Giving you the highlights from the last three months at Smartshares and the markets

In this issue

From Anna’s desk:

Celebrating diversity at Smartshares

Fund Spotlight:

How you can invest a little closer to home

What’s New:

What you need to know about tax season

Quarterly Highlights:

Celebrating new partnerships and big occasions

The Stocktake:

Record highs and a recession? What three months brought in markets

Kia ora koutou,

March marked 6 months since I joined Smartshares and it’s already been a bustling first quarter. I’ve taken the opportunity to reflect on what we’re doing to meet your diverse needs as an investor.

Celebrating diversity at Smartshares

Diversity has been a theme for Smartshares during the last 3 months, with Pride Month, Lunar New Year and International Women’s Day being important events that we have celebrated. On International Women’s Day, we announced a new partnership with Powrsuit, a membership network for women leaders – more on that in our Quarterly Highlights. As part of that launch, I sat down with their founders to discuss what leadership means to me.

During the interview, I was asked about why diversity is important to Smartshares, this prompted me to think of all of you, our investors. We know our investors aren’t a homogenous group who all need or want the same thing. Our goal is to give you investment options to support you to achieve the financial future you’re working so hard for, and to access these options in way that suits you. The best way for us to provide valuable products and service for you is to make sure that you have a voice at the table. By embracing what makes every one of our team different, we make our customers’ voice louder – that will always be a good thing. You can check out the entire interview on Powrsuit's LinkedIn.

Creating pathways for growth

As well as celebrating the diversity of our business this quarter, we’ve been working hard on building on our strategic business activity to deliver our 5 year growth aspirations. One of those is a rebrand to bring together our market proposition across our SuperLife and Smartshares brands. This is a hugely exciting initiative for us, as this also presents an opportunity to deliver a greater investor experience. More to come soon.

The past 6 months leading the Smartshares team has been a whirlwind and a privilege, and I’m excited to share more of what we’re working on at your next quarterly.

Ngā mihi nui,

Anna Scott - CEO, Smartshares

Fund spotlight

Asia Pacific Fund: There’s more places to invest than the U.S.

Have you been looking to add an investment to your portfolio that’s a little closer to home?

The Asia Pacific Fund in SuperLife Invest could be what your portfolio is missing.

The Asia Pacific Fund is part of our International Shares range, and unlike other sector funds – such as the US 500 Fund or the S&P/ASX 200 Fund (both also available in SuperLife Invest) – your investment is geographically diversified by not being invested in just one country’s market.

You can:

- Get exposure to financial products included in the FTSE Developed Asia Pacific All Cap Index.

- Diversify your portfolio by investing in a broad international market, giving you an even broader regional range of companies to be invested in.

What’s new?

Tax season is back

April marks the first month of the new financial year, and the previous one ending means one thing for all of us: tax time. What does that mean for you? It’s the time of the year where you find out whether you need to pay a shortfall to the IRD, or whether you’re owed some money from overpaying.

Here’s what you need to know:

- Know your PIR: If you haven’t recently checked it, now’s the time to check that your Prescribed Investor Rate (PIR) is up to date. If it’s too high, you could be getting taxed too much and be owed a return, but if it’s too low you could owe money form underpaying on tax. Do yourself a favour and verify that it’s where it should be - check yours in minutes on our SuperLife member portal.

- File a return: If you have income that hasn’t already been taxed, then you need to head to the IRD website and fill out the IR3 return. These sources could be, shareholder salaries, rental income or if you’re self-employed. Returns have deadlines, so make sure you get yours in!

- Check your assessment: If you only earn income from salary/wages or investments, which have been subject to tax in New Zealand already, then the IRD already have your info and you do not need to file an IR3 return. Instead, they’ll send you an automatic assessment letter that outlines whether you owe money or have been paid a refund. Remember tax is your own responsibility, so even if you think IRD have all your information, still review this automatic assessment to make sure it is correct!

- Get your tax breakdown: We’ll be in touch this quarter with your tax certificate from the last financial year. Make sure you have a read and get in touch if you have any questions.

Your tax obligations can depend on your own individual circumstances, if you are unsure we recommend you reach out to a tax advisor.

We don’t want you to miss a thing

Checking your contact info is up to date is easy. Simply login to our member portal, and we’ll make sure you hear about the exciting things coming soon.

Quarterly Highlights

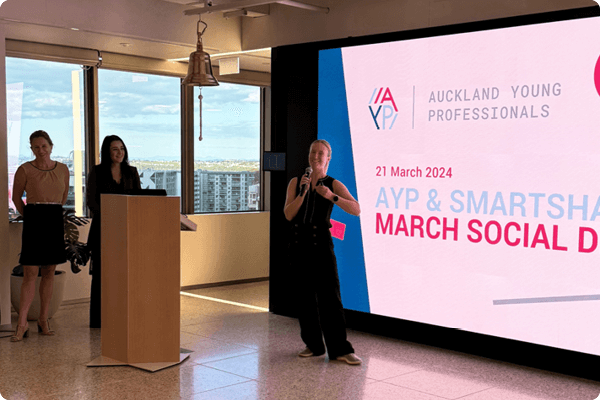

(Clarissa Hirst from AYP opens our AYP & Smartshares Networking Drinks at the Smartshares Auckland office.)

Building perfect partnerships

Smartshares has partnered with two, local organisations: Auckland Young Professionals (AYP) and Powrsuit. Together, we’re helping build better professional and financial futures for young Aucklanders and future female leaders.

Our partnership with AYP creates new opportunities for both AYP members and the Smartshares business. Through AYP, we have another avenue to lowering the educational barrier to investing, especially for young Aucklanders who are already working towards financial goals of their own. As part of our partnership, it was a pleasure to host AYP’s first networking drinks of the year at our Auckland office in March!

Powrsuit is a new and unique organisation, and we’re proud to be a foundational partner. Founded by the two co-founders of the investment platform Hatch: Kristen Lunman and Natalie Ferguson, Powrsuit is a membership network for women leaders. Their action-based approach transforms leadership development into an ongoing practice, alongside a powerful network of women (and male allies) who share challenges and aspirations. Our membership of Powrsuit is a great opportunity for us to create an internal network of future female leaders (and male allies) to connect and grow together!

Check out AYP and Powrsuit to learn more about their organisations.

Celebrating IWD

International Women's Day is a critical opportunity to recognise the women in our lives, as well as the need to keep accelerating progress. To mark this important day, we did more than just announce our membership of Powrsuit.

We wouldn’t be where we are without the women of Smartshares, and we’re lucky to have women make-up such a large portion of our team. To support their professional journeys and career goals, we’re giving our staff access to Powrsuit to start strengthening our internal network.

Anna, our CEO also featured on NZX’s Opening bell podcast to talk about women in investing. It was an insightful episode that covered a range of topics worth hearing, and you can listen on Spotify, Apple Podcasts or on the NZX website.

(Client team stars, Ivy Valderrama, David Buell and Jermaine Cooper at FANZ in Wellington.)

Amidst the Experts

Industry events are one way to connect with other financial experts in the market. We got the opportunity to do that again this quarter, with features on InvestNow’s Fund Manager Panel Discussion, and going to another year of the Financial Advice New Zealand (FANZ) conference in Wellington.

David Taylor is our Senior Portfolio Manager - Diversified Funds, joined the InvestNow panel to discuss Managing Foreign Currency Exposure. David shared some interesting insights in their discussion with other fund managers, and you can check them out by watching here.

The FANZ conference is a mainstay in the Smartshares’ calendar, and it was great to be back and get time with our advisor network. Thanks to everyone who came and saw us for a coffee and a chat, we always love being able to talk about delivering a better future for investors with those who are helping make that happen.

Taking time for our team

Quarter 1 doesn’t just mark the end of Aotearoa’s financial year, there are some deeply important cultural milestones that mean a lot to us. Two of those are Lunar New Year and Pride Month, both of which proudly featured around our business.

To mark the Year of the Dragon, we hosted a Lunar New Year morning tea that featured wonderful Asian treats! But aside from great food being shared together, it was also an opportunity for those who don’t celebrate to learn more about this significant cultural occasion.

February also marks Pride Month in Aotearoa, where we recognise, celebrate and are allies for the rainbow community. Our Senior Customer Experience Representative, Melissa Robinson – who many of you will know from helping you over the phone – shared some beautiful badges to wear with pride and recognise the inequalities the rainbow community still face. Initiatives like this may seem small, but they have great significance – thank you, Melissa for leading our pride celebrations.

The Stocktake

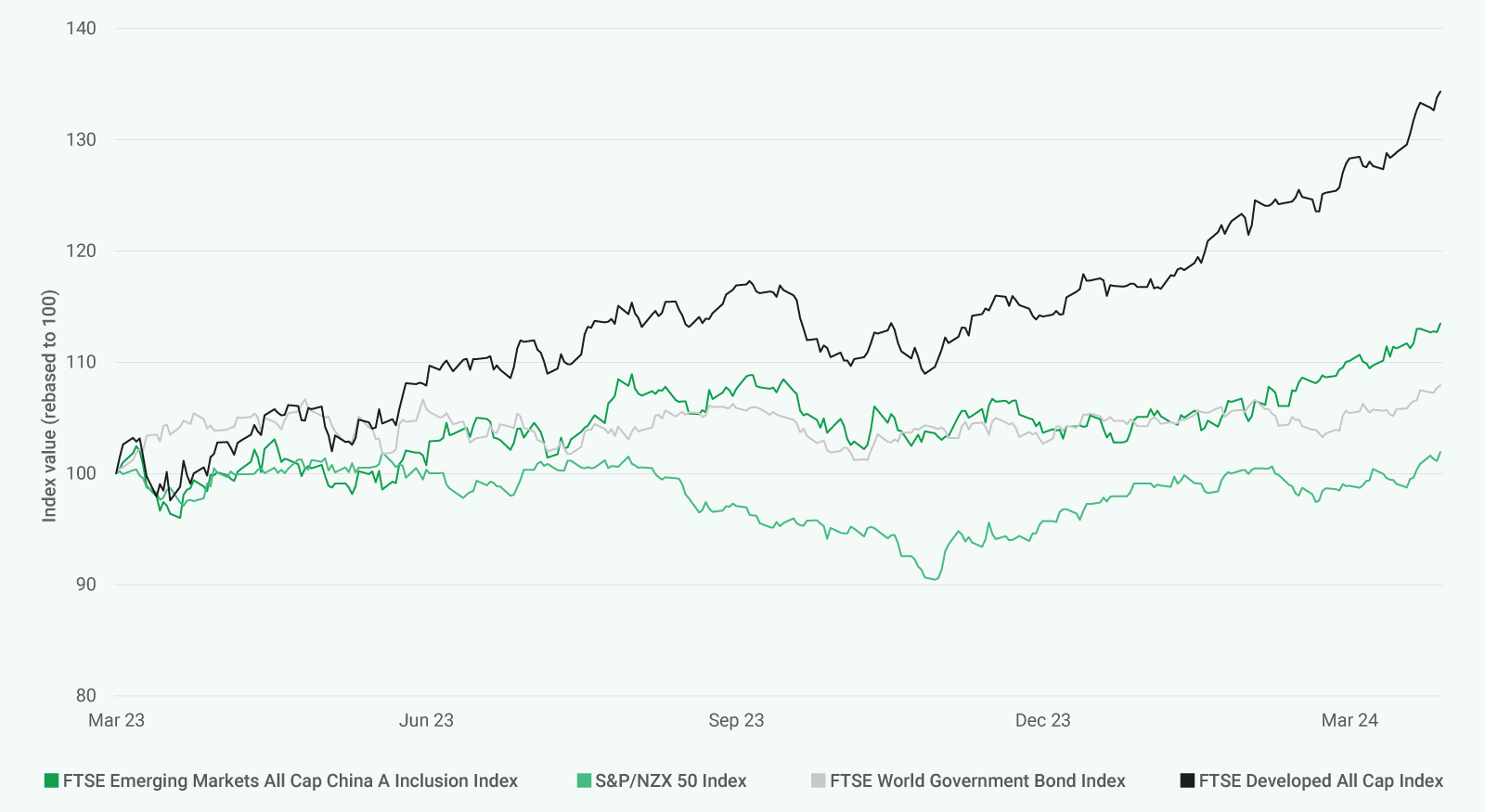

This quarter saw confidence stay elevated, and equity markets grind higher. This was helped by the flow of positive economic news in the US, and persistent signalling from central banks that rate cuts are looming. Most major benchmarks hit new record highs, as market breadth improved and hype around Artificial Intelligence (AI) continued to gather steam. The MSCI World (NZD) Index was no exception, with its 15.3% return for Q1 24 – one of the best quarterly performance periods since 2006.

For offshore returns, currency was a major tailwind on the back of a weaker Kiwi dollar, in particular versus the US Dollar, against which it fell 5.4%. Fixed income assets underperformed, as bond yields rose on the flow of positive economic data and progress on the inflationary front was generally more negative than positive. The Bloomberg Global Aggregate (NZD Hedged) Index was flat overall, and corporate issues outperformed government bonds on the back of credit spreads tightening to historically low levels.

Highs and lows across Asia

After assessing the key drivers of performance across equity markets, we know the rally for Q1 was a continuation of the same drivers prevailing in late 2023. The parts of the market most exposed to the AI opportunity continued to build on their gains, followed closely by cyclical and consumer discretionary segments. Defensives and interest rate-sensitive names lagged, but still managed to eke out positive returns. From a region-specific point of view, Japan was the standout market with the Nikkei 225 Index rising 21.4%, driven by strong foreign inflows and solid corporate reporting.

Economic challenges in China, and concerns over its growth prospects and lack of meaningful policy support in response, translated into lower equity returns as the Chinese CSI 300 Index rose 3.1%. The negative sentiment in Asia permeated across to Australasian markets, which also underperformed global peers as the S&P/ASX 200 Index and the S&P/NZX 50 Index returned 5.3% and 2.8%, respectively.

Goodbye rate cuts, hello recession

As global economic indicators showed a lift in overall activity, there was a significant shift in expectations from a “soft-landing” scenario to a “no-landing” one. This saw the number of rate cuts being priced in for this year substantially reduce, with the Federal Reserve now expected to cut only three times this year instead of the seven cuts that were expected at the start of the year. Global government bond yields climbed higher, with the 10-year US Treasury Note rising 32bp to 4.2%.

In New Zealand, the economic backdrop remains frail, with the latest GDP print confirming the country is once again in a technical recession. This is the second time in 18 months that New Zealand has entered a recession, despite an estimated record of almost 3% population growth and expanded government spending. The next OCR announcement from the Reserve Bank will be on 22 May, which many Kiwis will be watching closely as inflation has reached its lowest levels since June 2021.

Finance in full

World indices at a glance

| EQUITIES | Q1 2024 RETURN | 1 YEAR RETURN | 3 YEARS (P.A) RETURN |

|---|---|---|---|

| International | |||

| FTSE Developed All Cap Index | 8.4% | 24.7% | 8.0% |

| FTSE Emerging Markets All Cap China A Inclusion Index | 1.8% | 8.2% | -3.3% |

| S&P 500 Index | 10.6% | 29.9% | 11.5% |

| Australasian | |||

| S&P/NZX 50 Gross Index | 2.8% | 1.9% | -1.2% |

| S&P/ASX 200 Index | 5.3% | 14.4% | 9.6% |

| FIXED INTEREST | Q1 2024 RETURN | 1 YEAR RETURN | 3 YEARS (P.A) RETURN |

|---|---|---|---|

| International | |||

| Bloomberg Global-Aggregate Index | -2.1% | 0.5% | -4.7% |

| US 10-year government bond yield (%) | 4.2% | 3.9% | 3.5% |

| New Zealand | |||

| S&P/NZX A-Grade Corporate Bond Total Return Index |

0.6% | 5.5% | 0.0% |

| NZ 10-year government bond yield (%) | 4.5% | 4.3% | 4.2% |

(Data source: Bloomberg, compiled by SuperLife)

Global assets: major market movements over the last 12 months

(Source: Bloomberg)

SuperLife KiwiSaver Diversified Funds as at 31 March 2024

The investment returns shown below are for the specified periods ended 31 March 2024, for a SuperLife KiwiSaver Scheme member (after fund charges and tax). The SuperLife Default Fund is only available to members of the SuperLife KiwiSaver Scheme.

| FUNDS | 6 MONTHS | 1 YEAR | 3 YEARS (P.A) | 5 YEARS (P.A) | 7 YEARS (P.A) |

|---|---|---|---|---|---|

| Income | 3.6% | 2.4% | -0.9% | 0.4% | 1.2% |

| Conservative | 7.3% | 7.4% | 1.3% | 2.7% | 3.2% |

| Balanced | 10.3% | 11.2% | 2.9% | 4.8% | 4.9% |

| Ethica | 11.3% | 12.8% | 3.2% | 6.2% | 5.7% |

| Default | 10.0% | 12.3% | - | - | - |

| Growth | 12.4% | 14.0% | 4.1% | 5.9% | 6.0% |

| High Growth | 14.8% | 17.0% | 5.3% | 7.2% | 7.0% |

(Note: These figures are representative of the SuperLife KiwiSaver Scheme. Returns displayed account for fund charges and tax at 28%, but your tax rate may be lower. Past returns are not a reliable indicator of future performance.)

This information does not constitute financial advice and does not take account of personal circumstances; rather, it is designed to illustrate possibilities. As with all investment decisions, what might be the right strategy over the medium or longer term may not pay off over the very short term. No one can consistently predict what will happen over the short term. Those acting upon the information in this newsletter do so entirely at their own risk. Smartshares does not accept liability for the results of any actions taken or not taken based on this information. While every effort has been made to ensure accuracy, no liability is accepted for errors or omissions in this newsletter.