Welcome

Welcome to the June quarter news.

Markets continued their rally over the quarter ended 30 June. All asset classes, including government and corporate bonds, property stocks and equities, enjoyed strong returns over the year-to-date erasing the paper losses investors experienced last year. Some equity markets, including the NZ equity market, are at an all-time high.

Following on from our article last quarter on Socially Responsible Investing and the power of engagement, we feature SuperLife’s socially responsible fund Ethica.

See how your own investment strategy has performed:

Our regular My Future Strategy update continues to remind us that it is important not to be spooked by the market volatility. Time and time again, history suggests markets recover from periods of weakness. The risk of permanent capital loss is minimal given this pattern, along with SuperLife funds being broadly diversified across New Zealand and offshore markets. Read more

Also in this edition:

- How Inland Revenue is checking your PIR

- KiwiSaver for the over 65s and over 60s

- Check the dates of the remaining seminars for 2019

- Online withdrawal facility now available

- Did you get your maximum KiwiSaver government contribution?

Get more information on SuperLife’s investment options and returns

Market Update

Market commentary

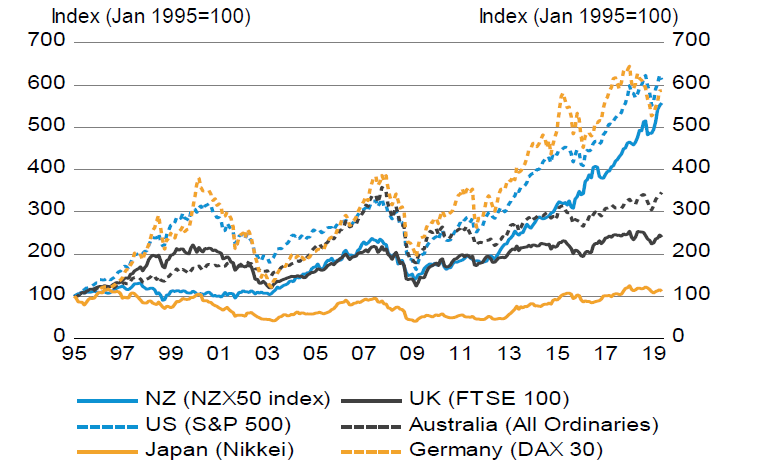

Markets continued their rally over the quarter ended June. All asset classes, including government and corporate bonds, property stocks and equities, enjoyed strong returns over the year-to-date, erasing the paper losses that investors experienced late last year. Some equity markets, including the NZ equity market, are at an all-time high (Figure 1).

Source: Haver Analytics, NZ Treasury

There’s an old investment mantra: “Don’t fight the Fed”. The Fed in this case is the US Federal Reserve which sets monetary policy and interest rates in the US. Historically, investors have done well when they align with how the Fed sets its monetary policy and this pattern has repeated over the past six months. The Fed has now completely backed off increasing rates in response to a slowing global economy and heightened trade war risks. Instead, there is speculation the Fed will likely cut interest rates in line with cuts that have already taken place in New Zealand and Australia. In response, markets and the range of Superlife funds have rallied strongly. Investors and active fund managers who reduce allocations to risky assets in response to the slowing economy – fighting the Fed – have missed out on this rally. See the box below for further discussion on the link between economic growth and equity returns.

International enquities

International developed markets increased by around 5.3% over the quarter, implying a 6.2% return for the year ended June 2019 (FTSE Developed All Cap Index in NZ dollar terms). NZD hedged equity returns were also solid, returning 3.9% for the June quarter.

Emerging markets

Emerging market stocks have borne the brunt of the slowdown in global trade and trade war fears. Despite this, emerging market equities returned around 3.6% in the quarter (FTSE Emerging Markets All Cap Index), sufficient to bring the annual return back into positive territory at around 6.1% for the year ended June 2019.

Trans-Tasman equities

Trans-Tasman equity markets also enjoyed a strong quarter. Australian shares returned 8.1% in the June quarter (S&P/ASX 200 Index). New Zealand shares returned 6.8% in the quarter and 17.5% over the year to June 2019, a very strong performance both in absolute terms and compared to offshore equity markets (S&P/NZX NZ 50 Index).

Bonds

Global bonds returned 2.7% in the quarter and 7.3% in the year to June 2019 (Bloomberg Barclays Global Corporate Bond Index NZD hedged). New Zealand investment grade bonds returned 1.8% for the quarter and around 6.8% for the year.

SuperLife Funds

Given the strong performance of markets, Superlife Fund returns were positive across the board in both the quarter and over the year to June 2019. SuperLife Income, which has no exposure to equities, had a positive return of around 1.7% over the quarter and 5% over the year (all figures in this paragraph are after fees and tax at the highest rate).

The SuperLife Balanced fund returned around 3% in the quarter and 6.4% over the year, while the SuperLife High Growth fund, which largely invests in equities and property stocks, increased 3.7% in the quarter and 6.9% over the year.

SuperLife Ethica, which invests into funds that have strict sustainability criteria, also performed well, returning 3.4% over the quarter and 7.1% over the year to June 2019.

Economic growth and equity returns

Currently, global economic growth is slowing, with the Trump Administration’s trade war being cited as the main culprit. World trade volumes before the trade wars were running around 5% per annum and global growth around 3.5%. Today, global trade volumes are flat and global growth has fallen closer to 3%. Looking forward, macro forecasters expect global growth to mildly decline further, conditional on how the trade wars evolve from here.

What does this uncertainty mean for long-term equity returns? The short answer? Likely not a lot for investors holding broadly diversified portfolios, as the range of SuperLife funds are designed to be. The evidence from decades of market history, which covers a broad range of economic environments, is that:

- There is little relationship between an economy’s long-term economic growth and equity market performance.1 High growth rates do not necessarily translate to high returns and vice-versa. This is because GDP growth isn’t the only thing that matters for returns (e.g. interest rates also matter), and also because companies on a national stock exchange may not be a close match to an economy’s overall business sector exposures.

- Most equity and bond markets deliver a significant premium (excess return) to cash over time. Some individual markets don’t deliver premiums over some time periods, but this risk can be guarded against by holding broadly diversified exposures to New Zealand and global markets.

1Elroy Dimson, Paul Marsh and Mike Staunton, authors of the annual Investment Returns Handbook, looked at the GDP growth and domestic equity returns across 83 countries. They accumulated data for many countries going back 50 years or more and after crunching all the numbers, they concluded that ‘99% of the variability of equity returns is associated with factors other than changes in GDP’.

My Future Strategy

As our reports have stressed, it is important not to be spooked by market volatility. Time and time again, history suggests markets recover from periods of weakness. The risk of permanent capital loss is minimal over the longer term given this pattern, along with SuperLife funds being broadly diversified across New Zealand and offshore markets.

For investors with long-term horizons, staying the course with your present investment strategy is usually the best option, subject to your goals, objectives and cash needs remaining broadly the same as when your strategy was established.

Investors concerned with performance over a medium-term horizon (the next three to five years or so) may see an opportunity to enhance returns by tweaking your allocation to cash, bonds, equities and property stocks as follows:

- Holding less in bonds and, therefore, more cash and shares. This reflects the view that equity markets offer better value, while for bonds there is risk that interest rates may increase more quickly than is currently factored into bond prices given how low rates have now fallen.

- Favouring value, emerging market, Australian and European equities compared to US and New Zealand equities. These latter markets are broadly assessed to offer less value (upside return potential) than other markets.

- Maintaining holdings of property stocks at around your longer-term allocation.

- Maintaining the currency hedge on overseas shares at around your longer-term allocation. Our interest rates are still slightly higher than foreign rates on a global market capitalisation (e.g. MSCI World Index) basis. This means hedging global equities will still earn investors a positive “carry”.

This strategy does not constitute financial advice and does not take account of personal circumstances; rather, it is designed to illustrate possibilities. As with all investment decisions, what might be the right strategy over the medium or longer-term may not pay off over the very short-term. No one can consistently predict what’ll happen over the short-term.

SuperLife’s socially responsible investment fund Ethica

At the recent seminars, there was a lot of interest around socially responsible investment and how SuperLife’s socially responsible fund, Ethica, works.

What is Ethica?

Ethica is a socially responsible fund, which started in 2008, that invests in a balanced mix of income and growth assets.

How does it determine what to invest in?

It excludes assets that do not meet the fund’s defined ethical investment standards. That means that the fund may not invest in investments where, in Smartshares Limited’s opinion, the activities of the entities behind the investment:

- have an overall negative impact on social and community outcomes; or

- would be illegal in New Zealand; or

- are inconsistent with the United Nations policies on health and safety, child rights and human rights; or

- are expected to result in long-term detrimental change to the environment.

What investments are currently excluded?

Current investments and sectors excluded are those where a material part of the revenue and/or activities cover gambling, tobacco, alcohol, armaments, pornography and fossil fuel extraction. Details of how Ethica invest and the top ten holdings can be found here.

How do the returns compare?

If we compare the Ethica returns in the SuperLife KiwiSaver scheme to the SuperLife Balanced Fund for the year to 30 June 2019, Ethica returned 7.13% against the SuperLife Balanced Fund return of 6.37% (both after tax and fees).

If we compare Ethica to other balanced investments using the Sorted website, the five-year return of 7.55% (after fees and tax) was significantly higher than the five-year average return of 6.38% when compared to other balanced KiwiSaver funds.

Ethica’s fees of 1% were also the lowest of the four socially responsible balanced investment funds, with the average fee being 1.34% and the highest fee at 2.8% (for the year to 31 March 2019).

What other criteria should be considered when choosing an investment option?

Of course, socially responsible investment is just one factor to be considered when deciding on an investment option. The level of risk, the long-term effect of fees on outcome and consistent performance are all things to be considered when choosing an investment option. Help on choosing a fund can be found at the Sorted website.

KiwiSaver for the over 65s

A question that comes up from KiwiSaver members is whether they should stay in KiwiSaver once they reach age 65 or move their funds to a different account.

If you are still contributing from your pay and your employer is still contributing (even though they don’t have to), then keeping your KiwiSaver account will enable you to continue to receive your employer’s contributions.

Otherwise, you might consider moving your balance to a SuperLife Invest account. Reasons for doing that include:

- keeping your funds invested until you want to use them

- SuperLife Invest has all the same investment options that are available under KiwiSaver

- completing the KiwiSaver withdrawal process to remove your funds from the KiwiSaver regulations so that you can access whenever you wish

- fund charges in SuperLife Invest are slightly lower

- setting up a managed income from your SuperLife Invest account

- consolidating into one account if you already have a SuperLife Invest account will also reduce your administration fees.

The same things need to be considered by people over 65 who can now join a KiwiSaver scheme. Unless you or your employer is contributing from pay to KiwiSaver, you could simply join SuperLife Invest instead of KiwiSaver to access the full range of investment options available under SuperLife.

KiwiSaver for the over 60s

Those over 60 who first joined KiwiSaver after 1 July 2019, the retirement age will be 65, whereas previously they had to be in KiwiSaver for five years. However, at 65, you also cease to be eligible for the government contribution and your employer can stop contributing.

The lock-in of savings for five years of membership has been retained for those who joined before 1 July 2019, as has their eligibility to receive the Government Contribution and compulsory employer contributions, for the five-year period.

However, from 1 April 2020, these members can opt out of the five-year minimum, but they will cease to be eligible for the Government Contribution and their employer can stop their contributions.

Online withdrawal facility now available

If you have set up online access to your SuperLife account, you can now request a withdrawal online.

Once you have logged in, click “Withdrawal” at the top of the page and complete your details. If you have made a withdrawal before, your bank account details will already be there. You can also add a new bank account by following the instructions. Note that if you are a member through your employer, payments will only be made under the rules of your scheme.

KiwiSaver members can also contribute online by clicking “Contribution” at the top and following the instructions.

If you don’t have online access, you can register now at www.superlife.co.nz.

How Inland Revenue is checking your prescribed investor rate (PIR)

It is now more important than ever to make sure that you are on the correct prescribed investor rate (PIR)). This is because Inland Revenue’s new system can now identify all income including wage and salary and investments. From this information, they can tell which PIR you should be on.

If you have paid too much tax, you will not get a refund from Inland Revenue. However if you have underpaid, you will receive a bill to pay at the end of the tax year.

Inland Revenue is contacting investors, including KiwiSaver members, if they believe they’re not on the correct PIR. If you are advised to change your PIR, you need to contact us or you can do it online.

You can also check your PIR here.

Your questions on tax

What is a PIE?

PIE stands for portfolio investment entity. It means that you pay tax at your prescribed investor rate (PIR).

What is PIR?

PIR stands for prescribed investor rate and can be 10.5%, 17.5% or 28%, depending on your taxable income.

Why do I have to chooose a PIR?

Basically, you must nominate a PIR to ensure you’re paying the right amount of tax on your investments. If you don’t choose a PIR, you’ll be on the highest rate of 28% which might be correct or might mean you are paying too much tax. If you choose a rate that is too low, you will not pay enough tax and Inland Revenue will require you to pay the difference at the end of the tax year.

How does Inland Revenue know how much tax I’ve paid on my investments?

SuperLife is required to deduct the tax at your PIR rate and pay it to Inland Revenue on your behalf.

How do I know how much tax I’ve paid?

The PIE tax deducted from your investment return is shown on your statement under “PIE tax at your PIR”. We also send you a tax certificate each year to confirm the amount deducted and paid to Inland Revenue.

How often should I check my PIR?

It’s good practice to check each year, especially if your income from wages and salary or from investments has changed. SuperLife also sends annual reminders to check your PIR. Now, Inland Revenue may also contact you if they believe your tax rate is incorrect.

How do I change my PIR?

You can change it by emailing This email address is being protected from spambots. You need JavaScript enabled to view it. or using your online access.

Did you get your maximum KiwiSaver Government Contribution?

The Government Contributions for SuperLife’s KiwiSaver members have been coming in and now is the time to check if you got your maximum.

The Government Contribution is $1 for each $2 you save up to a maximum Government Contribution of $521 in a full year to each 30 June. The maximum applies once you have been in KiwiSaver for more than 12 months. In the first year, the maximum is proportionate, based on how long you have been a member at your first 30 June over the age of 18. Each year after the first, it will be $521 if you save $1,043.

An easy way to check if you are saving enough to get the maximum is to check if you are saving $87 a month or $20 a week either from your pay or by saving directly. If not, you can set up additional contributions over the year or save a lump sum to bring your total contributions to the amount needed to get your maximum. Get more information here.

Contact This email address is being protected from spambots. You need JavaScript enabled to view it. for help in setting up your KiwiSaver contributions. If you have online access you can set up your contributions online.

Smartshares Limited is the issuer of SuperLife Invest, the SuperLife KiwiSaver scheme, the SuperLife UK pension transfer scheme and the SuperLife workplace savings scheme. The Product Disclosure Statements and Fund Updates for these schemes are available at www.superlife.co.nz/legal-doc