Your latest fund updates, Investor education and market insights.

In this issue

From Scott’s desk:

Canstar award - SuperLife continues to stand out in a competitive KiwiSaver market.

Fund Spotlight:

Looking to broaden your global portfolio? We explain how with regional funds.

The Stocktake:

Conditions calmed, though that can sometimes signal complacency. Markets adjust to a new normal.

Kia ora koutou,

We have news! Our SuperLife KiwiSaver Scheme has been named a winner in the Outstanding Value KiwiSaver Scheme Award at the 2025 Canstar KiwiSaver Awards. Plus, two of our funds earned 5-Star ratings: the Ethica Fund (in the Balanced category) and the SuperLife Conservative Fund.

That’s great news for us - but even better news for our members who want their KiwiSaver to work as hard as possible for them, and their future. SuperLife continues to stand out in a competitive KiwiSaver market.

We’re here for the long run – just like your investments. We are committed to offering customers real choice, cost-effective and member-focused KiwiSaver solutions.

We’re investing not only in the quality and timeliness of the support you receive, but also in new digital tools that give you greater control and flexibility through improved self-service options.

We’re growing our engagement team to ensure help is always within easy reach, while laying the foundations for a new, smarter member experience that will roll out over the next 18 months.

As we head toward the end of the year, it’s a good time to pause and make sure your investments are set up to support your goals. Before the rush of Christmas, take a few minutes to check your details and investment strategy.

A little time today can make a big difference tomorrow.

Ngā mihi nui,

Scott Lumsden – General Manager Operations

Smart (Smartshares Limited)

Fund spotlight

Beyond America: Broadening your global portfolio with regional funds

Global investing is about spreading your risk and capturing opportunities across different parts of the world.

The US market has delivered strong returns, but its growing weight means many global portfolios are now more concentrated than expected.

For investors seeking to broaden their international exposure, the SuperLife funds and equivalent Smart Exchange Traded Funds (ETFs) give you the flexibility to rebalance, spread risk, and capture opportunities across Europe, Asia Pacific and Emerging Markets.

Looking to build a diversified global portfolio?

We’ve hit a milestone - $15 billion funds under management.

A huge thank you to the 165,000+ New Zealanders who trust us with their investments.

Our purpose remains the same: to help Kiwis grow wealth today, so they have choices tomorrow.

Across Smart and SuperLife, we offer more than 40 funds - from diversified and sector options to global, cash, and age-based funds - giving investors the flexibility to build portfolios that suit their goals and risk tolerance.

We’re moving to online statements

To keep you informed in a faster, safer, and more sustainable way, we’re moving to online statements.

Make sure your contact details are up to date, so you don’t miss important updates. Log in or register at the member portal, to check your details. You can also view your latest statements and account balances anytime.

If you’ve chosen to receive printed statements, you’ll still get one annually.

The Stocktake

Confidence returns as markets find a ‘new normal’

Market commentary by Stuart Millar, Chief Investment Officer

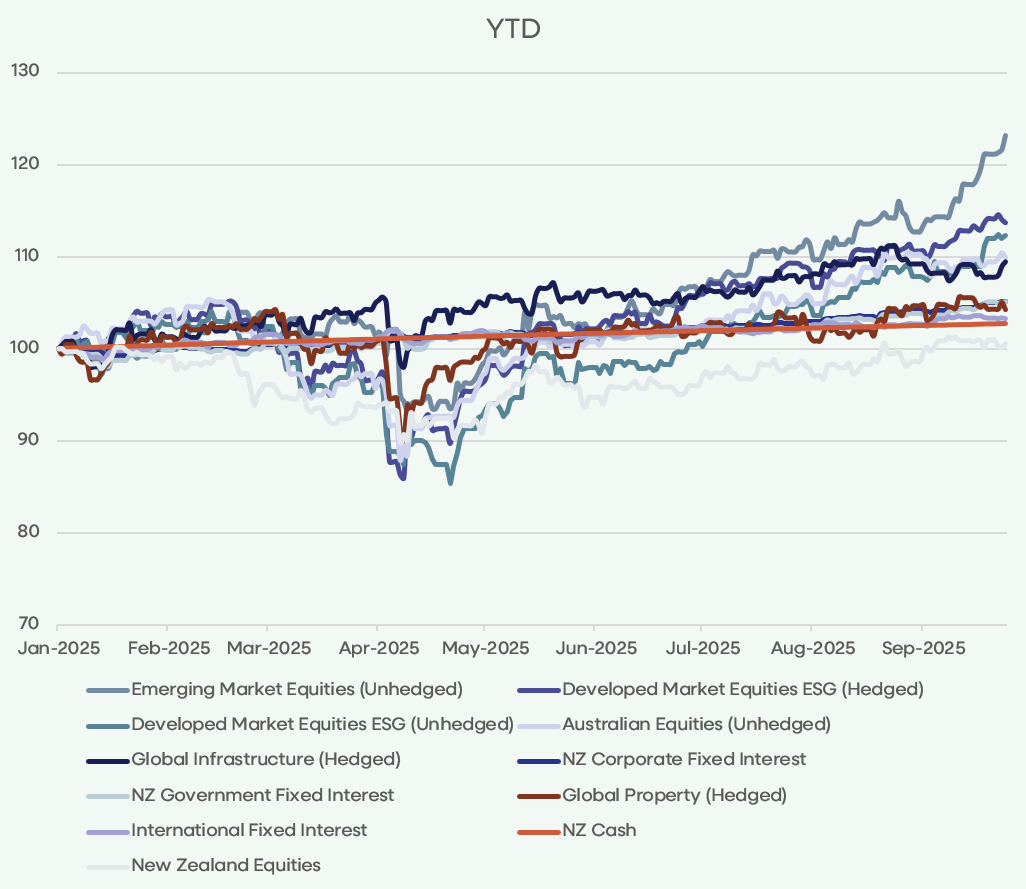

In Quarter 2, investor confidence improved despite ongoing trade policy uncertainty and geopolitical tensions. In Q3, the recovery was even stronger, with the S&P 500 hitting all-time highs. Investor confidence strengthened after the Federal Reserve cut interest rates at the end of September - for the first time since December 2024.

Equity market volatility (measured by the VIX Index) eased after peaking in April. While the labour data pointed to a softer US economy, strong corporate earnings and the prospect of earlier and more sustained policy easing have continued to support the equity rally.

Figure 1: Major market performance YTD

(Source: Bloomberg)

Table 1: Major market performance over the past year

| Asset class | 3-month asset class return | 12-month asset class return |

|---|---|---|

| NZ Cash | 0.84% | 2.8% |

| NZ Corporate Fixed Interest | 2.71% | 5.3% |

| NZ Government Fixed Interest | 2.86% | 5.3% |

| International Fixed Interest | 0.80% | 3.3% |

| New Zealand Equities | 4.38% | 1.4% |

| Australian Equities (Unhedged) | 9.50% | 11.9% |

| Developed Market Equities ESG (Unhedged) | 13.09% | 13.3% |

| Developed Market Equities ESG (Hedged) | 8.09% | 14.5% |

| Emerging Market Equities (Unhedged) | 15.38% | 22.9% |

| Global Property (Hedged) | 2.96% | 5.5% |

| Global Infrastructure (Hedged) | 3.95% | 11.0% |

Global Equities

Global equity markets continued their strong run in Q3, supported by resilient earnings, easing tariff risks, and prospects of rate cuts.

The S&P 500 rose 13.1%, the Nasdaq 11.2%, and the Russell 2000 12.0%. Technology, communications, and consumer discretionary sectors led.

Developed markets (MSCI World) gained 11.5%, and emerging markets (MSCI EM) rose 16.3%, driven by rising Chinese stocks and ongoing growth in India and Latin America.

Emerging markets continued to be the best performing asset class over the year to date having advanced more than 25% in USD terms so far.

Key takeaway: Diversified investors with a long-term perspective continued to be rewarded as global markets proved resilient.

NZ & Australian Equities

NZ equities performed positively in Q3, reversing declines at the start of the year, with the benchmark S&P/NZX 50 up over 5% for the quarter and 1.3% year to date. The top performing stock for the quarter was Heartland Group Limited, which saw its share price climb over 30%. Both Summerset and EBOS were poor performers, down over 20%, with Healthcare being the worst performing sector over the quarter.

There was a similar positive trend in the Australian market with the headline S&P/ASX 200 Index, finishing over 5% up for the quarter. All sectors apart from healthcare delivered positive returns for the quarter, with Technology and Materials companies the best performing. Strong performers were AI Drone company, Droneshield Limited, up over 100% as it continues to advance its relationship with the US Department of Defence, and mining company Pilbara Minerals (PLS), up almost 90% after with strong results and the increased strength of lithium.

Cash

The Reserve Bank of New Zealand cut the Official Cash Rate by 25bps to 3.25% in August, signaling further easing as growth slows and inflation moderates. GDP fell 0.9%, well below expectations, prompting forecasts for a further 75bps of cuts by November.

NZ Fixed Interest

Reflecting expectations of further OCR cuts, the 2-year NZ Government Bond yield fell 60bps, while the 10-year yield declined 35bps.

The S&P/NZX Government Bond Index returned 3.19%, and the Corporate Bond Index 2.90%, driven by falling yields and strong demand for new issues. The quarter also welcomed two new issuers - Watercare Services and the Community Housing Funding Agency.

Global Fixed Interest

The US was the main driver of global bond markets. With the Fed cutting rates, short-term yields declined. At the same time, persistent government deficits kept longer term yields elevated.

Across regions, this led to mixed results, with short-term yields generally moving lower in the US and UK, while longer-term yields have risen in Europe and Asia. Because yields are moving in different directions across markets, the net effect has been relatively stable overall returns, with almost all gains coming from interest income.

- The Bloomberg Global Aggregate Treasuries Index (NZD Hedged) returned 0.31% for the quarter and 2.22% year to date.

- The Bloomberg Global Aggregate ex Treasury Index (NZD Hedged), returned 1.54% over the quarter and 4.62% year to date.

- The Bloomberg Global Aggregate Index (NZD Hedged) delivered a 0.88% return over the quarter and 3.33% year to date.

Outlook

Talk of uncertainty - and actual uncertainty - faded in Q3 as markets adjusted to the “new normal.” Headline surprises were less frequent, and geopolitical tensions calmed (though not disappeared).

Economic data remains mixed: growth is steady, employment is soft, and The Federal Reserve has resumed cutting rates, creating scope for financial markets to stabilise and edge higher, albeit at a more measured pace.

The outlook is broadly positive, with markets likely to stay supported while company earnings remain solid. It is worth noting that when conditions are calm, it can sometimes signal complacency.

Our diversified approach helps ensure resilience when markets shift unexpectedly.

Q3 Takeaway

Q3 was a rewarding quarter for those who stayed invested. Diversification remains central to managing risk and staying on track amid uncertainty.

Make sure your contact details are up to date

Access your statements and tax certificates online - faster, safer, and all in one place. In the portal you can check your account balances, update your details, set up a direct debit and check if your PIR is right.

Log in to your member portal to update your details so we can send you important updates.

Fund performance

This information does not constitute financial advice and does not take account of personal circumstances; rather, it is designed to illustrate possibilities. As with all investment decisions, what might be the right strategy over the medium or longer term may not pay off over the very short term. No one can consistently predict what will happen over the short term. Those acting upon the information in this newsletter do so entirely at their own risk. Smartshares does not accept liability for the results of any actions taken or not taken based on this information. While every effort has been made to ensure accuracy, no liability is accepted for errors or omissions in this newsletter.