KiwiSaver started on 1 July 2007 and is the “brand” for a taxpayer-subsidised, personal retirement savings regime. KiwiSaver is not restricted to employees. It works on the principle of auto-enrolling new employees and allowing all other eligible people to voluntarily join by opting-in.

Under KiwiSaver, employers make payroll deductions, through the PAYE tax system, for each employee who is required, or choses, to save to a KiwiSaver scheme. Employers also compulsorily subsidise their employees’ savings.

This article summarises the features of KiwiSaver as they apply to employees and employers. Separate articles cover non-employees.

Application & eligibility

- Applies to everyone who is a New Zealand citizen or entitled to be in New Zealand indefinitely and is normally living in New Zealand at the time they join. A civil servant working outside New Zealand can also join.

Auto enrolment

- Auto-enrolment applies for all new permanent employees, aged 18-64, regardless of pay level, except where the employer offers an alternative scheme for all its new employees and has obtained “exempt” status.

- A “permanent employee” is an employee for whom the employer must pay holiday pay during leave as required by the Holidays Act 2003. If holiday pay is included in regular pay, the employee is a casual employee - i.e. not a “permanent employee”.

- A part-time employee who is also self-employed, even if the self-employment is the main source of income, is an “employee” as far as KiwiSaver is concerned.

- New employees when auto-enrolled have savings deducted from their first pay. They can choose to opt-out, but only in the period from day 14 (2 weeks) to day 56 (8 weeks) of employment. Late opt-outs can also be processed in the 3 month period after the first contribution is paid.

Voluntary opt-in

- New employees under age 18 are not auto-enrolled. They can join, i.e. “opt-in” but must join by direct application to a KiwiSaver provider.

- Existing employees who are not members can join at any time. They apply direct to a KiwiSaver provider or, if over 18, can complete a contributions deduction notice (KS2) and give it to their employer. The official KS2 deduction notice is the quicker way of getting contributions started. Such employees still need to choose a provider or they will be allocated to a default provider.

- Employees who join by opting in cannot opt-out.

Employee contributions.

- Employees who participate will pay a minimum 3% of their total gross taxable pay. From 1 April 2026, the default contribution rate will go to 3.5% and then, from 1 April 2028, to 4%. For this transitional period, employees will temporarily be able to opt down to the 3% rate, but will only receive employer contributions at that rate.

- Employees can choose to increase the minimum to 4%, 6%, 8% or 10% and reduce it back to the minimum at any time. An employee’s “total gross taxable pay” includes bonuses, holiday pay and overtime but does not include redundancy pay, accommodation benefits and taxable overseas living and accommodation allowances.

- An employee on ACC or parental leave must contribute on their ACC compensation and paid parental leave payments. As these are not paid by the employer, no employer contributions are required.

- The employer must deduct the employee's savings, as part of the PAYE system, and forward them to the IRD.

- After 62 days, the IRD will forward the initial contributions (with interest added) to the employee’s KiwiSaver provider. Subsequent contributions are forwarded by the IRD as received.

- A new employee’s contributions, if they are auto-enrolled, start on the first pay day after they commence employment.

- Employees who do not opt-out, and employees who opt-in, must contribute for at least 1 year.

- An employee who has contributed for at least 1 year, can choose to stop saving at any time. This is a “savings suspension”. After 1 year, employees tell the IRD when they want to start a savings suspension. A savings suspension must be for at least 3 months and for a maximum of 1 year. At the end of a savings suspension it can be renewed. A savings suspension can start during the first year, but only in cases of significant financial hardship, as the IRD decides.

- While employed, employees must continue contributions until the earliest of:

- the day the auto-enrolled employee opts-out.

- the start of a savings suspension - this must be for a minimum of three months unless the employer agrees to a shorter period.

- the employee reaches the age of eligibility of NZ Super (currently age 65). However, employees past the age of 65 can choose to continue their contributions.

- If a new employee starts a second new job, under an alternative employer, the contributions are also payable in respect of that second job, unless the employee is on a savings suspension.

- If one employment is “exempt”, i.e. the employer has exempt status, but another is not, the contribution obligation applies to the “non-exempt” employment.

- Employees must keep their savings suspension certificates received from the IRD. A new employer must also auto-enrol a new employee if they cannot produce the certificate or if already in KiwiSaver, start deducting contributions at the minimum.

Non-employee contributions

- A KiwiSaver member who is not an employee can contribute the amount they agree with their KiwiSaver provider. This can be nil and need not be a regular amount and can be one-off or occasional lump sums.

- Note: To receive your full government contribution of $260.72 each year, you will need to make sure you have contributed at least $1,042.86 before 30 June each year.

- The same provisions apply to an employee who ceases to be an employee i.e. the minimum contribution requirement is no longer applicable.

Employer contributions

- If you’re over 18 (or over 16 from 1 April 2026) and contributing to KiwiSaver, Employers are also generally required to contribute to your KiwiSaver.

- Employer contributions are a minimum of 3% of your before-tax pay and are subject to tax. From 1 April 2026, employer contributions will go to a minimum of 3.5% and then, from 1 April 2028, to 4%. However, if you opt to take the temporary contribution rate of 3% your employer may choose to contribute 3% as well.

- An employer can contribute at a higher level.

- An employer's contributions for savings must go via the IRD.

Government contributions

- If eligible, the government will contribute 25 cents for every $1 you contribute up to $260.72 a year (from 1 July to 30 June). The government contribution is paid to the provider after the end of each year (30thJune). In the period before 30 June a member can top up their regular KiwiSaver contributions with a lump sum to ensure they receive the maximum government contribution.

- To be eligible, you must be aged 16-64, mainly living in New Zealand (or meet certain other criteria), and had an income of $180,000 or less for the year.

- The government contribution is proportionate for the first year depending on the period of membership.

Vehicle

- There are many “approved” private sector KiwiSaver providers and each provider offers a range of investment options.

- KiwiSaver members can choose their own KiwiSaver scheme from those available and can change their KiwiSaver scheme provider from time to time, at any time.

- An employer can select an approved provider to be the “chosen scheme” for any of its staff who do not make their own selection.

- Several (currently six) of the approved providers are designated “default” providers, which includes the SuperLife KiwiSaver Scheme. Employees who do not choose their own provider, and where their employer does not have a chosen scheme, will be allocated, randomly, by the IRD to a default provider.

Benefits payable

- Benefits are mainly available from the age of eligibility of the NZ Super (currently age 65). The KiwiSaver provider can pay benefits, on the member’s request, from age 65.

- Benefits are payable earlier:

- for first home housing assistance, or

- on significant financial hardship grounds (as assessed by the KiwiSaver scheme’s supervisor), or

- on serious illness,

- following permanent emigration with special rules applying to Australia where benefits are only available to be transferred to an Australian scheme and not paid in cash; and

- on death.

- Benefits are not payable to an employee on changing employers.

- Benefits are lump sums.

- Benefits are “relationship property” and form part of the relationship’s assets on separation. Benefits payable on death are paid to the deceased member’s estate.

- Benefits do not affect a person’s entitlement to NZ Super.

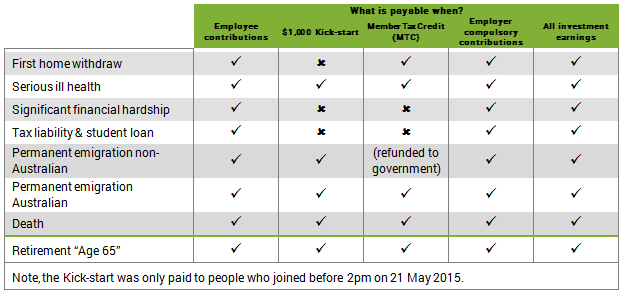

A summary of the benefits are:

First home withdrawal

- Members can, after being members of KiwiSaver for three years, withdraw part of their KiwiSaver account to help buy their first home.

- The maximum amount is equal to your balance, less $1,000.

- Where a person has owned a home before but is in a similar financial position to someone who has not owned a house, they can also withdraw money under the “second chance” provisions.