KiwiSaver

General

KiwiSaver is a government savings initiative to help you save for your retirement. It is a smart and affordable way to save for your future.

For every dollar you put into your KiwiSaver account in the “KiwiSaver year” (1 July to 30 June), the government will contribute 25c up to a maximum amount of $260.72. To qualify for the government contribution you must be 16 or older, and under 65.

If you are an employee, you will also get a contribution from your employer.

KiwiSaver is designed to help you build long-term wealth, for your retirement. It is also possible to withdraw your savings if you are buying your first home, or in cases of significant financial hardship, serious illness and permanent emigration.

All contributions and benefits payable are subject to the KiwiSaver Act 2006.

No. Your KiwiSaver account is in your name and your investments are securely held on trust for you by an independent custodian appointed by the scheme’s Supervisor, Public Trust.

- KiwiSaver is a savings initiative to help you save for retirement - You choose how much to contribute and your employer also makes regular contributions. You can choose to contribute at least 3% (which is lifting to 3.5% in April 2026 and 4% in April 2028) of your gross (before tax) wage or salary to your KiwiSaver account. Or you can select 4%, 6%, 8% or even 10%.

- If you make contributions to KiwiSaver, your employer must also contribute at least 3% of your gross pay. This applies if you’re 18 or older (or 16 or older from 1 April 2026) and under age 65. The minimum employer contribution rate is set to increase to 3.5% in April 2026 and 4% in April 2028.

- When you reach age 65 you can access some or all of your SuperLife KiwiSaver Scheme savings whenever you need it.

- The government helps you to save - At the end of June each year the government will top up your KiwiSaver account by 25 cents for every $1 you save, up to the value of $260.72 (provided you are 16 or older, your primary residence is New Zealand, had an income of $180,000 or less for the year and you are not yet eligible for a retirement benefit). The maximum amount you receive will be pro-rated if you are eligible for only part of the year.

- You can access your KiwiSaver savings early to purchase your first home - If you've been a member of KiwiSaver for 3 years you may be able to withdraw some of your KiwiSaver savings to put towards purchasing your first home.

You can join KiwiSaver if you are self-employed or not employed.

You can make contributions directly if you’re self-employed or not currently earning either through lump sum payments or by direct debit and enjoy all of the benefits of KiwiSaver - however, you won’t receive employer contributions. These benefits include the government contribution and the ability to withdraw your savings for the purchase of your first home.

What happens if you become an employee (start earning income that is subject to PAYE)?

If you become an employee, then a different set of rules apply. The main change is that you may be required to contribute a minimum contribution rate of your taxable earnings to KiwiSaver. Your employer will need to pay on your behalf, if you are aged between 18 (or 16 from 1 April 2026) and 65.

The annual KiwiSaver statement shows the movements in your KiwiSaver account for the year to 31 March. To learn more about the information included in the statement, you can read our guide here.

Joining KiwiSaver

If you are a New Zealand citizen or entitled to live in NZ indefinitely, are living or normally living in NZ (with some exceptions) you should be eligible for KiwiSaver. More information about KiwiSaver eligibility can be found on the government’s KiwiSaver website by clicking here.

Click here to sign up online now.

If you are new to KiwiSaver or already a KiwiSaver member, you can sign up to SuperLife online in a few minutes, or complete an application form and send it in to us.

There are three ways to join KiwiSaver - automatic enrolment when you start a new job, opting in through a KiwiSaver provider or opting in through your employer. You can read more about these options on the government’s KiwiSaver website by clicking here.

In most cases, when you are automatically enrolled you will be assigned a default KiwiSaver provider unless your employer has a chosen provider. However, you have the option to choose a provider, or change your provider if you have already been assigned one.

If you are already a member of KiwiSaver and wish to transfer your membership to SuperLife, click here. IRD will then advise us of your previous provider and we will contact them to arrange the transfer. Your previous provider has a timeframe of 10 business days to complete the transfer from when we contact them.

The fees you pay when you join the SuperLife KiwiSaver scheme are set out here.

SuperLife's fees are among the lowest in the market. You can see how competitive we are using Sorted's KiwiSaver fees calculator.

Yes, there is no minimum age. If the child is under 16 the signature of one legal guardian must be given and if the child is aged 16-17, the child must co-sign with one guardian.

The Government has made changes to KiwiSaver settings affecting contribution rates and the government contribution.

Key updates include:

- Contribution rates increase from 3% to 3.5% from April 2026, rising to 4% from April 2028.

- Members can apply to temporarily remain at 3% if needed.

- The government contribution rate has halved from 50 cents to 25 cents from July 2025 and is now capped at $260.72 per year.

- Members with a taxable income of over $180,000 per year are no longer eligible for the government contribution.

- Eligible 16 and 17-year-olds now receive government and will become eligible for employer contributions from April 2026.

Read the full explanation of KiwiSaver changes here.

You must be normally living in New Zealand to join KiwiSaver. If you join KiwiSaver and you move overseas for an extended period, you can remain in KiwiSaver, but you will not be eligible for the government’s government contributions for the time you are out of NZ. There are some exceptions to this normal position, for example for state sector employees working overseas.

Contributions and savings

Employees

If you are an employee you must contribute a minimum of 3% of your before tax pay. After one year you can stop contributing (i.e. go on a “savings suspension”). You can choose to increase the 3% to 4%, 6%, 8% or 10%, and to reduce it back to 3% whenever you choose.

From 1 April 2026, the default contribution rate will go up to 3.5% and then, from 1 April 2028, to 4%. For this transitional period, you will temporarily be able to opt down to the 3% rate, but may only receive employer contributions at that rate.

You can make also make regular contributions directly to your KiwiSaver account.

Non-employees (for example, self-employed, children, beneficiaries, stay-at-home spouse)

If you are not an employee, there is no minimum. You can choose not to contribute in the first year.

If you are 16 or older, saving at least $1,042.86 a year (i.e. $87 a month) until you reach your KiwiSaver retirement age maximises the government contributions.

Yes, your employer must contribute a minimum of 3% of your pay while you are also contributing 3% of your pay. From 1 April 2026, the minimum employer contribution rate will go up to 3.5% and then, from 1 April 2028, to 4%. However, if you choose to opt down to the 3% rate, your employer may also contribute at that rate. The employer contribution applies to employees aged 18 or older and under the KiwiSaver retirement age.

Contributions your employer makes into your KiwiSaver account are subject to Employer Superannuation Contribution Tax (ESCT).

No, if you want to break from making contributions to your KiwiSaver account you can take a savings suspension by applying to Inland Revenue through myIR. If you have been in KiwiSaver for less than a year, IRD may require evidence of financial hardship.

Your employer does not have to make compulsory employer contributions to your KiwiSaver account if you are not contributing (for example, on a savings suspension or on leave without pay.

If you are between the ages of 18 and 65, and have been with SuperLife for the entire financial year (12 months to 31 March), your KiwiSaver annual statement will show projections of the lump sum you will receive, and its weekly equivalent until you reach 90 years old.

The projections are not available for those under 18 and over 65, and those who have not been a member of the SuperLife KiwiSaver scheme for the entire financial year.

These projections are not a guarantee from SuperLife, or the government, of what your actual retirement savings will be.

We make projections of how much your KiwiSaver savings will grow to when you reach 65 years old based on factors including:

- your choice of funds

- your contribution rate

- how long you contribute for.

The calculations are also made based on an assumed inflation rate, and assumed investment return rates set by the government.

You can learn more about how the projections are made by reading the Financial Market Authority’s explanation here.

Government contributions (GC)

At the end of each “KiwiSaver year” (1 July to 30 June) the government will top-up your KiwiSaver account by 25 cents for every $1 you save, up to the value of $260.72 - provided you are 16 or older, your primary residence is New Zealand, had an income of $180,000 or less for the year and you are not yet eligible for a retirement benefit.

It is up to you whether you put savings into your KiwiSaver account to get your maximum government contribution of $260.72. You can do so by making regular contributions or making a lump sum contribution before 30 June each year.

You can read more about the government contribution on the government’s KiwiSaver website by clicking here.

The government contribution is paid into your KiwiSaver account and invested along with your other savings.

Yes, if you are eligible. In the first year, the maximum government contribution you can receive is proportionate to the period of time you have been a KiwiSaver member. If you have only been eligible for part of the year (from 1 July to 30 June), the maximum government contribution is reduced based on the number of days you have been a member.

You must be 16 or older, have an income of no more than $180,000, and your primary residence must be New Zealand to receive the government contribution.

Yes. In the year you turn 16, you will get your first government contribution. The calculation is based on the period from your 16th birthday to 30 June (which is the end of the “KiwiSaver year”). Each year after that, it will be the $260.72 maximum if you save $1,042.86 until your last year.

If you reach age 65 part-way through the year, the government contribution you can receive is based on how many days in the year you have been eligible.

- If you are an employee, check your payslip to see how much you are saving from your pay. If it is less than $20 a week (or $87 a month) you will not get the maximum, but you will still get a government contribution based on the amount you are saving. You can also save extra directly to SuperLife while you are saving from your pay.

- If you are not an employee (for example, self-employed), you can decide how much to save and save directly to SuperLife. You get the maximum government contribution if you save $20 a week or $87 a month or $1,043 a year. You can also set up a direct debit or make a lump sum payment to save.

Regular savings / contributions

- You can save by making regular payments and change (or stop) the amount you save at any time.

- Regular savings can be set up via your online login, by selecting "Add contributions" in the menu. These are made by direct debit from your bank account. Contact Us to learn more, or visit our Forms page ("Contributions and withdrawals") if you prefer to print and send a form to us.

- If you have joined through your employer, you may be able to contribute by deduction from your pay.

Lump sum payment / investment

- You can make a lump sum payment into your account at any time using internet banking by selecting ‘SuperLife (Invest & KiwiSaver)’ as the payee or by using the bank details below.

Alternatively, if you are a member of SuperLife Invest or the SuperLife KiwiSaver scheme, you can log in to your account and set up a lump sum contribution, made via direct debit.

By Internet Banking

Bank name: ASB Bank

Account name: SUPERLIFE WORKPLACE SAVINGS SCHEME

Account number: 12-3244-0039562-00

Payment reference: SuperLife Member number (or your IRD number if your payment is for your SuperLife KiwiSaver account)

Payment code: Your surname

Please email superlife@superlife.co.nz to inform us of the transfer.

If you want to choose a specific investment strategy for your contribution, please complete a contribution form for KiwiSaver or SuperLife Invest (non-KiwiSaver members), which tells us when and how you would like the money invested.

One year after you permanently emigrate to a country other than Australia, you can apply for a early withdrawal from your KiwiSaver. If eligible, your KiwiSaver Account is paid out minus the government contributions which are refunded to the government. The investment earnings on the government contributions are however paid out as part of your benefit. You will still receive the $1,000 kick-start payment if you were eligible for it. If you defer payment until your KiwiSaver retirement age, the government contributions that you were eligible for while living in New Zealand are paid out to you as part of your retirement benefit.

If you permanently emigrate to Australia, you can transfer your KiwiSaver balance to a complying Australian superannuation scheme and the government contributions will also be transferred. Please contact us if you wish to transfer your KiwiSaver balance to an Australian scheme.

Accessing your KiwiSaver savings

Your KiwiSaver retirement age is generally the age you qualify for New Zealand Superannuation, this is currently age 65.

When you reach your KiwiSaver retirement age you can access some or all of your KiwiSaver account balance whenever you need it. Many people benefit from keeping their funds invested rather than withdrawing everything at once. Until you take your account balance out in full, you remain invested, and you can also choose to continue to make contributions.

KiwiSaver does not currently affect your entitlement to New Zealand Superannuation.

It’s important to remember you don’t actually have to retire to access your KiwiSaver savings; you just have to reach your KiwiSaver retirement age.

When you reach your KiwiSaver retirement age, you can:

- Withdraw some or all of your savings;

- Leave your KiwiSaver savings in SuperLife until you want to access them;

- Transfer your KiwiSaver savings to SuperLife Invest. This is a non-KiwiSaver investment that allows you to access the same investment options at lower fees;

- Set up a SuperLife “managed income”, where you decide how much you want to take out on a regular basis (e.g. every two weeks) and have it paid to a bank account

Until your KiwiSaver Account balance is paid out in full, your balance continues to be invested and you can continue to save until you advise otherwise. When your account balance is paid out in full, you cease to be a member of the SuperLife KiwiSaver Scheme.

When you reach your KiwiSaver retirement age:

- You don’t have to contribute to KiwiSaver, but you can if you want to.

- The compulsory employer contributions stop. However, some employers may choose to continue and you will need to find out if your employer will, and if yes, what the rules are.

- Your contributions continue unchanged until you change them. If you are employed, you will have to tell your employer if you want to stop contributing to KiwiSaver. Otherwise, they have to keep making deductions from your pay.

- If you are currently saving by direct debit to SuperLife, this will continue until you tell us to stop.

It’s important to be aware that the government contribution does not apply after your KiwiSaver retirement age. However, you are eligible for a proportion of the government contribution for the period from 1 July to when you reach your KiwiSaver retirement age. SuperLife will tell you what that entitlement is and how much you need to save to get your maximum final government contribution. These contributions need to be made before your KiwiSaver retirement age.

You may be able to withdraw all or part of your savings early if you're buying your first home, emigrating or suffering financial hardship or serious illness. You can read more about this on the government’s KiwiSaver website by clicking here.

If you would like help with the application process, please contact us. It is important to note that for the application to be approved, it must meet the legislative test for significant financial hardship.

Please note, your hardship request will be handled by Debtfix. You can learn more about them and what they do here. By submitting the application form, you consent to share your details with the Debtfix Foundation and the Scheme Supervisor for assessment. More information here.

If you would like help with the application process, please contact us. More information here.

If you would like help with the application process, please contact us. More information here.

If you've been a member of KiwiSaver for 3 years you may be able to withdraw some of your KiwiSaver savings to put towards purchasing your first home.

You can withdraw some or all of your KiwiSaver savings, except you must leave a minimum balance of $1,000. You cannot withdraw any amount transferred from an Australian complying superannuation scheme, or any government contributions received during any period you lived overseas and didn’t have permanent residence in New Zealand.

If you have owned a house before, you may still qualify if Kāinga Ora considers that your financial situation, in terms of your income, assets and liabilities, is the same as what would be expected for a person who has never owned a home. In this case, you need to get a certificate from Kāinga Ora verifying this.

More information about first home withdrawals through KiwiSaver can be found here.

To make a first home withdrawal, complete the first home withdrawal form and give it to your solicitor. Your solicitor must sign the legal confirmation where indicated and attach the information required from them. You must also sign the form where indicated. You or your solicitor should then send the completed form, together with any supporting documents to us.

If you die, the administrator of your estate needs to contact us to advise of your passing and to receive a copy of our deceased estate withdrawal form. Once the completed form and supporting documents are sent to us and processed, your savings will be paid to your estate.

KiwiSaver for children under age 18

Yes. There is no minimum age.

While retirement for a child is a long way off, KiwiSaver also helps them save to buy their first house, learn about investments and to establish a savings habit.

Signing up your child to the SuperLife KiwiSaver Scheme is simple, and can be completed online in minutes. Click Getting my KiwiSaver savings early to get started. You can also complete the application form attached to the product disclosure statement.

No. KiwiSaver applies to employees and non-employees. They do, however, have to have an IRD number. You can obtain an IRD number for a child by completing the IRD application form here.

Government contributions do not apply to children until they turn 16.

For those 16 or older, the government pays a government contribution to their KiwiSaver account each year. The tax credit is 25 cents for each $1 of savings made that year, to a maximum government contribution of $260.72 a year.

If they start a part time job and they are in KiwiSaver, they have to pay 3% of their wages to KiwiSaver unless they are on a “savings suspension”. They can go on a savings suspension once they have been in KiwiSaver for one year.

KiwiSaver savings can only be paid out prior to retirement in certain circumstances (for example, purchasing a first home). These circumstances do not currently include education. If you wish to save for your child’s education, we recommend the SuperLife Invest scheme, which has the same investment options and the flexibility to make withdrawals at any time.

There is no minimum amount required for a child to join the SuperLife KiwiSaver Scheme, and no minimum contribution is needed to keep the account active. However, there is an annual $30 per year administration fee (unless you have elected to have all your money invested in the SuperLife Default Fund).

KiwiSaver can be a great way for children to start learning about money including how it grows, the value of investing, and how to work towards long-term financial goals. You can choose how much and how often to contribute based on what works best for your situation.

Family and friends can also contribute to the child’s account. Contributions can be made regularly or as one-off payments, helping to build a strong foundation for their future.

If the child is employed (e.g. they have an after-school, weekend or holiday job), they have to save 3% of their before-tax pay e.g. $3 for every $100 gross that they earn. They have to do this for the first year they are in KiwiSaver. After one year, they can choose to stop saving at any time by going on a “savings suspension”. Please contact us if you would like to set up a savings suspension.

If they are employed and they are saving the default contribution rate (or a higher contribution rate) then, when they turn 18 (or 16 after 1 April 2026), their employer must also save the default contribution rate for them.

When you started working, and you are between the ages of 18 and 65, your employer was required to enrol you into KiwiSaver. There are many KiwiSaver providers. If you didn’t choose which KiwiSaver provider you wanted to join, Inland Revenue or your employer allocated you to the SuperLife KiwiSaver scheme. In either case, Inland Revenue will send us your details and once we receive them we will register you as a SuperLife KiwiSaver scheme member.

Inland Revenue holds your contributions for 2 months (62 days) from the date they're told you’re a new KiwiSaver member. After that they pass them on to your scheme provider. If you want to track your KiwiSaver contributions before they make their way to SuperLife, you can do so through My IR.

If you are automatically enrolled and don’t want to be a KiwiSaver member you can choose to opt out. You need to do this between the end of week 2 and week 8 of starting work. You can read more about opting out by visiting the government’s KiwiSaver website

Once we have received your details from the Inland Revenue, we will register you as a SuperLife KiwiSaver member. We will then send you a welcome email with details on how to log into our online portal.

It’s important that the details we hold for you are correct. When you first use the online portal we recommend you review and update the following information:

- Your contact details.

- Your Presribed Investor Rate (PIR) - Your PIR is the tax rate that applies to the taxable investment returns paid on your KiwiSaver savings. If we have not been advised of your PIR, it will be set to the default rate (28%). You can find out what your PIR should be here. Not having the correct PIR means you may be paying more tax than you need to.

Your fund choice - if you were automatically enrolled through Inland Revenue, you’re investing into a fund that was automatically chosen for you. That means it wasn’t chosen based on your personal preferences or priorities, and you could be missing out on opportunities to grow your savings. You can view and choose from our wide range of investment options to find a fund that suits you better, in your Superlife online portal. It only takes a few minutes, and can massively improve your financial outlook.

There are many benefits to being a SuperLife member. We've been helping Kiwis manage their money for over 15 years. We offer a wide range of investment options with low fees. You can learn more our KiwiSaver scheme here.

As an employee, contributions are automatically deducted from your wages or salary. If you’re self-employed or not currently working, you can still make contributions directly into your account.

When you first join KiwiSaver and do not select a contribution rate, you’ll start at the minimum rate of 3% of your pay. This minimum rate is set to increase over time to:

- 3.5% from 1 April 2026, and

- 4% from 1 April 2028.

You can choose to contribute a higher amount of 4%, 6%, 8% or 10% of your pay at any time. Even a small increase can make a big difference to your savings over time.

If you need, there will be the option to temporarily remain at the current minimum 3% contribution rate. This means your employer may also contribute at the reduced rate. You will be able to apply to Inland Revenue for this temporary reduction from February 2026.

Employees can change their contribution rate through their employer. People who are self-employed or not currently working can make contributions themselves online.

Investments

Investing with SuperLife

Step 1: Enter your member number in the first box. You’ll find this in your Welcome Letter or Member Certificate. If you're a SuperLife KiwiSaver Scheme member, you can use your IRD number instead.

Step 2: Fill in your date of birth, last name, and email address. Make sure your last name matches our records exactly (including any hyphens) and double-check your date of birth.

Step 3: Under Login details, create a username and password. These will be your credentials for accessing the member portal.

Step 4: Press "Submit" to confirm your registration.

Step 5: Check your email inbox for a verification message from SuperLife. Open the email and follow the instructions to verify your email address.

Step 6: Once verified, you can log in using your new username and password.

SuperLife Invest is our most flexible investment and savings option. You decide how much you invest, when you invest and when to make a withdrawal. Our broad range of investment options lets you tailor an investment strategy to suit your needs, and our fees are among the lowest in the market.

To learn more, read the SuperLife Invest product disclosure statement or visit our Returns and Fees page.

It's easy to sign up online. Click here to get started.

Regular savings / contributions

- You can save by making regular payments and change (or stop) the amount you save at any time. Please note that changes to regular savings will be subject to the rules for the scheme you invest in - for example, rules relating to minimum contributions.

- Regular savings can be set up via your online login, by selecting "Add contributions" in the menu. These are made by direct debit from your bank account. Contact Us to learn more, or visit our Forms page ("Contributions and withdrawals") if you prefer to print and send a form to us.

Lump sum payment / investment

- You can make a lump sum payment into your account at any time using internet banking by selecting ‘SuperLife (Invest & KiwiSaver)’ as the payee or by using the bank details below.

Alternatively, if you are a member of SuperLife Invest or the SuperLife KiwiSaver Scheme, you can log in to your account and set up a lump sum contribution, made via direct debit.

By Internet Banking

Bank name: ASB Bank

Account name: SUPERLIFE WORKPLACE SAVINGS SCHEME

Account number: 12-3244-0039562-00

Payment reference: SuperLife Member number (or your IRD number if your payment is for your SuperLife KiwiSaver account)

Payment code: Your surname

Please email superlife@superlife.co.nz to inform us of the transfer.

If you want to choose a specific investment strategy for your contribution, please complete a contribution form for KiwiSaver or SuperLife Invest (non-KiwiSaver members), which tells us when and how you would like the money invested.

SuperLife is obliged to meet the requirements of the Anti-Money Laundering and Counter Financing of Terrorism Act and so we have to collect and hold on file verification of identity and address. The details of what is required can be found here.

As part of our commitment to sustainability and improving member services, we no longer print quarterly or monthly statements. Electronic delivery is faster, safer, and more environmentally friendly. The SuperLife member portal gives you secure access to your information whenever you need it. Login at my.superlife.co.nz

If you’ve chosen the printed option, you’ll receive an annual printed statement by post. Quarterly and monthly statements are only available online or by email.

Changing your investment strategy (including fund switches)

You can change your investment strategy for existing savings (i.e. fund switch to move money between funds) and/or future savings at any time online free of charge. Log in to My SuperLife and select "Change strategy" to get started.

If you prefer to complete a form and send it to us, simply download the "Change investment strategy" form from this page.

Investment basics

To help you make informed investment decisions, we have a range of online resources for you to draw from. View our articles and guides, recent newsletters and information about upcoming investment seminars across New Zealand.

The government’s Sorted website also includes a number of useful tools on KiwiSaver, investing and savings.

Income assets include cash and bonds (“fixed interest”). With cash, we would expect positive returns, but lower than the returns for other assets over the long term. Investing in cash is suitable when money may be required in the short term. With fixed interest, we would expect positive returns that are higher than the returns for cash over 3–5 years, but at times returns can be negative over the shorter term. Investing in fixed interest is suitable when money may be required in the medium term.

Growth assets include shares and property. With shares and property, we would expect positive returns that are higher than the returns for cash and fixed interest over the long term, but at times returns can be negative over the short to medium term. These negative returns can be quite large. Investing in shares and property is suitable when money can be invested for the long term.

We believe that an index-tracking approach to investing will deliver better long-term results. Index-tracking investing means we will either invest in a fund designed to track an index or in a number of assets for the long term. We do not think that constantly changing our investments (that is, trading regularly and seeking short-term gains), consistently adds value to investors.

Diversification (not putting all your eggs in one basket) is one of the most effective ways to smooth out the highs and lows in your investments.

By investing across different asset types (cash, bonds, property, and shares) and markets, you’re not relying on one to do all the work. Spreading your investments delivers steadier growth over time because different types of investments can react differently to market movements.

How you mix your investments will depend on your goals, how long you plan to invest, and how comfortable you are with the ups and downs along the way. These factors will help you tailor your investment portfolio.

People with a longer investment timeframe or a higher tolerance for short-term ups and downs may be comfortable holding more growth assets (property and shares), while those with shorter timeframes often choose to hold a larger share of income assets (cash and bonds).

Everyone’s situation is different, so the right balance will depend on your goals and circumstances.

A 'core-niche' approach - One way to balance long-term stability with exposure to particular regions or sectors is using a core and niche approach.

In this approach, your core portfolio consists of your key long-term investments that typically make up the majority of your overall portfolio – often 80% or more. Your niche investments are smaller, more dynamic positions, such as sector-specific or thematic investments, allowing you to take advantage of emerging trends or market opportunities.

Investors can apply this kind of thinking by combining diversified funds as a core portfolio and adding selected single-sector funds as niche tilts.

Investing involves risk. We recommend you seek professional assistance from a licensed Financial Advice Provider before making any investment decision.

Understanding your investment returns

SuperLife generally credits the investment returns to members’ accounts on a daily basis (a valuation day). Each valuation day, we calculate the amount of the investment earnings for each investment fund since the previous valuation day. We then allocate that amount across the members’ balances, for the members who had a holding in that fund at the end of the day. The allocation is made proportional to the value at the beginning of the valuation period, less any payments subsequently made. There are no reserves or smoothing mechanisms applied. The total return earned on the investments of the fund, whether positive or negative, is what is credited each valuation day.

You can read more about the allocation of investment returns by clicking here.

The New Zealand tax laws are complex because investment earnings are taxed in one of three ways and not all investment earnings are taxable. An explanation of the tax treatment of earnings is here.

With New Zealand shares, for example, tax is only payable on the dividends we receive. The market movement is not taxable. So if we receive a 6% dividend and the market goes up by 10%, your total return is 16% but you only pay tax on 6%. Likewise if the market goes down by 10%, your total return is -4% (i.e. 6% dividend less 10% market downturn) but you still pay tax on the 6% dividend. The same applies for Australian shares. Over the long term we expect the share market to go up, so you will pay less tax than you would if the total return was taxable, but over short periods you get strange looking results.

Overseas shares are more complex. With overseas shares we pay tax on 5% of the assets as if we always get a 5% return. This is irrespective of what return we get. Again long term we expect to pay less tax than your PIR rate but when the markets go down we still have to pay tax.

Annual PIE Tax Certificate

The Annual PIE Tax Certificate is sent to members of the SuperLife schemes. It shows the amount of tax you paid on taxable income earned by the schemes for the year ended 31 March.

You will receive a certificate even if you left a SuperLife scheme during the year ended 31 March.

The SuperLife KiwiSaver scheme, SuperLife workplace savings scheme and each fund in SuperLife Invest is a portfolio investment entity (PIE), which means that tax has already been calculated and paid to Inland Revenue using your prescribed investor rate (PIR).

Your PIR is shown on the certificate. You can also work out your PIR by using the Inland Revenue’s PIR calculator.

Your PIR can be 0%,10.5%, 17.5% or 28%. You don’t have to do anything if the PIR shown on the certificate is correct, as your tax has already been paid on the taxable portion of your investment income by adjusting your balance in the relevant fund(s).

You may need to complete a tax return if the PIR we held for you was incorrect. If you are not sure, you should consult your accountant or tax adviser.

- Change your PIR online at my.superlife.co.nz

- Email superlife@superlife.co.nz (include your name, date of birth, SuperLife member number or your IRD number).

- Call us on 0800 27 87 37 if you need help with your PIR.

The amount of tax paid is calculated based on your PIR at the end of the period.

You can find more about PIRs and how to work out your rate on Inland Revenue's website.

Where an account is jointly held, each holder must advise SuperLife of their IRD number and PIR. SuperLife will use the higher of the two PIRs when calculating the tax payable on the account.

If you have a 0% PIR, you are required to include the information from the Annual PIE Tax Certificate in your tax return. If you are not sure, you should consult your accountant or tax adviser.

Insurance

*

SuperLife offers four types of insurance:

- Life insurance - Provides your beneficiaries (for example, children or spouse) with a lump sum amount in the event of your death. The benefit can also be paid should you become terminally ill.

- Total and permanent disability insurance - Allows for an early pay out of your life insurance if you suffer illness or injury that leaves you totally and permanently disabled.

- Disability income protection insurance - Helps protect you from the loss of income through a severe disability that prevents you from working for an extended period.

- Medical insurance - Insures you and/or your family against part or all medical expenses.

The life and disability insurance solutions are provided by Fidelity Life, and medical insurance is provided by UniMed.

If you already have insurance with SuperLife, or belong to a SuperLife workplace savings scheme offering insurance benefits, get in touch with the SuperLife team at 0800 27 87 37, or email us superlife@superlife.co.nz

Life insurance

The amount charged depends on factors such as:

- gender, age and health;

- whether or not you smoke;

- the premium basis you choose i.e. the 1 or 5 year option; and

- the amount of cover you take out (as the premium rates relate to each $1,000 of cover you choose)

A lump sum will generally be paid if you die, for any reason, except if:

- you have not paid for the insurance; or

- you did not complete the application form accurately.

There are also special provisions that apply in times of war.

If you die, SuperLife will pay your life insurance to the person or people you nominate (i.e. beneficiaries). If you nominate more than one person, you need to state what proportion each person should receive. SuperLife is required by law to pay the beneficiaries you nominate, so you need to make sure your nomination is kept up to date. If you want to edit, remove or add beneficiaries to your life insurance you will need to fill in an update beneficiary form or do it online.

If you don’t make a nomination, SuperLife must pay the insurance to your estate.

SuperLife can delay payment if it is aware that your benefit might be subject to a claim under the Property (Relationships) Act 1976.

SuperLife will need copies of your death certificate before it pays the insurance money.

In most cases an increase to your insurance cover (“benefit”) requires you to provide medical details.

Call our team on 0800 27 87 37 to discuss your situation.

When you first apply for life insurance cover and before it is confirmed, the insurer has agreed to cover you for “accidental death” for the amount you choose for up to three months from the date SuperLife receives your application form.

This accidental death cover will cease within the three month period, when you are advised by SuperLife of the terms on which the insurer has accepted (or declined) your application.

All life insurance costs more as you get older, and SuperLife is no different.

The 5-year option means the premiums that you pay for your insurance stays the same for 5 years rather than increasing each year.

This means, instead of a smaller annual increase, your premiums will stay the same for 5 years but increase more substantially at the end of this period. Whether you choose the annual or 5-year option, overall, you will pay about the same.

For an additional premium, you can extend your life insurance benefit so the cover can be paid if you become "totally & permanently disabled" (TPD) before age 65. You are not required to have the same amount of TPD cover as for death - it can be less.

The insurance policy gives the legal definition of "total & permanent disablement". The main features are:

- You are sick or injured;

- You are away from work for six months in a row or more;

- You must have a full medical examination;

- The insurer decides, either:

- You are incapacitated to the extent that you are never likely to work in a job for which you are reasonably qualified by education, training or experience, or

- You have lost the use of two limbs, or you are blind (or have lost one limb and are blind in one eye).

The insurer decides if you are "totally & permanently disabled". As a result, you will need to supply the insurer with medical evidence of your disablement. If the insurer needs more information, it can arrange for you to be examined by its own medical advisers.

Disability insurance

The amount charged for disability insurance depends on factors such as your sex, age, job category, health, benefit period and the level of the benefit.

You can choose any benefit level you want between the minimum under Rule 1 and the maximum under Rule 2.

- Rule 1: It must be at least $5,200 a year ($433 a month);

- Rule 2: It cannot be more than $55 for every $100 of your before-tax pay. Remember the benefit paid is tax free.

The insurer decides if you are totally disabled and will get a benefit. You will need to supply the insurer with medical evidence of your disablement. If the insurer needs more information, it can arrange for you to be examined by its own medical advisers. The insurer will meet the cost of this.

SuperLife’s insurance policy provides the legal definition of "totally disabled". The main features are:

- You are sick or injured;

- You have been away sick or injured for the whole of the "waiting period" (time between your first day off work and the day your disability insurance starts);

- A qualified doctor is in charge of your treatment;

- The insurance company considers that (i) for office workers, “travellers” and technicians - you can’t do your own job, or (ii) for light & heavy manual workers, trades and hazardous occupations - during the first two years, you can't do your own job; and after the first two years, you are incapacitated to the extent that you are unlikely to work in a job for which you are reasonably qualified by education, training or experience.

Once the insurer has determined that you are disabled, SuperLife will start paying your benefit monthly in arrears.

Each year, the insurer will increase the amount SuperLife pays you, in line with increases in the cost of living (CPI) to a maximum of 5% a year.

You must keep paying for your insurance premiums during the "waiting period" you have chosen (time between your first day off work and the day your disability insurance starts). If you are not getting paid by your employer, the cost can be rolled up and come out of the first month's benefit payment (if you get better and go back to work, that cost can then come out of your pay). You can also use money that you have in your SuperLife savings voluntary account to pay those costs.

The benefit will stop before the end of the “benefit period” or when you are no longer "totally disabled" - whichever happens first. You are classified as no longer “totally disabled” when:

- you start working again; or

- a qualified doctor is no longer looking after you; or

- the insurer, based on medical evidence, concludes that you are no longer disabled; or

- you die.

The insurance company offers a special deal to encourage you back to work. If you go back to your original employer but can't earn as much (because of your disability) your benefit won't stop. It will be reduced by the proportion that your new lower pay bears to your old higher pay. This special deal is called a "recovery benefit". It could last for up to two years (but not past the end of your benefit period).

There are some exceptions to be aware of. A benefit will not be paid if:

- you stopped paying premiums; or

- you intentionally injure yourself; or

- you stopped work due to pregnancy or childbirth (but a benefit may be payable if you cannot return to work due to complications from pregnancy or childbirth); or

- your income ceased before you become ill or disabled; or

- special circumstances exist - for example, there are particular provisions which apply in times of war.

This is the period between your first day off work and the day your disability insurance starts.

You can choose your waiting period (one, three or six months). You should allow for any sick leave you are entitled to and consider how long you can afford not to have an income if you are disabled; the longer the waiting period, the cheaper the cost of cover.

You can choose the maximum number of years that the disability insurance benefit is paid to you while you are disabled - this is called the "benefit period". Your choices for the benefit period are:

- two years;

- five years, or

- until you reach age 65.

The benefit period starts when you receive the first disability insurance payment at the end of the waiting period. The disability insurance payments will stop before the end of the benefit period if the insurer determines that you can start work again.

In most cases an increase to your insurance cover (“benefit”) requires you to provide medical details.

Call our team on 0800 27 87 37 to discuss your situation.

SuperLife lets you replace some of the income you may lose from being disabled or sick. In some situations, you might have an “agreed amount” of insurance for example, in cases where your income varies a lot from year to year. This will need to be organised at the time your insurance policy is set up.

If you leave employment and don’t have a job to go to, you can continue as a SuperLife member but will need to arrange an “agreed amount” of insurance with the insurer.

With the exception of an “agreed amount”, your cover cannot be more than 55% of your before-tax regular pay at the date the benefit entitlement arises even if your original cover is higher.

Your actual benefit paid will also be reduced if you get an ACC pension or income under other disability or accident insurance. The SuperLife insurance will only top up the money you get from those sources, i.e. it will not exceed the disability insurance benefit otherwise payable.

Medical insurance

- If you are a SuperLife investor, fill out Add Medical Insurance form.

- You will also need to complete the UniMed application form.

If there is information you wish to keep confidential, the UniMed form can be placed in a sealed envelope and SuperLife will forward this onto UniMed. UniMed will then process the application form and then send you confirmation of your cover.

If you want to change or cancel the cover, you have 30 days from the date that UniMed receives your application to do so. If you do not contact UniMed within 30 days of receiving your confirmation, you will be regarded as having accepted your chosen cover and the first premium payment will be deducted from your bank account. SuperLife will confirm the starting date of your cover.

UniMed is an independent not-for-profit mutual society working for the benefit of its members.

The insurance benefits paid to you by SuperLife are administered under a contract between SuperLife and UniMed (we do so in accordance with UniMed’s standard terms and conditions).

When you take out medical insurance, there is an agreement between you and UniMed through SuperLife. This is to provide the agreed benefits in exchange for the premiums in each policy period. The 1st of April in each year constitutes the beginning of a new policy period and UniMed reserves the right to change both the benefits offered and the premiums charged. You will be notified of any changes.

In exceptional circumstances, UniMed may alter its terms and conditions during a policy period. This may occur, for example, where the government makes material changes to the health system.

When you apply for insurance the insurer wants to know if you have any existing conditions that may create a future claim. In some cases UniMed may ask for more details.

All medical insurance companies have special rules about any existing conditions you may have when you take out new medical insurance. Some conditions prohibit insurance cover (such as chronic conditions and AIDS) and these vary between different UniMed medical plans. Details of the specific exclusions are in each plan's brochure.

Once your application form has been accepted, your contract may say that some existing conditions won’t be covered for a period (or at all). If that applies to you, UniMed will tell you before you have to make your decision to continue.

UniMed has the final say on whether you get the insurance cover you want.

Medical cover starts three months after the policy commencement date unless otherwise agreed. The rules for making claims and obtaining refunds for medical expenses will be detailed in your chosen policy.

UniMed will send you a claim form when you join. All dealings on claims will be between you and UniMed direct, however if a problem arises and you need our help, we will work with you and UniMed to try and resolve it.

Pension Transfers

Australian super transfers

For many people, transferring an Australian super balance to SuperLife will make sense. But for some, there will be advantages in keeping it in Australia. This is a decision you will need to make based on your personal situation and what is important to you.

Generally, having your savings in the country you will retire to makes sense. If you will probably return to Australia, keeping it in Australia is more likely to be the better option.

If you are not likely to return to Australia, it makes sense, at some point, to bring the money to New Zealand because this is where you will spend it. The question for most is "when," not "if." This may be now, or it may be at any time up to or during your retirement.

The following factors are also important for you to consider:

- Investment strategy: As a general rule, the investment strategy that is optimal for an Australian based investor is different to that which is best for a NZ based investor. You have to decide whether your current investment strategy under your Australian scheme is best for you based on your personal circumstances. If the current Australian scheme does not have the optimal strategy for you, transferring to SuperLife may make sense, because of SuperLife's flexibility.

- Fees: The only investment return that is important, is the net-of-tax and net-of-fees return. SuperLife has competitive fees and may have lower total fees than your current Australian scheme which may result in a higher net return, all else being equal. Small fee savings can make a difference to the accumulated savings at retirement.

- Tax: The tax laws between NZ and Australia are different. Tax laws will also change. In Australia, you generally pay tax at 15% on income and any capital gains. In general, New Zealand adults pay tax at 17.5% or 28% on income (some pay 10.5%) and 0% on capital gains. While the NZ rate is often higher (e.g. 28% versus 15%), it is applied to less of the total return and so for many investors, it will result in less tax paid.

- First home withdrawal: Funds transferred from an Australian Complying Superannuation scheme cannot be withdrawn for a first home withdrawal.

No. Transferring is voluntary. You should only do so if you decide it is best for you.

No. The money transferred must stay for retirement. However, the investment earnings on the transfer value can be withdrawn as part of the first home withdrawal.

Yes. In addition, you can transfer your other KiwiSaver money as well.

No. The money must stay in KiwiSaver in New Zealand, or must be transferred back to Australia.

No. If you immigrate to Australia, you do not have the option to withdraw your KiwiSaver account balance (excluding the government contributions) after 12 months.

Yes. If you retire on or after age 60 and meet the Australian definition of “retirement”, you can receive part of the Australian transfer portion of your KiwiSaver account without having to wait to your KiwiSaver retirement age. Typically, somewhere between 4% and 10% may be withdrawn each year. The balance of your KiwiSaver account is still locked in until your KiwiSaver retirement age.

This is the age of eligibility for NZ superannuation (currently 65). After age 65, you can access some or all of your SuperLife KiwiSaver Scheme savings whenever you need it.

Can I withdraw the transfer value of my Australian super if I suffer significant financial hardship?

Yes. The money transferred from Australia can be withdrawn in cases of significant financial hardship. Remember, you must meet strict legislative criteria for serious financial hardship.

No. The Australian super will be paid to your NZ KiwiSaver account tax free. When it is ultimately paid out of KiwiSaver, it will also be paid to you tax free.

You may be eligible to transfer your Australian super if you:

- have returned to New Zealand (or emigrated here) from Australia; and

- have savings in a complying Australian superannuation fund (self-managed super funds and defined benefit funds are excluded). You can find out which Australian funds comply by using the search engine available at www.superfundlookup.gov.au

You need to be a member of a KiwiSaver scheme before you can transfer your savings. If you wish to join the SuperLife KiwiSaver Scheme, click here to contact us and get started.

If you do not know or are unsure, go to www.ato.gov.au and search "superseeker". Superseeker will list your Australian super providers. You need your Australian Tax File Number to access this service. If you don't know it, contact the Australian Tax Office (ATO) on +61 2 6216 1111 (you will need to confirm the address ATO holds on file for you before they will provide this information; your former employer in Australia or your Australian bank may be able to provide the address).

First, contact your Australian super provider(s) to find out their process for transferring. To avoid delays, you will need to provide all of the documentation they request. If you have more than one Australian super account, you will need to contact each provider.

You need to provide them with your NZ IRD number and your KiwiSaver membership number so that we can identify the payment.

Your Australian provider has 30 days to complete the transfer. The 30 days starts from the date they receive all the information they need and not when you first apply. You can reduce the time by ensuring you provide all of the documents they require.

When we receive the payment from the Australian provider, it will be put in your KiwiSaver immediately. If you have several Australian super funds, payments may arrive at different times. We will tell you when we receive the money.

By internet banking (telegraphic transfer):

Bank name: ASB Bank

Account name: SUPERLIFE WORKPLACE SAVINGS SCHEME

Account number: 12-3244-0039562-00

Payment reference: Use your NZ IRD number (we need this to identify your payment).

Payment code: Your surname

By cheque:

Payable to the SuperLife KiwiSaver Scheme. Please ask your provider to print your IRD number on the back of the cheque so we know the payment is for you.

SuperLife for Employers

About us

Choosing SuperLife means:

- You can tailor the rules around the contributions and benefits, and create a plan designed for your business.

- It's more than just superannuation; we can add other benefits to your plan, such as insurance and KiwiSaver.

- We take care of the administration (e.g. collections and payments) and ensure that you and your employees receive regular important information including market updates.

- We are a master trust. Through SuperLife, your employees can choose investment options that suit them. SuperLife brings the advantages and lower costs of group purchase to your employees.

- Our savings, benefit payment and investment options offer a significant amount of choice, flexibility and value to your employees.

Superannuation Master Trust

The SuperLife Superannuation Master Trust was previously known as the ASB Superannuation Master Trust. Smartshares acquired the scheme in 2022 and the transition of the scheme from ASB to Smartshares is now complete.

FAQs and other information for SuperLife Superannuation Master Trust members and employer groups can be found here.

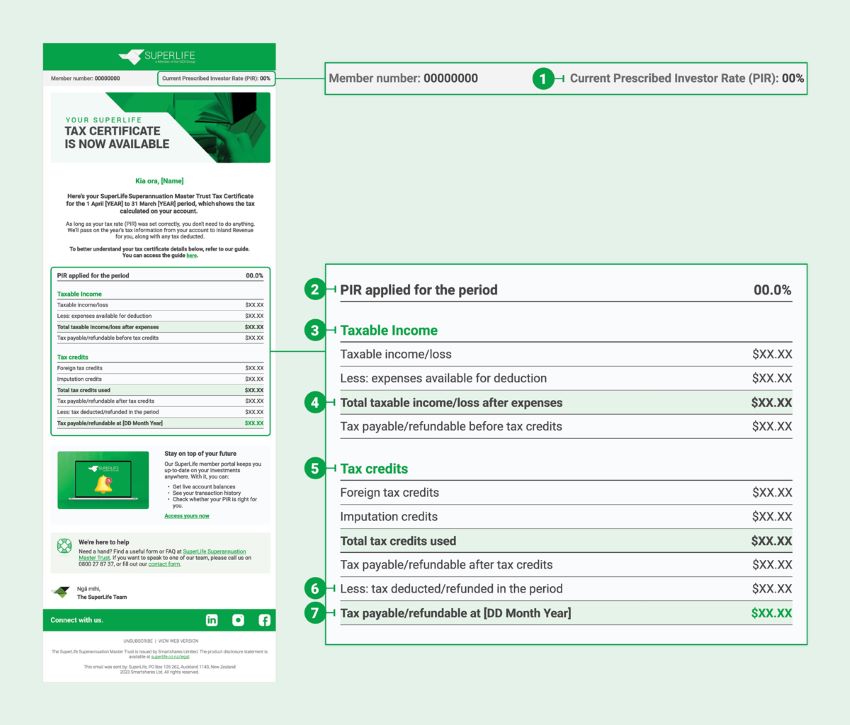

Understanding my Annual PIE Tax Certificate

- Your Prescribed Investor Rate (PIR) sets how much tax you pay on the taxable income from your investment. This is the PIR we currently have on record for you.

You can set your PIR rate at your profile page on the Member Portal or contact us.

You can work out your PIR rate by visiting the Inland Revenue website. - This is the PIR that has been used to determine your tax for the year ended 31 March.

- This is the income you’ve earned from your investment that’s subject to tax. The total taxable income/loss may not match your total returns, as not all return components are taxable.

- Your administration fees are expenses that can be deducted from your taxable income, which reduces the amount of tax you have to pay.

- Tax credits represent any tax that has already been deducted from your taxable income, or paid before it’s received by the fund. These credits reduce any tax you need to pay on your investment’s taxable income.

- Tax deducted/refunded highlights any tax that was paid on, or refunded to, your taxable income/loss during the last 12 months. These can occur when you make a withdrawal or switch between funds.

- This is your final amount of tax payable or refundable.

NZ Super

Eligibility and rates

You may qualify for NZ Super If you:

- are age 65;

- either:

- a New Zealand citizen

- are a permanent resident

- or hold a residence class visa

- are ordinarily resident in New Zealand, the Cook Island, Niue, or Tokelau when you apply

- have lived in New Zealand for at least 10 years since age 20;

- have lived in New Zealand, the Cook Islands, Niue or Tokelau (or a combination of these) for at least 5 years since age 50.

Residence in a country with which New Zealand has reciprocal social security arrangements (like Australia and the UK) counts as residence in New Zealand.

When we say ‘you live’ or ‘you’ve lived’, we mean you normally live in NZ, the Cook Islands, Niue or Tokelau and that’s where your home is.

You may qualify for NZ Super with less than 10 years residence if you have migrated to New Zealand from a country that New Zealand has a social security agreement with.

Click here for more information on NZ Super.

The NZ super benefit is linked directly to the national average wage and is reviewed each year (1 April). The current level is 66% of the net national average wage.

The pension is taxed as income in the normal way under the PAYE system.

There are no income or asset tests applied to NZ Super. However, if one partner of a couple qualifies and the other does not, both may receive the benefit, but an income test applies in respect of the benefit paid to the partner that does not qualify in their own right.

However, entitlements to an overseas social security pension (like the UK’s Basic State Pension) but not work-related, employer-provided pensions, reduce the New Zealand pension by the equivalent amount.

Please check the Work and Income website for full details of the most-recent superannuation rates.

Investing 101

Dealing with market volatility

Periods of volatility in global share markets and negative returns can understandably create uncertainty for many investors. These fluctuations are usually driven by a combination of factors, including geopolitical events, movements in interest rates, changes in the economic outlook and shifting investor sentiment.

While market downturns can be unsettling, it is important to remember that volatility is a natural part of investing. Share markets are constantly on the move, both up and down. History shows us that over the longer term, markets usually recover from short-term declines.

Although shares are volatile and occasionally deliver negative returns, they have historically offered the highest potential for long-term growth. By staying invested, you position yourself to benefit from the compounding returns that shares can deliver over time.

Market uncertainty is a constant – nobody can predict exactly when markets will rise or fall, or which markets or assets will perform best. This is why appropriate diversification (i.e. not having all your eggs in one basket) is such a cornerstone of long-term investing. Different assets and markets can react differently to market fluctuations. This means holding a range of investments, such as local and global shares, fixed interest and other assets can help offset losses, reduce your portfolio’s volatility and cushion the impact of downturns.

We offer a range of diversified funds (such as the SuperLife Income, SuperLife Conservative, SuperLife Balanced and SuperLife Growth Funds) that have been created to serve this purpose. They contain a mix of income and growth assets, potentially providing some protection against large downward movements in share markets.

While a decline in the value of your investments can understandably be concerning, making decisions based on short-term market fluctuations can have a negative impact on your long-term returns. For instance, selling during a market dip may lock in losses and prevent you from benefiting from any potential rebound as markets recover. It is important to consider when you will need to draw on your investments. If you have a shorter investment timeframe – meaning you may need to access your money sooner – you might want to consider a higher allocation to lower-risk investments, such as cash and fixed interest (bonds), which are less exposed to market fluctuations.

This is why it may be appropriate for investors near, or in, retirement, and others with a short-term investing timeframe, to have a mix of cash to cover immediate expenditure, fixed interest for medium term expenditure and shares for longer term expenditure.

On the other hand, if you’re investing for the long term, you’re better positioned to ride out market ups and downs. Shares have historically delivered higher returns over time, but they can experience short-term fluctuations. By staying invested through different market cycles, you give your portfolio the opportunity to recover from downturns and benefit from long-term growth.

Periodically reviewing your portfolio is a good way of ensuring it remains well-diversified and has a mix of assets which aligns with your goals, investment time frame and risk profile. These factors – rather than short-term market fluctuations – should guide your investment decisions.

Continuing your regular savings plan during periods of market volatility can be beneficial. If you are making regular contributions to your portfolio or KiwiSaver, a fall in markets means you can invest at lower prices. Picking the best time to invest is a lot easier said than done. For most investors it is better to invest regularly. This is called a “dollar cost averaging” approach. By investing on a regular basis, regardless of the price, you average out market fluctuations over time. This also lets you focus on the average return over the long-term and not react to short-term events.

Markets can continue to be volatile for some time. The timing or extent of any ‘turnaround’ after a period of negative returns is unpredictable, but history shows that markets do typically recover from downturns over time. In the meantime, it is important to maintain a diversified portfolio and stay focused on your long-term investment goals.