Your latest fund updates, changes to Kiwisaver, and market insights.

In this issue

From Anna’s desk:

Improvements at SuperLife to better support you.

Fund Spotlight:

More choice – your way with SuperLife funds.

Investing 101:

Changes to KiwiSaver and building an investment portfolio.

The Stocktake:

Markets rebound, but global risks remain.

Kia ora koutou,

At SuperLife, our focus is on giving New Zealanders simple, smart tools to grow their wealth over the long term. But we know that great products need to be matched with great service.

We’re investing in improvements behind the scenes to serve you better. We’re growing our Customer Service team to keep pace with rising demand and upgrading our internal systems to respond faster and more efficiently. We are here to make it easier for you to grow your savings and stay in control of your financial future.

The second quarter of 2025 saw markets recover from earlier volatility around tariffs. With tensions escalating in regions including the Middle East and Eastern Europe, uncertainty remains high. Conflict on this scale is deeply concerning on a human level, and it also creates effects in global markets. While short-term market movements are likely, history shows that a well-diversified, long-term investment approach remains one of the best ways to navigate uncertain times.

In this update we have included a summary of the Government’s changes to KiwiSaver, a useful resource for investors on how to build a diversified portfolio and information on building an investment portfolio that meets your needs from SuperLife’s investment options.

Ngā mihi nui,

Anna Scott - CEO

Smart (Smartshares Limited)

We’re moving to online statements

To keep you informed in a faster, safer, and more sustainable way, we’re moving to online statements.

Make sure your contact details are up to date, so you don’t miss important updates. Log in or register at the member portal, to check your details. You can also view your latest statements and account balances anytime.

If you’ve chosen to receive printed statements, you’ll still get one annually.

Fund spotlight

More choice – your way with the SuperLife KiwiSaver Scheme’s funds

KiwiSaver is a powerful way to save for your future - with the bonus of government and potential employer contributions - but at SuperLife, we believe it can do more.

Did you know that SuperLife offers one of the largest ranges of investment options in KiwiSaver? SuperLife offers over 40 funds to choose from, including a range of diversified funds and single sector funds such as global shares, NZ companies, property, and bonds.

If you are interested in building a personalised investment portfolio in your KiwiSaver account, SuperLife gives you the flexibility to tailor your KiwiSaver to your goals, risk appetite, and values.

- Pick one fund or combine several

- Mix growth and income options

- Adjust allocations as your goals change

- Low fees

We give you choice and control over how your money is invested. You can build your own portfolio or take a hands-off approach with our Age Steps fund - which automatically adjusts your investment mix as you get older. As an investor’s age increases, the proportion of investments in growth assets (such as shares and property) is reduced, and the proportion of income assets (such as cash and bonds) increases.

Compare returns and fees for SuperLife’s investment options here »

To change your current investment strategy, log in to the SuperLife member portal, click on change my investment strategy and select ‘My Mix’. You'll be able to define what percentage of your savings you want to invest in each fund.

We’re here to help. Contact us.

Changes to KiwiSaver – what you need to know

From 1 July 2025, several Government changes to KiwiSaver have come into effect. Here’s a quick summary:

Government contributions reduced from 1 July 2025

- You’ll receive 25c for every $1 you contribute, up to $260.72/year (previously 50c, up to $521.43).

- You’ll still need to contribute at least $1,042.86/year to get the full amount.

- If you earn over $180,000, you’ll no longer be eligible.

Added benefits for younger members

- From 1 July 2025, 16 - 17 year olds are eligible for government contributions.

- From 1 April 2026, 16 - 17 year olds will be eligible for employer contributions.

Minimum employer and employee contribution rates increasing

Default rates will rise:

- To 3.5% from 1 April 2026

- To 4% from 1 April 2028

A 12-month opt-out back to 3% will be available from February 2026.

What’s not changing?

You can still use KiwiSaver for a first home and retirement.

Investing 101

Building an investment portfolio beyond KiwiSaver

Even if you are invested in a KiwiSaver Scheme or Workplace Savings Scheme, adding another investment can help build your overall portfolio and boost your savings for the future.

Because KiwiSaver is generally locked until age 65, many people choose to build an additional investment portfolio that gives them more flexibility – something they can access earlier if needed.

A well-diversified portfolio helps manage risk, but you may also want the option to make more targeted investments. That’s where a core-and-niche approach can help.

Your core portfolio typically makes up 80% or more of your total investments – this is your foundation, focused on long-term growth and stability. Around that, niche investments allow you to explore new ideas, such as sector-specific or thematic funds, and take advantage of emerging trends.

You don’t need a lot to get started – even a small amount invested regularly can make a big difference over time.

Want to learn more? Explore SuperLife Invest’s fund options here »

The Stocktake

Market commentary by Stuart Millar, Chief Investment Officer

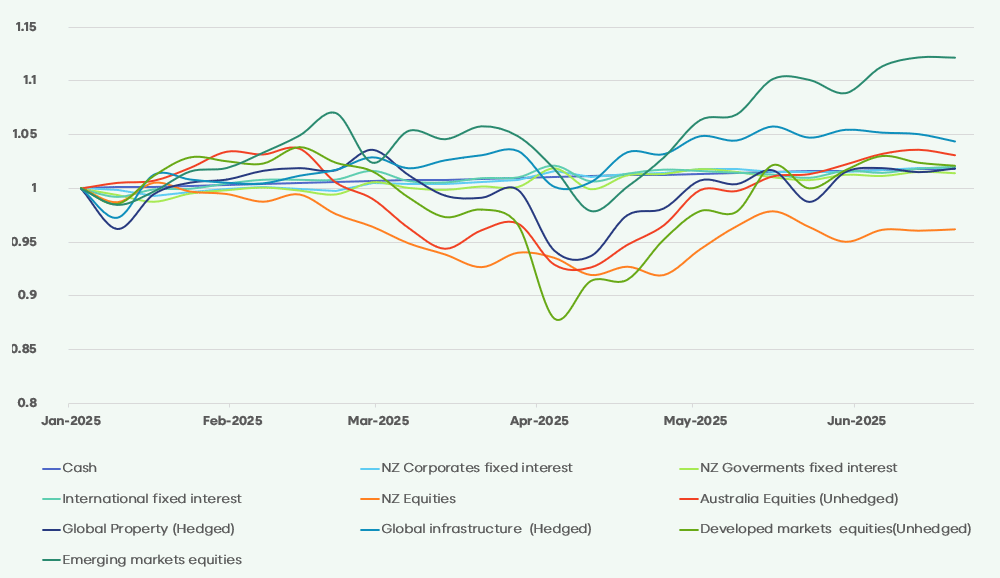

Q2 was a reminder of why it pays to stay the course. Volatility tested nerves, but investors who remained invested were rewarded.

Markets once again demonstrated their resilience, underscoring the importance of long-term investing through periods of short-term uncertainty. Diversification continued to add value within portfolios, helping to smooth returns amid market fluctuations.

As always, it’s worth checking that your investments align with your risk tolerance - so you can stay calm, confident, and on track, no matter what markets do next.

Global markets saw significant volatility on April 2nd, ‘Liberation Day,’ after Trump announced major tariffs on over 100 trading partners. The S&P 500 fell more than 10% in the days following but then rebounded, to 3% below its all-time high reached at the beginning of the year. More recently, geopolitical tensions have re-emerged, with rising conflict in the Middle East. So far, the main market impact has been a rise in oil prices, with only limited movement in equities and bonds – suggesting a relatively contained response from broader risk assets. However, this containment may prove short-lived if higher oil prices begin to feed more persistently into inflation and challenge central banks’ easing expectations.

One sign of potential longer-term shifts is the continued weakness in the USD and US Treasury bonds, with some commentators suggesting this marks the beginning of a structural ‘de-dollarisation’ trend. How sustainable the recovery is may depend on whether Middle East tensions escalate or ease.

Figure 1: Major market performance YTD

(Source: Bloomberg)

Table 1: Major market performance over the past year

| Asset class | 3-month asset class return | 12-month asset class return |

|---|---|---|

| Cash | 0.91% | 4.71% |

| NZ Corporates fixed interest | 1.32% | 7.38% |

| NZ Goverments fixed interest | 1.48% | 6.42% |

| International fixed interest | 1.32% | 5.26% |

| NZ Equities | 2.71% | 7.56% |

| Australia Equities (Unhedged) | 8.91% | 10.09% |

| Global Property (Hedged) | 1.32% | 8.58% |

| Global infrastructure (Hedged) | 1.21% | 15.99% |

| Developed markets equities(Unhedged) | 9.31% | 13.17% |

| Emerging markets equities | 11.99% | 15.76% |

Global Equities

The second quarter of 2025 delivered strong results for global equity markets. Global equities rebounded after a shaky start in April when the VIX, (often called the fear index), spiked to its highest level since the COVID-19 pandemic. However, corporate earnings were better than expected with a second quarter of double-digit earnings and more than 60% of companies in the S&P 500 reporting positive earnings, helping to stabilise markets later in the month. May delivered the strongest month in 18 months, helped by positive trade news (including a temporary tariff truce between the US and China) and strong tech performance. Emerging markets also benefitted, particularly Taiwan, Korea, and China. The NZ dollar strengthened over 8% YTD, benefiting those funds with hedging in place.

NZ & Australian Equities

NZ equities gained in Q2, with the S&P/NZX 50 up 2.7% for the quarter, though still down over 4% YTD. The top performing stock for the quarter was Briscoe Group Ltd (BGP), which saw its share price climb over 25% following the announcement that it would enter the S&P/NZX 50 index, replacing Warehouse Group Ltd (WHS). Manawa Energy and Tourism Holdings also performed well, while Vulcan Steel and Kathmandu struggled with headwinds in their respective markets. In Australia, the S&P/ASX 200 closely mirrored US markets, falling in the first week of April but ending the quarter over 9% higher.

Technology and Financial companies led the way, with strong gains from digital payments company Zip Co Ltd (ZIP), and family tracking company Life360 (360). On the downside, education consultant business IDP Education (IEL) was down over 60% as it felt the impact of both US and UK immigration and international student policy uncertainty.

Cash

The RBNZ cut the OCR twice in Q2, bringing it to 3.25%. The latest projections, released alongside the May meeting, remain largely unchanged – though they now suggest a modest possibility that the OCR could fall below 3%. The 3% level has been widely referenced as the neutral OCR for over a year, with RBNZ forecasts consistently pointing to this level as the endpoint across all projection horizons. Inflation risks remain due to oil prices and US tariffs, but one further rate cut is expected. Cash returns are likely to stabilise near current levels.

NZ Fixed Interest

NZ bond yields fell slightly over the quarter, falling by 16–21 basis points across both government and corporate bonds. The S&P/NZX NZ Government Bond Index returned 1.48% for the quarter, outperforming the S&P/NZX A-Grade Corporate Bond Index, which returned 1.32%. NZ corporate bond returns stayed strong thanks to fewer new bonds being issued and steady investor interest.

Global Bond Performance

The Bloomberg Global Aggregate Bond Index, which tracks worldwide bond returns, gained 1.32% for the quarter in NZ dollar hedged terms - reflecting decent performance in a complex economic environment.

Looking ahead

Markets are waiting for clarity on tariffs and geopolitical risks. For long-term investors, it’s important to focus on fundamentals.

We believe that artificial intelligence will continue to deliver productivity gains and support global economic growth. At the same time, central banks are well positioned to respond to economic shocks. And now more than ever, diversification is especially important – helping to manage risk in a world that’s becoming more unpredictable.

Update your email today!

Access your statements and tax certificates online – faster, safer, and all in one place. In the portal you can check your account balances, update your details, set up a direct debit and check if your PIR is right.

Register or Log in to your member portal to update your details so we can send you important updates.

Finance in full

World indices at a glance

| EQUITIES | Q1 2025 RETURN | 1 YEAR RETURN | 3 YEARS (P.A) RETURN |

|---|---|---|---|

| International | |||

| FTSE Developed All Cap Index | 11.8% | 16.3% | 18.2% |

| FTSE Emerging Markets All Cap China A Inclusion Index | 9.9% | 15.6% | 9.8% |

| S&P 500 Index | 9.5% | 13.9% | 13.6% |

| Australasian | |||

| S&P/NZX 50 Gross Index | 2.7% | 7.6% | 5.1% |

| S&P/ASX 200 Index | 9.5% | 13.9% | 13.6% |

| FIXED INTEREST | Q4 2025 RETURN | 1 YEAR RETURN | 3 YEARS (P.A) RETURN |

|---|---|---|---|

| International | |||

| Bloomberg Global-Aggregate Index | 4.5% | 8.7% | 2.7% |

| US 10-year government bond yield (%) | 4.2% | 4.2% | 4.3% |

| New Zealand | |||

| S&P/NZX A-Grade Corporate Bond Total Return Index |

1.3% | 7.4% | 5.2% |

| NZ 10-year government bond yield (%) | 4.5% | 4.5% | 4.7% |

(Data source: Bloomberg, compiled by SuperLife)

SuperLife KiwiSaver Diversified Funds as at 30 June 2025

The investment returns shown below are for the specified periods ended 30 June, for a SuperLife KiwiSaver Scheme member (after fund charges and tax). The SuperLife Default Fund is only available to members of the SuperLife KiwiSaver Scheme.

| FUNDS | 1 MONTHS | 3 MONTHS | 6 MONTHS | 1 YEAR | 3 YEARS (P.A) | 5 YEARS (P.A) | 7 YEARS (P.A) | 10 YEARS (P.A) |

|---|---|---|---|---|---|---|---|---|

| Income | 0.14% | 0.40% | 0.96% | 3.06% | 2.00% | 0.14% | 1.26% | 1.88% |

| Conservative | 0.81% | 2.04% | 1.30% | 5.71% | 4.90% | 3.20% | 3.28% | 3.82% |

| Balanced | 1.45% | 3.43% | 1.25% | 8.08% | 7.32% | 5.93% | 5.04% | 5.50% |

| Default | 1.17% | 4.06% | 0.89% | 7.06% | 7.77% | - | - | - |

| Growth | 1.84% | 4.21% | 1.03% | 9.52% | 9.12% | 7.78% | 6.06% | 6.46% |

| High Growth | 2.29% | 5.18% | 0.98% | 10.75% | 10.75% | 9.56% | 7.09% | 7.29% |

| Ethica | 1.53% | 3.37% | 1.29% | 8.54% | 7.82% | 6.58% | 6.10% | 6.01% |

(Note: These figures are representative of the SuperLife KiwiSaver Scheme. Returns displayed account for fund charges and tax at 28%, but your tax rate may be lower. Past returns are not a reliable indicator of future performance.)

This information does not constitute financial advice and does not take account of personal circumstances; rather, it is designed to illustrate possibilities. As with all investment decisions, what might be the right strategy over the medium or longer term may not pay off over the very short term. No one can consistently predict what will happen over the short term. Those acting upon the information in this newsletter do so entirely at their own risk. Smartshares does not accept liability for the results of any actions taken or not taken based on this information. While every effort has been made to ensure accuracy, no liability is accepted for errors or omissions in this newsletter.