As the COVID pandemic continues to affect countries and economies around the world, including New Zealand, it’s largely been business as usual for our virtual teams at SuperLife.

We are proud to have been selected by the Government as one of the new default KiwiSaver providers from 1 December, and this has been an important area of focus. We are excited with the new customer experience tool we will be introducing for our default members, and the launch of the SuperLife Default Fund. This fund provides a balanced option for new default members and will also be available for all our other KiwiSaver members.

In ‘Thoughts on investment strategy’, our chief investment officer, Stuart Millar maintains that in a rising interest rate environment it is likely that shares will continue to outperform bonds and cash. However, equities have been the star of the show for an extended period now and investors should expect only modest outperformance going forward.

Shares shine through as the asset class of choice for managed funds, KiwiSaver and other superannuation schemes, with the Reserve Bank’s latest QMF Survey showing a total of nearly $250 billion under management as at 30 June 2021.

Holdings of listed shares increased 7% to a record high of $119.3 billion. NZX-listed and international shares now account for more than 41% of total funds under management, compared with about 35% at the start of 2020 before the COVID-19 pandemic hit.

Enjoy the read.

Hugh Stevens

CEO, Smartshares

Follow these links to:

Market Update

For many industry old hands, September has been known to be the slow month of the trading year. Despite a slow September, market participants were largely pre-occupied with a few developing central themes.

The first is the reality of how tough it is to resuscitate an ailing economy. The U.S. economy’s rebound has not been a bed of roses given the teething pains brought on by the unleashing of pent-up demand which could not be matched by the supply side. Major shutdowns in ports and other infrastructure also caused logistic nightmares.

The second is the growing acceptance that COVID-19 is not going away anytime soon. Despite some countries coming out of lockdowns, others have, or are going back into lockdowns. Some scientists hold the view that this will be the new normal. Over time, as populations around the world develop immunity, COVID-19 will present itself much like the Spanish Flu of 1918 which started as one of history’s deadliest flus but eventually became a common cold.

The third is there is a finite flow to the aggressive funding coming from governments to keep the economic wheels churning. Even those with deep pockets are signalling they will be turning off the aggressive money supply being pumped into the financial system. President Joe Biden’s administration is, for instance, fighting hard to get Congress support for more stimulus budgets.

Given this backdrop, there was some evident shift in consumer confidence during the quarter reviewed. The Conference Board Consumer Confidence Index® reported that U.S. consumer confidence hit a seven-month low in September due to resurging COVID-19 cases. This has led to concerns about the economy’s near-term prospects. Another indicator, the University of Michigan Consumer Index survey also showed consumers were less optimistic about the economy, and buying sentiment fell in September, to a low not seen since 1980.

U.S. consumer price inflation (CPI) rose by an annual rate of 5.4% in September, after rising 5.3% in August, according to the Bureau of Labour Statistics. Month-on-month CPI rose 0.4% in September after rising 0.3% a month earlier. New Zealand’s CPI rose by an annual rate of 4.9% in the September quarter after growing 3.3% in the June quarter.

Around the markets

Equities led the market during the September quarter. The S&P 500 Index, which tracks 500 of the largest US companies, has risen 28.1% over 12 months. In the September quarter, it rose 0.2% after rising 8.2% in the June quarter.

The S&P/NZX50 Gross Index has risen 13% over 12 months. In the September quarter, it rose 4.9% after a 0.7% rise in the June quarter.

Smaller stocks, tracked by the Russell 2000 Index, rose 46.2% over 12 months but fell 4.6% in the quarter after a 4.1% gain in the June quarter.

At the end of September, the benchmark U.S. 10-year government bond yielded 1.49% while the NZ 10-year government bond yielded 2.09%.

The VIX Index, a measure of expected volatility of the S&P 500, was at 23.14 at the end of September up from 16.48 seen in August. Despite some creeping up in volatility, the VIX Index has remained relatively stable after crossing over 80 at the height of the pandemic in 2020.

International equities

In the September quarter, international shares, converted to NZ, returned 0.8%. Over 12 months, returns were 24.9% (FTSE Developed All Cap Index NZD).

NZ equities

NZ equities returned 4.9% in the quarter and 13% over 12 months (S&P/NZX 50 Gross Index).

Australian equities

Australian equities returned 1.7% in the quarter and 30.6% over 12 months (S&P/ASX200 Total Returns Index).

Emerging markets

Emerging markets returns fell 6.4% in the quarter but returned 19.8% over 12 months (FTSE Emerging Markets All Cap).

International fixed interest/bonds

Overseas bonds returned 0.1% in the September quarter, reflecting a low interest rate environment. Over 12 months, returns were down 0.6% as a result of very low, and sometime negative interest rates. (Bloomberg Barclays Global Aggregate Total Return Index, NZD hedged).

NZ bonds

NZ bonds returns fell 1.3% in the quarter and over 12 months, returns fell 4.1% (S&P/NZX A-Grade Corporate Bond Index).

SuperLife diversified funds

SuperLife Income, which does not have exposure to equities, saw returns drop 0.15% during the quarter and 0.84% over the year due largely to the low interest rate environment.

SuperLife Conservative, invested mainly in income assets, returned 0.18% during the quarter and 6.25% over 12 months.

SuperLife Balanced (which typically has 60% in equities/listed property and 40% in cash and fixed income) returned 0.55% in the quarter and 14% over 12 months.

SuperLife Growth returned 0.71% in the quarter and 18.87% over 12 months.

SuperLife High Growth, invested mostly in higher risk assets such as equities and property stocks, returned 0.89% in the quarter and 24.07% over 12 months.

Ethica, our socially responsible diversified fund, returned 0.58% in the quarter, and 15.09% over 12 months.

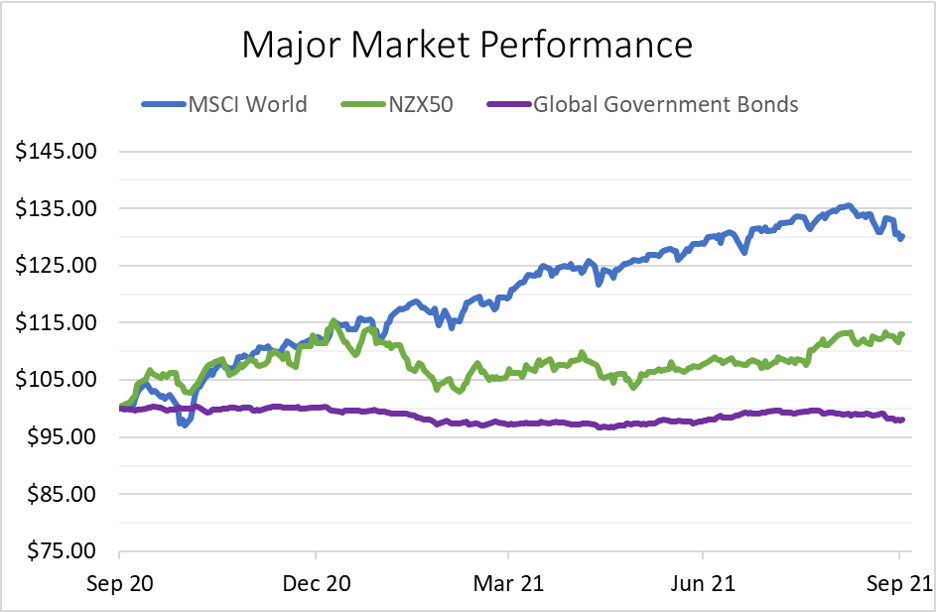

Figure 1: Bonds still sidelined, NZX 50 trails world markets

Source: Bloomberg/SuperLife

There is a well-known adage from Wall Street – don’t fight the Fed. For this reason, Wall Street has since the June quarter been preoccupied with trying to go with the flow of the Fed’s next move.

There have been expectations for a while now that the Fed might start tightening money supply by raising the Fed fund rate, which is the rate banks use to peg their cost of funds. The message is also loud and clear that the Fed will start to wind back its asset purchase programme. The Fed has been routinely buying US$120 billion of U.S. treasuries and debt securities each month. This purchase has lifted prices and lowered the yields of government securities. The aggressive asset purchases have meant a flow of cheaper funds to support economic rebuilding.

Other than the Fed, the European Central Bank also, in early September, announced it would pare back its bond-buying programme to a pace ‘moderately lower’ than the €80 billion (about NZ$133.50 billion) monthly purchases seen in the first two quarters of 2021.

At home, the New Zealand government had already stopped its large-scale asset purchase programme in July.

The Fed’s monetary policy is driven by two mandates — that of ensuring stable prices (measured by the consumer price index) and full employment to sustain stable economic growth.

For some time now, the market has been expecting a 0.25% hike in the Fed fund rate, if not in November, then early 2022. How quickly the Fed will act on interest rates depends on whether it thinks the recent rise in inflation is transitory or permanent and whether the economy’s recovery can be sustained.

It will never be easy ruminating the Fed’s next move because the Fed’s decision-making body, the Federal Market Open Committee, is not one unified voice but a disparate group of 12, each with a different view about when and how much the rate should be moved.

Given the market has been expecting some kind of rate rise, the fear is not so much the rise itself but whether the rate hike and the tapering of the asset purchase programme could end up being ill-timed, creating the unwanted side effects of suffocating the economy before it has a chance to take full flight.

Other than the Fed, Norway’s central bank became the first major Western central bank to hike interest rates in September after three rate cuts in 2020. The Bank of England has also signaled it might need to raise interest rates in 2022. At home, the NZ Reserve Bank raised the official cash rate (OCR) to 0.50% from 0.25% in October. This is its first increase since the OCR was trimmed in 2020 to help the economy paralysed by COVID-19.

What will keep investors awake?

The next few months are crucial months. Investors will be looking for strong indicators to confirm the U.S. economy is on a sustained growth trajectory and that inflationary forces at play are transitory and manageable.

The jury is still out on how strong the economy’s recovery is. At its September meeting, the Fed lowered its economic growth forecast to 5.9% this year, compared to the 7% forecast made in June. It however, raised its 2022 growth outlook to 3.8% (from 3.3% in June).

Investors will also be keeping a close eye on consumer confidence and the number of non-farm jobs being created. Any disruption to job creation will have an impact on how the Fed makes its next move. Although non-farm payrolls have recovered from their COVID-19 lows, in September non-farm payroll growth came in at 194,000 jobs against the 500,000 expected by economists.

Recently, there have also been emerging concerns about stagflation. It’s a term attributed to the late Tory politician Iain Macleod who also served very briefly as the U.K.’s Chancellor of the Exchequer in 1970. Macleod in 1965 foresaw the term ‘stagflation’ (which he coined) will be added to the lexicon of economic terms. He used stagflation to describe the worst of two events happening together — low economic growth timed with high unemployment.

Should investors be worried? The naysayers are of the view that the US economy's growth is merely taking a pause after accelerated growth over a few quarters; and the Fed has sufficient monetary tools to prevent runaway inflation. Those who are worried hold the view the Fed may run out of options in their monetary toolkit to keep inflation at bay and the economy will take a hit.

There is already an acute global shortage in the semiconductor industry, a situation that won’t go away overnight. Changes to semiconductor production takes time, and adding new capacity takes huge capital. The COVID-19 pandemic has definitely cranked up demand for technology products which are not likely to be met by supply for at least the next two years, according to one report.

There has also been a developing crisis in the global energy market, with European and Asian gas prices soaring. Various contributing factors to this energy crisis include: winter in the northern hemisphere; poor planning and China’s ban of Australian coal imports; demand overshooting supply in India; a rapid move away from fossil fuel as an energy supply source in Germany without alternatives being put in place; and Russia holding back its gas supply to Germany.

The market has been and will continue to adjust its position based on the themes described above. For the time being, most investors watching the market will be less sanguine until economic numbers in the next quarter point to more a decisive economic growth picture.

- The equities market is going through a consolidation phase. Although there are jitters around the impact of the impending rise in interest rates, a correction of between 5 and 10% in the near to medium term will not be unusual given the market has had an amazing run.

- S&P 500 companies continued to report robust earnings in the September quarter (Source: Lipper Alpha Insight). Estimated year-on-year earnings growth (as at mid-October) was 29.6% in the September quarter and 22.2% in the fourth quarter. Third-quarter growth estimated was higher than the five-year average of 7.1% and the highest seen in the same quarter since 2010. The energy, materials, industrials and IT sectors led the growth.

- Going forward, investors will be waiting to see whether rising interest rates will affect companies’ margins, and if so, which ones will be able to absorb rising cost of funds, and how that will affect earnings. Companies with high valuation who are unable to absorb the higher cost of funds will be at risk.

- Bond yields have moved up slightly as governments pare back money supply injected into the system. However, this is unlikely to pose any major threat to the equities market. Overall, equities markets will not have too big a hurdle to jump, to outperform bonds.

- Some investors are curious about whether they should shift their strategy given the rising interest rate environment. Traditionally, commodities, energy, and real property are considered inflation hedges. There might be premiums attached to companies whose businesses typically weather inflation well.

- However, as always, we remind investors not to be persuaded to switch in and out of funds. It is also good to remember that a good strategy is one that has a correct mix of different types of asset classes, carefully picked to match one’s risk profile. Investors averse to high risks should always have a well-balanced diversified portfolio, with some hedges built in for inflation risks, particularly if they rely on investments as a source of income.

SuperLife offers access to a range of funds across different sectors and country exposures, so investors can create portfolios tailored to their needs.

Our Ethica fund is a socially responsible fund with investments in a balance of income and growth assets.

The SuperLife Age Steps option lets you set your investment in income and growth assets based on your age. This means as you get older, the proportion of your investment in more volatile growth assets will be reduced, lowering the expected size of the ups and downs in the value of your investment.

If you are concerned about your investments or would like to find out more about how SuperLife can help with your investments, get in touch with us at This email address is being protected from spambots. You need JavaScript enabled to view it. or 0800 27 87 37.

This information does not constitute financial advice and does not take account of personal circumstances; rather, it is designed to illustrate possibilities. As with all investment decisions, what might be the right strategy over the medium or longer term may not pay off over the very short term. No one can consistently predict what will happen over the short term. Those acting upon the information in this newsletter do so entirely at their own risk. SuperLife does not accept liability for the results of any actions taken or not taken based on this information. While every effort has been made to ensure accuracy, no liability is accepted for errors or omissions in this newsletter.