Welcome

Welcome to the March quarter news.

We are delighted to report that in a recent Consumer KiwiSaver satisfaction survey, SuperLife achieved a top three place for overall customer satisfaction. This put us ahead of three of the biggest KiwiSaver schemes and default providers who recorded below average satisfaction scores.

We were rated above average for keeping customers up-to-date and timely responses to inquiries. Our members were more likely to know what fees they are paying and how their investments were performing relative to members of other schemes. They had the highest percentage who felt they had access to sufficient independent information and advice to confidently make decisions regarding their KiwiSaver investment. We continually look for ways we can support you better. Please call or email us if you have suggestions on how we can do better. We’re here to listen.

This quarter we have an update on market activity where markets have rallied strongly across all asset classes.

In our section on Socially Responsible Investing and the Power of Engagement, we advise that SmartShares has joined other large investors to engage with Facebook, Google and Twitter to invest more in monitoring and excluding violent and extremist content.

We include details of the changes to the KiwiSaver rules in 2019. You can now choose to contribute 3%, 4%, 6%, 8% or 10%. Our article on “should you increase your KiwiSaver contribution”’ gives some insight on whether it’s a good idea to increase your KiwiSaver savings or would you be better increasing your savings in a lower cost, non-KiwiSaver scheme like our SuperLife Invest scheme.

See how your own investment strategy has performed:

Our regular My Future Strategy update reminds us that it is important not to be spooked by the market volatility. Time and time again, history suggests that markets recover from periods of weakness. Read more

Also in this edition:- SuperLife changes 2019

- Check your PIR (prescribed investor rate)

- Check how to get the maximum government contribution (previously called MTC)

- SuperLife investment seminars 2019

- New NZ Super rates

Market Update

Market commentary

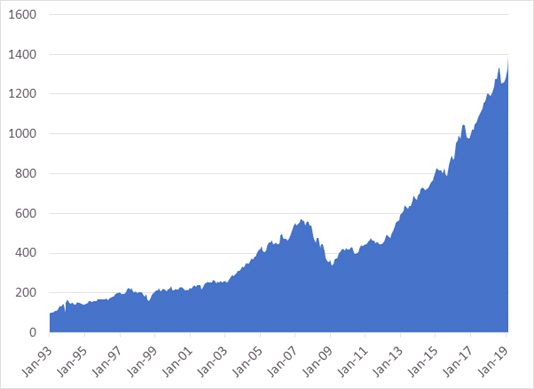

Markets have rallied strongly so far this year across all asset classes. This rally has largely erased the paper losses investors experienced in December 2018, and some markets, including the NZ equity market, are now on an all-time high (see the figure below).

S&P/NZX All Cap Total Returns Index, starting value = 100 in December 1992.

In our last update, we emphasised that the sell-off did not necessarily herald that tough times were ahead. The bounce back in markets so far this year has reflected this view. Downside risks have become less of a concern. We think there were three more specific catalysts for the recovery. Firstly, central banks (including in the US and New Zealand) changing their minds on the need for as large future interest rate increases. Secondly, the Trump administration kicking for touch threatened tariff increases on Chinese goods. Thirdly, a view that markets had become good value following the sell-off.

International equities

The international developed market increased by around 11% over the quarter, implying a 9.3% return for the year ended March 2019 (FTSE Developed All Cap Index in NZ dollar terms). NZD hedged equity returns were also strong, returning 12.7% for the March quarter.

Emerging markets

Emerging market equities returned around 8.5% in the quarter (FTSE Emerging Markets All Cap Index). However, this bounce still leaves these markets with a slightly negative return over the year (around -1.5%), reflecting that they’ve borne the brunt of the slow-down in global trade over 2018 and the trade-war fears.

Trans-Tasman equities

Trans-Tasman equity markets also enjoyed a strong quarter. Australian shares returned 10.7% in the March quarter and 11.5% over the year (S&P/ASX 200 Index). New Zealand shares returned 11% in the quarter and 18.5% over the year to March 2019 – a very strong performance both in absolute terms and compared to offshore equity markets (S&P/NZX NZ 50 Index).

Bonds

In recent quarters, we’ve seen bonds suffering relatively poor returns when equities have done well and vice-versa. This quarter, monetary policy easing led to both bonds and equities performing well. Global bonds returned 4% in the quarter and 4.8% in the year to March 2019 (Bloomberg Barclays Global Corporate Bond Index). New Zealand investment grade bonds returned 2.3% for the quarter and around 6% for the year.

Given the strong performance of markets, SuperLife Fund returns were positive across the board in both the quarter and over the year to March. SuperLife Income, which has no exposure to equities, had a positive return of around 4% over the quarter and 5.2% over the year (after tax and fees). The SuperLife Balanced fund returned 8.2% in the quarter and 7.5% over the year. The SuperLife High Growth fund, which largely invests in equities and property stocks, increased 11.5% in the quarter and 8.1% over the year.

Socially Responsible Investing and the power of engagement

The notion that Facebook and other social media providers (e.g. YouTube which is owned by Google) need not take responsibility for what is broadcast on their platforms was shattered following the Christchurch tragedy. There is a growing chorus in New Zealand and offshore to bring them under the same standards that other broadcast media (radio and television) must comply with to maintain their licence to operate.

New Zealand’s institutional investor community, of which we are a part, has taken these concerns extremely seriously. Smartshares (the owner of SuperLife) has joined large investors like the NZ Superfund and ACC, and an increasing number of global investors, to formally engage with Facebook, Google and Twitter.

Our aim is to encourage those platforms to invest more in monitoring and excluding violent and extremist content.

KiwiSaver - changes to the rules 2019

From 1 April 2019, the government made a number of changes to the rules around KiwiSaver. Some come into effect from 1 April 2019, and others from 1 July 2019.

A key change is that you can now choose to contribute 3% (the minimum), 4%, 6%, 8% or 10%. Previously you could only choose 3%, 4% or 8%. Giving you more options is intended to give you more flexibility to choose a contribution rate that suits your particular circumstances and retirement outcomes you want to achieve.

From 1 April 2019

- New contribution rates: 6% and 10%

If you are employed, you can now choose to have 6% or 10% deducted from your pay – in addition to the current rates of 3%, 4% or 8%. You can also make voluntary contributions for any amount at any time.

- Government contribution

This used to be called the Member Tax Credit (MTC). It’s the contribution of up to $521 the government makes to your KiwiSaver account if you save $1,043 (for a full year).

- Savings suspension

This used to be called a “contributions holiday” and the maximum period was 5 years. Now, if you’re on a savings suspension, you must renew it each year.

From 1 July 2019

- Joining over age 60

If you join KiwiSaver after turning 60 you can now withdraw your savings at age 65. Previously, you had to be a member for five years.

- If you joined over age 60 and are already locked in as at 1 July 2019

You can opt out of lock-in as at 1 April 2020, but if you do, you won’t be eligible (from the date of the withdrawal) for compulsory employer contributions or the government contribution.

You will, however, still be eligible for compulsory employer contributions and the government contribution if you remain a member for the five-year period. This ensures you retain the entitlements in place when you joined KiwiSaver.

- Joining over age 65

If you are already over 65, you can now join KiwiSaver. Previously you couldn’t join after age 65. You can withdraw at any time. Unless you, or your employer, is contributing from pay to KiwiSaver, we would encourage you to use SuperLife Invest instead of KiwiSaver as the fund options are the same and the fees are lower.

My Future Strategy

As discussed in the last update, it’s important not to be spooked by market volatility. Time and time again, history suggests markets recover from periods of weakness. The risk of permanent capital loss over the long term is minimal given this pattern, and because SuperLife funds are broadly diversified.

For investors with long-term horizons, staying the course with your present investment strategy is usually the best option, subject to your goals, objectives and cash needs remaining broadly the same as when your strategy was established.

Investors concerned with performance over a medium-term horizon (the next three to five years or so) may see an opportunity to enhance returns by tweaking your allocation to cash, bonds, equities and property stocks as follows:

- Holding less in bonds and, therefore, more cash and shares. This reflects the view that equity markets offer better value, while there is risk that interest rates may increase for bonds more quickly than is currently factored into bond prices.

- Favouring value, emerging market, Australian and European equities compared to US and NZ equities. These latter markets are broadly assessed to offer less value (upside return potential) than other markets.

- Maintaining holdings of property stocks at around your longer-term allocation.

- Maintaining the currency hedge on overseas shares at around your longer-term allocation. Our interest rates are still slightly higher than foreign rates on a global market capitalisation (e.g. MSCI World Index) basis. This means hedging global equities will still earn investors a positive “carry”.

This strategy strategy does not constitute financial advice and doesn’t take account of personal circumstances; rather it is designed to illustrate possibilities. As with all investment decisions, what might be the right strategy over the medium or longer-term may not pay off over the very short-term. No one can consistently predict what’ll happen over the short-term.

SuperLife changes April 2019

SuperLife recently made some changes designed to streamline the investment options and to make it easier for you to identify and compare the type of fund you are in. New product disclosure statements for the SuperLife schemes are now available at www.superlife.co.nz/resources/legal-documents

- As advised last quarter, the SuperLife Managed Funds name has changed to SuperLife Diversified Funds.

- The Property Fund has been renamed the Global Property Fund, reflecting its holdings of New Zealand, Australian and international listed property assets.

- ETF funds is dropping ETF from the fund name as the funds were not "exchange traded" themselves.

- The NZ Bonds Fund and the NZ Bond ETF Fund were combined into the NZ Bonds Fund.

- The Overseas Bonds Fund and the Global Bond ETF Fund were combined into the Overseas Bonds Fund.

- The Emerging Markets Fund and the Emerging Markets ETF Fund were combined into the Emerging Markets Fund.

Changes to SuperLife Invest

SuperLife Invest is the unrestricted scheme through which you can save and also through which the other SuperLife schemes invest. From 31 March 2019, instead of all funds being pooled together, SuperLife Invest will be segregated into 38 separate unit trusts, so that assets of one fund are unequivocally, clearly and legally ring fenced to investors in that particular fund.

Change to withdrawal request timing

Please note that the deadline to receive withdrawal requests from voluntary or individual accounts is now midnight and will normally be processed for payment the following evening. This is to ensure fairness to all members by reducing the possibility for a member to take advantage of overnight news which has not yet affected their balances.

Check your PIR (prescribed investor rate) here. You can change your PIR online or by contacting SuperLife. Check how to get the maximum government contribution (previously called MTC). Find out how to get your maximum government contribution of up to $521 to your KiwiSaver account. Note: you can now set up a KiwiSaver lump sum payment online.

New NZ Super rates

NZ Super rates increased on 1 April 2019. Get the new rates here.

Should you increase your KiwiSaver contribution rate?

With the introduction of two additional KiwiSaver rates – 6% and 10% - it may be time to review your savings rate and consider whether increasing your contribution rate would be right for you.

What if I increased my contributions?

To work this out accurately, you’ll need to use a calculator like the one on the Sorted website. It will help you work out how much extra you would save and what that will mean for your retirement savings (or your first home deposit if eligible).

What you receive at age 65, depends on your current age, your contributions, whether you’re in conservative or growth funds, and whether you make additional payments.

A recent article in the New Zealand Herald provided some useful number crunching from Canstar across a range of ages and percentage contributions to show the impact of increasing KiwiSaver contribution rate across different ages and different investment options.

To increase their KiwiSaver contribution rate, employees just need to advise their pay department. SuperLife members contributing directly can change their rate simply online or by emailing This email address is being protected from spambots. You need JavaScript enabled to view it..

Should I save more in KiwiSaver or in a non KiwiSaver fund?

There are arguments for both options. Increasing your KiwiSaver contributions will, over time, result in you having a higher retirement savings balance or first home deposit if that’s your aim. For KiwiSavers on low incomes, increasing contributions might also bring them up to the contributions needed to get the full government contribution. However, it also means that the savings are locked in until age 65 unless you are eligible for a first home deposit withdrawal (or under financial hardship or medical grounds).

If you want to increase your savings, but you don’t want to lock in any more than is required to get the maximum benefit from KiwiSaver, you can do that using the SuperLife Invest fund. You can save additional amounts to your SuperLife Invest account, which you can withdraw as required, to manage major health, employment or life events that require emergency funds. SuperLife Invest offers all the same investment options as the SuperLife KiwiSaver scheme. You can set up a SuperLife Invest account online.

As always, KiwiSaver and investing for your retirement present you with many options to consider and choices to make. We suggest you do the sums based on your age, current income, plans for the savings whether it be first home deposit or retirement, and whether you think you can save a little more today to have more savings available in the future. More information on KiwiSaver is available here.

Smartshares Limited is the issuer of SuperLife Invest, the SuperLife KiwiSaver scheme, the SuperLife UK pension transfer scheme and the SuperLife workplace savings scheme. The Product Disclosure Statements and Fund Updates for these schemes are available at www.superlife.co.nz/legal-doc