Your latest fund updates, market insights and simple actions for the year ahead.

In this issue

From Lisa’s desk:

New year, new savings goals.

Investing 101:

Compounding rewards consistency over time.

Markets at a glance:

More volatility, but solid earnings kept markets supported. See what shaped Q4.

Kia ora koutou,

At the time of writing, markets have been more volatile with investors reacting to rising bond yields in Japan and renewed geopolitical uncertainty, but short-term swings are normal - staying diversified and focused on the long term remains key.

As we step into the new year, I want to thank you for the trust you place in us.

We now manage more than $15 billion on behalf of investors across our investment products. That’s your money - invested for the long term and diversified across markets, sectors and regions.

This includes the SuperLife KiwiSaver Scheme, one of New Zealand’s original KiwiSaver schemes, supporting more than 90,000 savers. Also, the SuperLife Workplace Savings Scheme, offered by employers who want to help staff save for the future. And it includes Superlife Invest unlisted funds and the Smart Exchange Traded Funds (ETFs) that give investors simple access to global markets, from the US 500 to emerging markets, through a single listed investment.

Our long-term approach - built on diversification and time in the market - has guided us for decades and will continue to guide us as we help more New Zealanders build long-term wealth.

At the start of the new year, there’s one simple thing I encourage you to check: Are contributions still going in regularly?

If you can set and forget a payment or increase your existing contributions, you will build your future wealth. Even modest, consistent contributions can benefit from compounding returns over time.

This year make regular investing your new habit. Your future self will thank you!

Ngā mihi nui,

Lisa Turnbull

CEO - Smart

Five strategies for dealing with market volatility

Although downturns can be unnerving, making decisions based on short-term market movements can hurt your long-term returns. History shows that staying invested during periods of market ups and downs is one of the best ways to build wealth over time.

Learn more about dealing with market volatility »

This article is from our team at Smartshares Limited (Smart), which manages SuperLife. As part of the NZX Group, Smart provides investment expertise across a range of funds, including the SuperLife range of schemes and Smart Exchange Traded Funds (ETFs).

Investing 101

Grow your money with compounding returns – how it works

When your investment grows, future returns are calculated on a larger balance - not just what you originally put in.

Over time, this effect becomes more powerful. The longer you stay invested and keep contributing, the more your money can grow - even if contributions stay the same.

Regular savers can benefit from compounding returns. Example shown is for illustration only.

Time does the heavy lifting.

If, for example, you saved $200 a month ($2,400 a year) it would add up to $48k over 20 years – growing to about $81k (based on a 5% annual return after fees and tax).

After 30 years, compounded returns make up more than half the total. And by 40 years, around two-thirds of the value comes from compounding.

Regular saving, staying invested, and keeping costs low can make a meaningful difference to your long-term outcome.

Staying alert to investment scams

Investment scams are becoming more common and more sophisticated, so it pays to stay alert.

- If an offer sounds too good to be true, it probably is.

- If something doesn’t feel right, trust that instinct.

Before you click a link or share information, pause and check the sender and web address carefully. Be wary of requests for personal details, messages that create urgency or claims of “guaranteed” returns.

If you think you’ve come across a scam, please contact us.

You can also report it directly to the Financial Markets Authority at fma.govt.nz/scams/report-a-scam.

View your statements online anytime

To keep you informed faster and more safely and sustainably, we’ve moved to online statements.

Make sure your contact details are up to date, so you don’t miss important updates. Log in or register at the member portal to check your details. You can also view your latest statements and account balances anytime.

If you’ve chosen to receive printed statements, you’ll still get one annually.

Markets at a Glance

More volatility - but markets ended 2025 on a strong footing.

Market commentary by Stuart Millar, Chief Investment Officer

A quick note on markets at time of publishing - January 2026:

Global markets have been more volatile this week, with shares and long-term bonds falling and the VIX volatility index jumping to its highest level since November.

Two developments appear to be driving the move. The first was a sharp rise in long-dated Japanese bond yields, which spilled into other global bond markets. The second was renewed geopolitical uncertainty, as fresh political statements increased concerns around global stability and trade relationships.

While periods like this can feel unsettling, market swings are a normal part of investing. Our focus remains on diversification and a long-term approach, rather than reacting to short-term headlines. Staying focused on your long-term plan rather than reacting to short-term noise is often the wisest course.

2025 wrapped up with plenty of noise - but fundamentals continued to hold up.

In Q4, volatility lifted as markets reacted to fresh AI bubble fears and uncertainty about the Fed’s next move. The S&P 500 recovered after strong Nvidia earnings sparked a tech-led rebound, before markets moved into a holding pattern late in the quarter while investors waited for delayed US economic data and the Fed’s final meeting in mid-December.

The Fed delivered the expected rate cut, but growing differences within the committee reinforced expectations that future cuts may slow. In New Zealand, the final RBNZ decision of the year surprised markets by signalling the easing cycle may be over - wholesale rates rose around 0.4% and banks lifted mortgage rates.

More broadly, it feels like we may be through the peak headwinds to global growth as trade policy uncertainty fades. With inflation largely contained, several central banks now appear at or near the bottom of the rate cycle, and markets are beginning to price the next move as a hike across multiple regions.

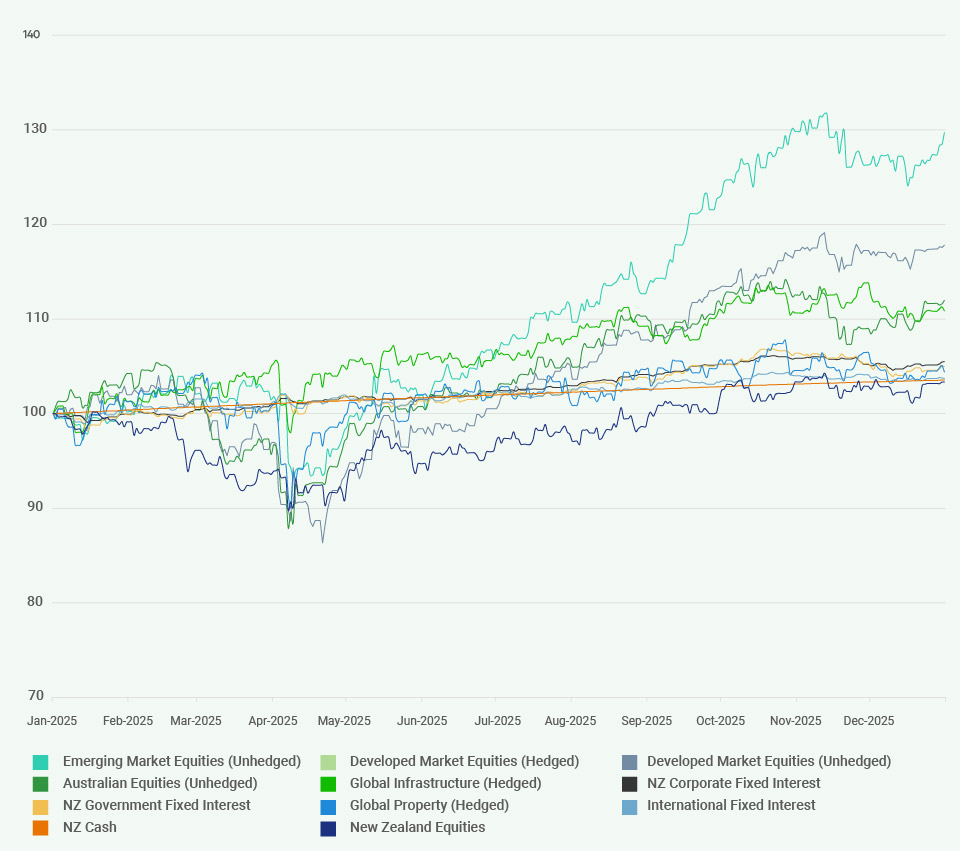

Figure 1: Major market performance YTD

(Source: Bloomberg)

Table 1: Major market performance over the past year

| Asset class | 3-month asset class return | 12-month asset class return |

|---|---|---|

| Developed Market Equities (Hedged) | 2.87% | 18.1% |

| Developed Market Equities (Unhedged) | 3.84% | 17.8% |

| Emerging Market Equities (Unhedged) | 5.27% | 29.7% |

| Australian Equities (Unhedged) | 0.47% | 12.0% |

| New Zealand Equities | 0.85% | 3.3% |

| Global Infrastructure (Hedged) | -0.01% | 10.9% |

| Global Property (Hedged) | -1.21% | 4.4% |

| International Fixed Interest | 0.29% | 3.7% |

| NZ Corporate Fixed Interest | 0.28% | 5.5% |

| NZ Government Fixed Interest | -0.19% | 5.0% |

| NZ Cash | 0.68% | 3.6% |

Global Equities

Global equities extended their strong run into year-end, with many indices finishing 2025 at or near record highs. Markets pushed higher despite a fragile backdrop, including the longest US government shutdown in history, slower employment growth and weaker consumer sentiment.

Key takeaway: Resilient earnings helped offset these headwinds. Developed markets gained over the quarter, while emerging markets were once again the standout performer for the year.

NZ & Australian Equities

New Zealand equities finished Q4 2025 on a positive note, with the S&P/NZX 50 Index delivering a low single-digit total return of around 3% for the year. Sector performance was mixed, with utilities and infrastructure-related stocks holding up well, while consumer-facing sectors remained under pressure.

With the RBNZ signalling it may be done cutting rates, and confidence improving, the outlook into 2026 may be more positive.

Australian equities also ended the year on a positive note, with the S&P/ASX 200 delivering a low double-digit return for 2025. Materials led performance, while healthcare remained a laggard, with an average loss of 7%, weighed by CSL and Telix Pharmaceuticals.

Cash

The RBNZ’s November update surprised markets with a more hawkish tone (more likely to hold or raise rates) than expected. Wholesale rates rose and banks lifted mortgage rates, prompting borrowers to focus on fixing rates ahead of possible further increases.

NZ Fixed Interest

Bond yields rose as markets brought forward expectations for future OCR increases, which reduced returns from government bonds. Corporate bonds were more resilient, supported by strong investor demand.

Global Fixed Interest

Global fixed interest returns were positive but modest in Q4, with corporate bonds outperforming government bonds as investor demand stayed strong and credit spreads* remained tight. With markets increasingly pricing rate hikes in several regions, yields may rise, which could mean more moderate returns in 2026.

*Credit spreads (a simple explainer) - the difference in return between two debt securities with different credit quality but the same maturity, e.g. what investors expect when lending to companies instead of governments.

Q4 Takeaway

The global economy delivered strong growth despite significant volatility and policy shifts, which supports the case for continued expansion in 2026 as inflation eases and policy settings remain supportive.

Earnings remain a key driver - particularly in AI-related sectors - and while the longer-term debate around AI continues, the fundamentals remain strong. Markets expect growth to broaden as AI adoption spreads across more industries. This could lift productivity and keep inflation contained, supporting valuations into 2026.

Our view is that markets are likely to rise at a measured pace, with diversification continuing to play a key role in keeping portfolios resilient, if conditions change.

Make sure your contact details are up to date

Access your statements and tax certificates online - faster, safer, and all in one place. In the portal you can check your account balances, update your details, set up a direct debit and check if your PIR is right.

Log in to your member portal to update your details so we can send you important updates.

Fund performance

This information does not constitute financial advice and does not take account of personal circumstances; rather, it is designed to illustrate possibilities. As with all investment decisions, what might be the right strategy over the medium or longer term may not pay off over the very short term. No one can consistently predict what will happen over the short term. Those acting upon the information in this newsletter do so entirely at their own risk. Smartshares does not accept liability for the results of any actions taken or not taken based on this information. While every effort has been made to ensure accuracy, no liability is accepted for errors or omissions in this newsletter.