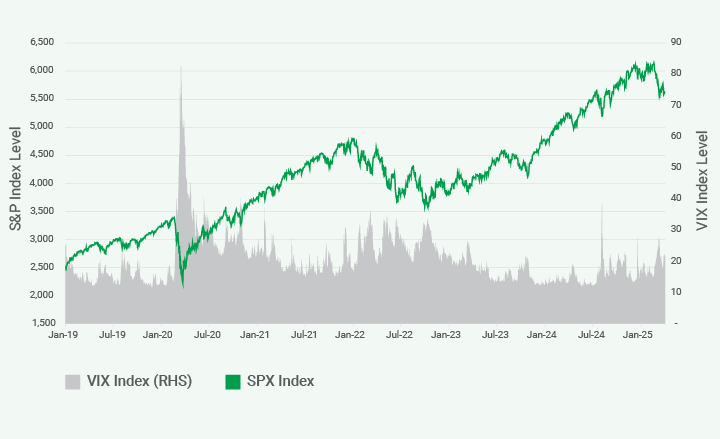

Chart 1: Major market performance over the past year

(Source: Bloomberg)

Global Equities

Global share markets showed positive signs at the beginning of January following on from a strong finish to 2024. This didn’t last long with markets pulling back with trade tensions, policy changes and tariffs dominating headlines.

Business and consumer confidence declined over the quarter, with consumer confidence declining more than 20%. The introduction of tariffs reignited fears of inflation and lower levels of growth.

US equities, particularly tech stocks, fell. Falling US stocks made way for other regions to outperform. European shares benefitted from a rotation out of large US tech stocks and into relatively cheaper European value stocks. Europe outperformed US stocks by the widest margin in 30 years and helped reduce the current valuation gap between the two regions.

Global Infrastructure, Global Property and Emerging Markets proved more resilient over the quarter with flat or positive returns, highlighting the role diversification plays in a portfolio.

In New Zealand, the S&P/NZX 50 Index fell over 7% as at the end of Q1, with Spark and Infratil the worst performers.

Ryman Healthcare announced a $1 billion equity raise in February at a 30% discount to reduce debt, but weak retail participation left underwriters holding 53 million shares. Ryman Healthcare shares are down over 40% for the year. On a positive note, A2 Milk surged nearly 40% after announcing it would pay a dividend for the first time.

Australia’s S&P / ASX 200 Index also declined, down almost 3% - impacted by global politics and upcoming elections. Information Technology has been the worst performing sector down over 16%, with mining and utilities companies some of the few to see positive returns in 2025.

Chart 2: S&P500 Index and VIX Index shows market sentiment v performance

(Source: Bloomberg)

Investor sentiment ebbs and flows are a common feature of global markets

Chart 2 shows how the US share market (S&P 500 Index – green line) has moved over the last five years, alongside the VIX Index (grey bars), often referred to as the ‘fear index’, reflecting how nervous or calm investors are feeling.

When the VIX is high, it means markets expect more ups and downs—usually during times of uncertainty or bad news.

Right now, uncertainty is being driven by President Trump’s tough trade talk and what it could mean for the US economy.

Short term volatility is a constant - history has shown that markets tend to rise over time.

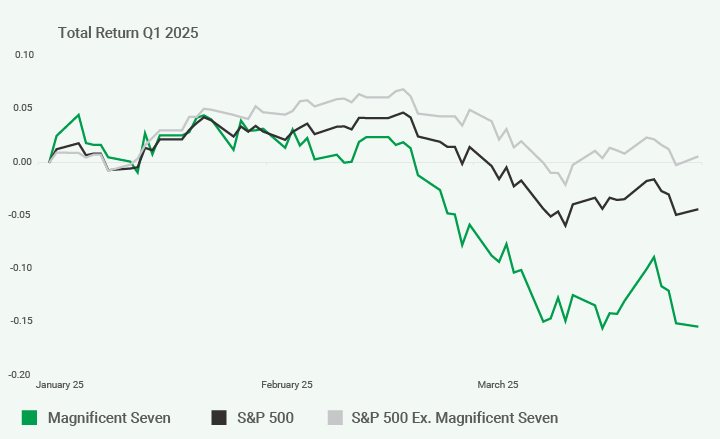

Chart 3: Attribution of S&P 500 decline to the Magnificent Seven

(Source: Bloomberg)

In our view, investors had become overly optimistic about the US economy and Trump’s return to power.

It’s worth noting that most of the S&P 500's gains came from a few large companies, known as the "Magnificent Seven," (Apple, Microsoft, Google parent Alphabet, Amazon.com, Nvidia, Meta Platforms and Tesla) and their drop is responsible for nearly all of the recent market decline, as seen in as seen in Chart 3.

This highlights why diversification is so important.

Looking Ahead

Market volatility will persist as geopolitical uncertainty and policy decisions unfold. Looking at the bigger picture, we’re still in an environment of global monetary policy easing. The market is currently being supported by lower policy rates in the US and Europe and fiscal support in China which should pave the way for the business cycle to continue.

In 2025, it is undeniable that policy and economic uncertainty will continue to drive market volatility, but this is why we strongly believe in building diverse and resilient portfolios.

SuperLife’s diversified funds and investment strategies are well-positioned for resilience. Investors can take advantage of our wide range of diversified funds and age steps models that have been carefully crafted and managed by our investment team. Alternatively, you can build your own investment strategy using our core asset class exposures for equities and fixed income, but also alternative assets such as property, infrastructure and gold.

A long-term perspective and diverse portfolios remain crucial as global markets navigate ongoing challenges.

Have you checked your details lately?

Please check your contact information is up to date for a safer, faster and more convenient way to stay informed. Register or Log in to your member portal to update your details so we can send you important updates.

Finance in full

World indices at a glance

| EQUITIES | Q1 2025 RETURN | 1 YEAR RETURN | 3 YEARS (P.A) RETURN |

|---|---|---|---|

| International | |||

| FTSE Developed All Cap Index | -1.6% | 6.5% | 7.3% |

| FTSE Emerging Markets All Cap China A Inclusion Index | 1.2% | 11.0% | 2.6% |

| S&P 500 Index | -4.3% | 8.3% | 9.1% |

| Australasian | |||

| S&P/NZX 50 Gross Index | -6.4% | 1.4% | 0.4% |

| S&P/ASX 200 Index | -2.8% | 2.8% | 5.6% |

| FIXED INTEREST | Q4 2025 RETURN | 1 YEAR RETURN | 3 YEARS (P.A) RETURN |

|---|---|---|---|

| International | |||

| Bloomberg Global-Aggregate Index | 2.6% | 3.0% | -1.6% |

| US 10-year government bond yield (%) | 4.2% | 4.6% | 4.2% |

| New Zealand | |||

| S&P/NZX A-Grade Corporate Bond Total Return Index |

1.0% | 7.2% | 4.2% |

| NZ 10-year government bond yield (%) | 4.5% | 4.4% | 4.5% |

(Data source: Bloomberg, compiled by SuperLife)

Global assets: major market movements over the last 12 months

(Source: Bloomberg)

SuperLife KiwiSaver Diversified Funds as at 31 March 2025

The investment returns shown below are for the specified periods ended 31 March, for a SuperLife KiwiSaver Scheme member (after fund charges and tax). The SuperLife Default Fund is only available to members of the SuperLife KiwiSaver Scheme.

| FUNDS | 3 MONTHS | 6 MONTHS | 1 YEAR | 3 YEARS (P.A) | 5 YEARS (P.A) | 7 YEARS (P.A) |

|---|---|---|---|---|---|---|

| Income | 0.56% | 0.16% | 3.17% | 1.06% | 0.72% | 1.25% |

| Conservative | -0.72% | 0.58% | 3.99% | 2.52% | 4.02% | 3.28% |

| Balanced | -2.11% | 0.87% | 4.55% | 3.62% | 7.07% | 5.02% |

| Default | -3.05% | -0.45% | 3.42% | 4.28% | - | - |

| Growth | -3.05% | 0.93% | 5.33% | 4.57% | 9.13% | 6.05% |

| High Growth | -4.00% | 0.91% | 5.17% | 5.32% | 11.13% | 7.06% |

| Ethica | -2.02% | 0.51% | 4.57% | 3.70% | 7.99% | 6.01% |

(Note: These figures are representative of the SuperLife KiwiSaver Scheme. Returns displayed account for fund charges and tax at 28%, but your tax rate may be lower. Past returns are not a reliable indicator of future performance.)

This information does not constitute financial advice and does not take account of personal circumstances; rather, it is designed to illustrate possibilities. As with all investment decisions, what might be the right strategy over the medium or longer term may not pay off over the very short term. No one can consistently predict what will happen over the short term. Those acting upon the information in this newsletter do so entirely at their own risk. Smartshares does not accept liability for the results of any actions taken or not taken based on this information. While every effort has been made to ensure accuracy, no liability is accepted for errors or omissions in this newsletter.